Introduction

Beginning in 1908 with the discovery of oil in Persia Gulf, and the story has dependably been about advances – from coal to oil, from oil to gas, from inland to profound water, and now onwards towards another blend of energy sources as the world moves into a lower carbon future.

BP Oil Company is one of the world’s leading Company in terms of oil and gas globally. The company operates in more than 80 countries, providing the customers with heat and light, fuel for transportation. Also the retail services and petrochemicals products for everyday items.

As an international company; the laws and regulations are taken in account for different jurisdictions – the interests and activities are operated through subsidiaries jointly controlled entities or associates established. In 2010 there were two business segments covered by interest and activities, which are Exploration and Production and Refining and Marketing.

Through the alternative energy business, the BP’s activities in low-carbon are managed efficiently (BP, 2010)

As a junior manager with responsibility of strategic management decisions at BP, my CEO asks me to make and produce a report in the next meeting regarding the oil spilling disaster in the ocean in the Gulf of Mexico in which the company is losing such a huge amount of money, as well the availability of essential resources and the loose of key workers to our competitors. The impact is that the company is uncertain about profitability and the future’s existence of the company, add to that the compensation issues.

P1 Applying appropriate frameworks analyse the impact and influence of the macro environment on a BP oil company as an organisation and its strategies.

To design the appropriate frameworks analyse the impact and influence of the macro environment we need to demonstrate:

- Mission statement: which is the formal summary of the aims and values of BP which describe the present strengths, customer’s consideration, activities which contribute to the human progression in terms of respect, honesty and integrity – That is BP fundamental purpose.

- Vision: BP vision is that to be competitive and to have the best financial performance, to improve, to be diverse and inclusive.

- Objectives: BP objectives and goals are a piece of the arranging procedure. They are depict at what they hope to achieve consistently. BP has a rule, plot their objectives and targets in their strategies for success. … BP utilises particular estimations to monitor their objectives and destinations.

- Strategy: The system is the heading and extent of BP over the long haul: which accomplishes advantage for BP through its setup of assets inside a testing domain, to address the issues of business sectors and to satisfy partner desires.

A technique or plan realised a coveted future, for example, accomplishment of an objective or answer for an issue.

Strategic Intent

BP have ascended to worldwide initiative in the course of recent years perpetually started with desire that were out of all extent to their assets and abilities. In any case, they made a fixation on winning…this fixation is vital expectation (Hamel and Prahalad, 1989).”

Strategic direction

Key heading is a game-plan that prompts the accomplishment of the objectives of BP’s methodology.

The BP strategy is about modernising the entire group:

Improve and modernise so we can proceed to contend and seize new open doors with our accomplices and partners in an evolving world.

How we do this:

- Rearrange our hierarchical structures and procedures.

- Acquaint advanced arrangements with upgrade our efficiency and administrations for our clients.

- Augment an incentive from our benefits through our oil, gas, control and renewables exchanging exercises.

- Change how it feels to function for BP – rousing our kin to perform taking care of business.

- Make progress toward approaches to keep enhancing the security and unwavering quality of our tasks.

BP is utilising cloud-based stages for fast examination and basic leadership with cutting edge representation and prescient instruments. We are presenting computerised applications in our retail and aeronautics organizations that can enhance client administration and comfort. Our new armada of submerged robots are enhancing how we screen the sea condition and survey dangers. Also, we have extended our worldwide business administrations association, which lead to open our tenth BP focus. (BP, 2017)

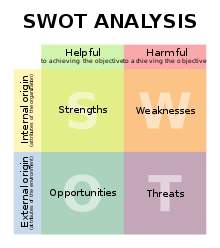

The key BP’s destinations are objectives regarded most critical to the present and future strength of a business. Goals are organised by BP through a careful examination of business practices, for example, a SWOT investigation. SWOT remains for qualities, shortcomings, openings and dangers. Despite the fact that prioritisation of key goals is interesting to every business, regular destinations exist. Six of the most widely recognized regions to centre vital business objectives are in the zones of piece of the overall industry, monetary assets, physical assets, profitability, development and activity arranging (Burris T, 2015)

Get Help With Your Assignment

If you need assistance with writing your assignment, our professional assignment writing service is here to help!

Effective organisations depend on the two objectives and destinations, as they clear up the motivation behind the business and help distinguish fundamental activities Goals are general explanations of wanted accomplishment, while targets are the particular advances or moves you make to achieve your objective. The two objectives and targets ought to be particular and quantifiable. Objectives can include regions, for example, benefit, development and client benefit, with a scope of destinations that can be utilised to meet those objectives (Joseph C, 2015)

Benefit:

A typical business objective is to run a beneficial activity, which regularly implies expanding income while constraining costs. To achieve this goal, objectives could comprise of expanding yearly deals by 10 percent or landing three new records every month. Cost objectives could include finding another working office that declines your lease by £200 a month or cutting month to month service charges by 15 percent.

Customer Service:

Customer service goals could incorporate diminishing dissensions by 50 percent more than one year or to enhance determination times to client grumblings to at least one business day. To meet customer service goals, objectives could incorporate expanding your customer service staff from one to three employees before the years over or actualizing a strategy where clients are ensured to get an arrival telephone call before the finish of the business day.

Maintenance:

On the off chance that you’ve encountered an issue with worker turnover, your general objective could be to enhance maintenance or retention to make this goal particular, you could quantify the present turnover rate, similar to one representative in five leaves following three months, and choose to twofold this figure to a half year. The objectives to meet this goal could incorporate actualizing a preparation program that subtle elements new-procure exercises for the initial 90 days at work. You additionally could actualise one-on-one fortnightly gatherings with your representatives with an end goal to manufacture compatibility and discover what’s at the forefront of their thoughts.

Proficiency:

Goal could be to wind up noticeably more effective in your business activity as an approach to expand profitability. To enhance effectiveness, you could set up a goal of expanding shipping times from three days to two days. The objectives to meet this goal could incorporate finding another shipper, or enhancing generation times to have units prepared to send before 10 a.m. every morning.

Development:

Maybe you will probably develop your business task. On the off chance that you possess an establishment unit, for instance, your objective may be to open three more units inside a five-year time span. On the off chance that this was the situation, your destinations could incorporate exploring another city once each quarter, or diminishing your establishment charges by 25 percent for the following a half year.

Macro Environment

The macro environment is the condition that exists in the economy overall, as opposed to in a specific division or locale. As a rule, it’s incorporated drifts in total national output (GDP), expansion, business, spending, and money related and monetary strategy.

PESTLE – Macro Environmental Analysis

The PESTLE Analysis is a structure used to examine BP’s outer full scale condition. The letters stand for Political, Economic, Socio-social, Technological, Legal and Environmental. Some methodologies will include additional variables, for example, International, or expel some to lessen it to PEST – help the management for the strategy’s decision making.

Be that as it may, these are all just minor departure from a topic. The vital standard is distinguishing the key components from the more extensive, wild outer condition that may influence BP Oil Company.

The PESTLE Factors

Political powers: As a matter of first importance, political variables allude to the security of the political condition and the dispositions of political gatherings or developments. This may show in government impact on assess approaches, or government involvement in exchanging understandings. Political components are definitely laced with Legal factors, for example, national business laws, universal exchange controls and confinements, imposing business models and mergers’ guidelines, and shopper insurance. The contrast amongst Political and Legal variables is that Political alludes to states of mind and methodologies, though Legal elements are those which have progressed toward becoming law and controls. Legitimate should be conformed to while Political may speak to impacts, confinements or openings, however they are not obligatory.

Financial elements: speak to the more extensive economy so may incorporate monetary development rates, levels of work and joblessness, expenses of crude materials, for example, vitality, oil and steel, loan costs and money related arrangements, trade rates and swelling rates. These may likewise fluctuate starting with one nation then onto the next.

Socio-social elements: speak to the way of life of the general public that an association works inside. They may incorporate socioeconomics, age appropriation, populace development rates, level of instruction, dispersion of riches and social classes, living conditions and way of life.

Mechanical variables: allude to the rate of new creations and advancement, changes in data and versatile innovation, changes in web and web based business or even portable trade, and government spending on look into. There is regularly an inclination to concentrate Technological advancements on computerised and web related regions, yet it ought to likewise incorporate materials improvement and new techniques for produce, conveyance and coordination. Ecological effects can incorporate issues, for example, restricted common assets, squander transfer and reusing methods.

Disadvantage

As a hypothetical instrument of key administration PESTLE investigation definitely have some huge confinements.

The hugest burden of the model is that PESTLE investigation is just in light of an appraisal of the outer condition or environment. So the outcomes acquired from this model are not valuable or complete.

Key points:

To expand the advantage of the PESTLE Analysis it ought to be utilised all the time inside BP to empower the ID of any patterns.

But similarly as with all methods there are advantages and disadvantages to utilising it to help design authoritative technique (Hoffman D, 2017)

(WordPress, 2015)

M1 Critically analyse the macro environment to determine and inform strategic management decisions.

The outside Environment Component of Business environmental assortment of variables can influence BP oil Company decisions. Such factors can be national level, regional level, and universal level and natural powers. These elements are additionally known as societal components or full scale level business condition factors (Bain S, 2012)

The structure– conduct– performance (SCP) worldview, first distributed by market analysts Edward Chamberlin and Joan Robinson in 1933, and created by Joe S. Bain is a model in Industrial Organisation Economics which offers a causal hypothetical clarification for firm execution through financial lead on inadequate markets.

BP plan of action

BP trust the most ideal approach to accomplish manageable accomplishment as a gathering is to act in the long haul interests of our investors, our accomplices and society. By making important and good decisions, providing vitality, we bolster monetary advancement and help to enhance personal satisfaction for many individuals. Our exercises likewise create occupations, venture, foundation and incomes for governments and local communities.

SWOT analysis: The BP’s study undertaken is to identify its internal strengths and weaknesses, as well as its external opportunities and threats.

BP works in a mind-boggling industry so we should oversee numerous types of hazard.

We take a gander at vital, operational and consistence chances over the gathering.

Outside economic situations, for instance, can affect our budgetary execution. We effectively deal with this hazard through BP’s broadened portfolio, our money-related system, customary audits of economic situations and our arranging and speculation forms.

The differing areas of our activities around the globe open us to an extensive variety of political improvements and resulting changes to the working condition. We look to deal with this hazard through our company with governments and partners. Likewise, we nearly screen occasions and actualise relief designs where fitting.

Changes in laws and open arrangements identifying with environmental change, for example, carbon evaluating, could affect our benefits, costs, income age and interest for our items. We are attempting to help ensure our business is supportable – financially, naturally and in a lower carbon future (BP, 2017)

(edrawsoft, 2017)

(edrawsoft, 2017)

Examination of the Macro environment

A company disregards the macro environment at its own incredible peril. Numerous examinations bolster the idea that there are should be a connection between the company’s vital choices and its condition – Management must make very good and strategical decisions.

All company are influenced by four macro environmental powers: political-legal, economical, technological, and social.

- Political and Regulatory Forces

Political-legitimate or legal powers incorporate the results of races, enactment, and court judgments, and also the choices rendered by different commissions and organisations. The political part of the earth presents genuine and potential limitation in transit a company works.

Political precariousness in a few zones influences the very type of government to subject to progressive changes.

- Economical Forces

Economic powers allude to the nature and course of the economy in which business works. Economical elements tremendously affect business firms. The general condition of the economy (e.g., sorrow, subsidence, recuperation, or success), loan cost, phase of the financial cycle, adjust of instalments, money related strategy, monetary approach, are enter factors in corporate venture, work, and estimating choices.

The effect of development or decrease in net national item and increments or abatements in financing costs, swelling, and the estimation of the dollar are considered as prime cases of noteworthy effect on business activities.

- Technological Forces

Innovative powers impact associations in a few ways. A mechanical advancement can have a sudden and emotional impact on the earth of a firm. In the first place, innovative improvements can fundamentally adjust the interest for an organisation or industry’s items or administrations.

Innovative change can destroy existing organisations and even whole businesses, since its works day request starting with one item then onto the next. In addition, changes in innovation can influence a company’s tasks also its items and administrations.

These progressions may influence handling strategies, crude materials, and administration conveyance. In worldwide business, one nation’s utilisation of new mechanical improvements can make another nation’s items overrated and non-competitive

- Social Forces

Social powers incorporate conventions, values, societal patterns, customer brain research, and a general public’s desires of business.

The accompanying are a portion of the key worries in the social condition: environment (e.g., a dangerous atmospheric deviation, contamination); socioeconomics (e.g., populace development rates, maturing work drive in industrialized nations, high instructive necessities); personal satisfaction (e.g., training, security, medicinal services, way of life); and noneconomic exercises (e.g., foundations).

In addition, social issues can rapidly end up noticeably political and even lawful issues. Social powers are regularly most vital as a result of their impact on individuals’ conduct. For an association to survive, the item or administration must be needed, accordingly shopper conduct is considered as a different natural conduct. Conduct factors additionally influence companies inside, that is, the workers and administration.

A general public’s desires of business show different open doors and requirements. These desires radiate from various gatherings alluded to as partners. Partners incorporate a company’s proprietors (investors), individuals from the top managerial staff, supervisors and working representatives, providers, leasers, merchants, clients, and other premium gatherings – at the broadest level, partners incorporate the overall population.

Deciding the correct effect of social powers on an association is troublesome, best case scenario. Be that as it may, surveying the evolving esteems, demeanours, and statistic qualities of an association’s clients is a fundamental component in setting up hierarchical targets.

D1 Critique and interpret information and data applying environmental and competitive analysis to produce a set of valid strategic directions, objectives and tactical actions.

P2 Analyse the internal environment and capabilities of BP using appropriate frameworks.

Strategic capabilities (capacities)

Vital capacity alludes to BP’s capacity to effectively utilise aggressive systems that enable it to survive and increment its incentive after some time. While vital ability takes into account the techniques a business utilises, it centres on BP’s benefits, assets and market position, anticipating how well it will have the capacity to utilise procedures later on. There is no single strategy or all-inclusive metric for estimating or noticing key ability.

Components

Numerous components can conceivably add BP’s key ability. Resources, for example, money, property and licenses all add to the business’ capacity to plan and utilise systems. Different components of key capacity incorporate HR and authoritative structure, since worker abilities and initiative systems all add to a business’ competitiveness. Estimating can likewise be a piece of key ability, with organisations that see how to control costs to amplify benefits liable to appreciate vital favourable circumstances over contenders that experience difficulty landing at gainful value focuses for their item (Hartman D, 2017)

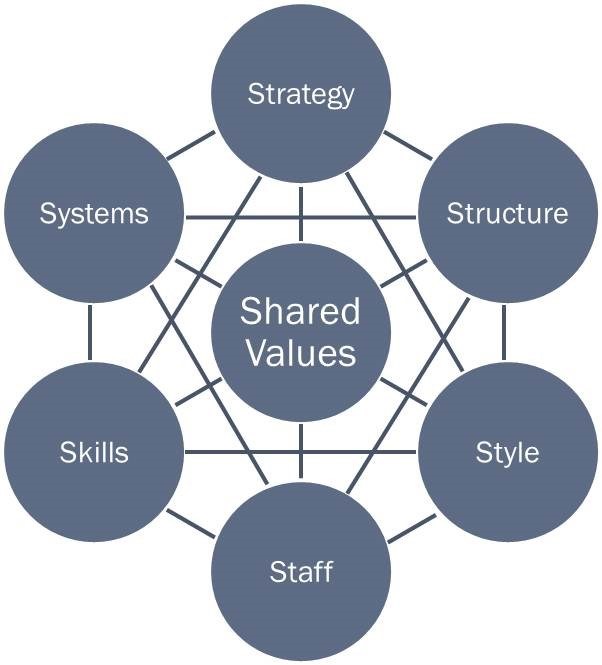

Mckinsey’s 7s Model:

The 7 s are structure, procedure, frameworks, abilities, style, staff and shared esteems. The model is regularly utilised as an authoritative investigation instrument to evaluate and screen changes in the inside circumstance of an organisation.

Created in the mid-1980s by Tom Peters and Robert Waterman, two advisors working at the McKinsey and Company counselling firm, the essential commence of the model is that there are seven internal parts of an organisation that should be adjusted on the off chance that it is to be effective.

The 7-S model can be utilised as a part of a wide assortment of circumstances where an arrangement point of view is valuable, for instance, to help BP:

- Enhance the execution of BP Oil Company.

- Inspect the possible impacts of future changes inside BP.

- Adjust offices and procedures amid a merger or procurement.

- Decide how best to actualise a proposed technique.

Short Description:

- The McKinsey 7S model is a diagnostic management tool used to test the strength of the strategic degree of fit between a firm’s current and proposed strategies.

- It is a management tool designed to facilitate the process of strategy implementation within the context of organisational change (Fleisher C & Bensoussan B, 2007).

Foundation:

• Idea that structure will take after technique had been a conspicuous idea in current procedure hypothesis.

• Consultants at McKinsey and Co. perceived a roundabout issue vital to their customer’s inability to adequately actualize procedure, and co-created the McKinsey demonstrate.

• Successful usage of technique requires administration of the interrelationships between seven elements.

Background:

• There are four key bits of knowledge which can be determined by BP Oil Company from this model:

– Five different components include hierarchical viability notwithstanding the conventional technique what’s more, structure.

– The lines associating every component distinguish the common reliance between every component.

– Strategic disappointment might be owing to carelessness to one or a blend of seven components.

Qualities and Advantages:

• Emphasis on BP’s technique execution.

• Organisational viability was not subject to just methodology and structure.

• Comprehensive in light of the fact that the expert must consider each of the seven builds, and how they communicate.

• First model to merge the “hard” and “soft” parts of the undertaking.

Shortcomings and Limitations:

• May miss some fine-grained territories in which holes in system origination or execution can emerge.

• Little observational help for the model or of its originator’s decisions.

• Remains hard to legitimately evaluate the level of fit.

• Difficult for examiners to clarify what ought to be finished for usage utilising the model.

• The 7S is generally a static model.

Process for Applying the Technique:

• The initial step for BP is to nearly inspect every ‘S’.

• The key achievement factors for every component need to be recognized.

• Can make a 7 X 2 grid with the best line containing basic highlights of every ‘S’ that BP does to a great degree well.

• The base column would contain the components of every ‘S’ where BP is accomplishing trashy analysis.

• After detaching the key separation between the seven components of key fit, there are basically three alternatives:

– BP can work to change the required parts of every ‘S’ with the goal that they are reliable with technique.

– It can change the technique to fit the current introduction of the other six components of the model.

Frequently, a trade-off between every choice is the sensible option.

BP Oil Company Assets and capabilities

In any case, to make the best utilisation of their accessible assets, companies require abilities. Such capacities likewise come in a wide range of structures. They may, for instance, be the order of a specific material innovation, abnormal state promoting abilities, viable item advancement forms, a capable treasury work or a bent in presenting new creation forms. They likewise, fundamentally, incorporate administration capacities.

In any case, abilities are likewise significantly more than this. They are in themselves one of a kind assets, accessible to chiefs, to be conveyed in various ways.

BP idea of capabilities

While numerous assets that companies have are substantial resources, abilities are, by their extremely nature, elusive. They are to be found in authoritative structures and methods for getting things done, in schedules and administrative procedures. They speak to authoritative capital as the experience, aptitudes and know-how that empower individuals to do things well, and can even been found in the way that colleagues cooperate in a specific organization condition. Such capital does not, obviously, show up on the asset report.

BP upper hand

In the event that it is these assets and capabilities, in all their different structures, that make the potential for upper hand, the inquiry concerning how they can really make it remains. The underlying answer is that they should be created, co-ordinated and afterward conveyed such that the organisation can give products or administrations more monetarily than others or have the capacity to fulfil clients’ needs and needs superior to rivals. The perfect being a blend of the two.

A few conclusions

By taking a gander at assets and capacities or capabilities along these lines, it ends up plainly evident that the more physical and more unmistakable they are, the more prominent the probability that they can be imitated or possibly sensibly copied. Then again, the more immaterial the asset or capacity, the more troublesome that progresses toward becoming. In any case, what likewise has all the earmarks of being the situation is that impersonation is most troublesome when the asset is one that must be created after some time, or when achievement originates from a blend of abilities that are troublesome for contenders to recognize (Foss N, 1997)

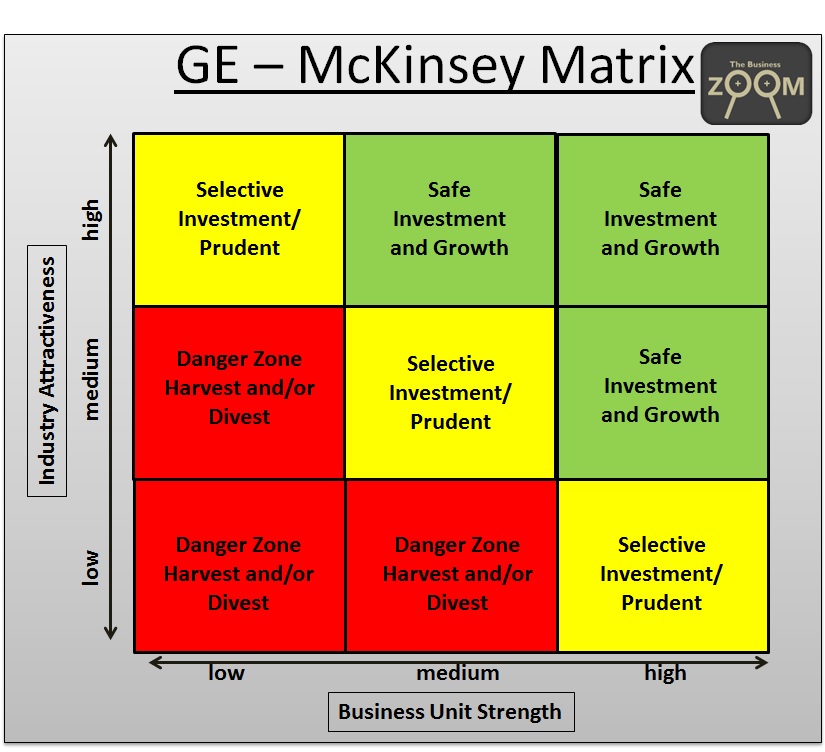

M2 Critically evaluate the internal environment to assess strengths and weaknesses of an organisation’s internal capabilities, structure and skill set using BP Oil company as an example.

(Zoom, 2015)

- VRIN Framework/VRIO Analysis: In 1984, Birger Wernerfelt thought of the asset-based view (RBV) as “a reason for the upper hand of a firm that untruths fundamentally in the use of a heap of important substantial (tangible) or impalpable (intangible) assets at the association’s disposal (Wernerfelt, 2017)

What makes BP unique!

Not all assets of a business are similarly and deliberately pertinent, however. Certain assets give the business an upper hand.

These have the VRIN attributes, which can be found by concentrating on four fundamental characteristics:

Value: Resources that can bring quality can be a wellspring of an upper hand. Remember that not all assets are similarly simple to acquire.

Rareness: Resources that are accessible to all contenders infrequently give any critical upper hand.

Imitability: A perfect asset can’t be acquired by contending organisations.

Non-substitutable: A perfect asset can’t be substituted by some other asset.

The VRIO system is especially helpful for evaluating and breaking down the BP’s inward assets and its potential for applying these assets to accomplish upper hand.

The VRIO structure is incredible for the assessment of an organisation’s assets. It supplements the PESTLE examination strategy, which is generally utilised by advertisers to investigate and screen the large scale natural factors that affect the company. Business investigators can utilise VRIO to precisely evaluate the interior assets of a business, its upper hand potential, and the conceivable outcomes of change of its assets inside important business zones.

VRIO Framework is one such business examination structure apparatus used to investigate the inward assets and capacities of BP. The advancement of this system instrument began in 1991 by Jay B Barney in his work ‘Firm Resources and Sustained Competitive Advantage’. In this book, he pinpointed four factors that add to a company’s assets to wind up noticeably a wellspring of maintained upper hand. Initially, this system was called VRIN. He enhanced VRIN structure in 1995 in this later work, ‘Searching Inside for Competitive Advantage’ and named it VRIO (By Rameez M, 2017)

- Value chain investigation: is a vital apparatus used to examine interior firm exercises. Its will likely perceive, which exercises are the most significant (i.e. are the wellspring of cost or separation advantage) to the firm and which ones could be enhanced to give the aggressive advantage

The essential value chain exercises are Inbound Logistics: the getting and warehousing of crude materials, and their appropriation to assembling as they are required. Activities: the procedures of changing contributions to completed items and administrations (Dekker C, 2013)

- Benchmarking strategic capabilities: Benchmarking is the way toward contrasting what your organization is doing and what the best performing organisation in your industry is doing. Process benchmarking, one of three kinds of benchmarking, looks at operational procedures. Execution benchmarking looks at product offerings, promoting and deals to decide how to expand incomes. These are all the more here and now in their degree and deliver snappy outcomes. Key benchmarking takes a long haul perspective of the organisation bearing with respect to the future techniques of contending organisations (Victoria Duff, 2013)

BP’s key advantages using benchmarking

- Bringing down Labour Costs: One favourable position of benchmarking might be bring down work costs. For instance, a little assembling organisation may think about how a best contender utilises robots for a few essential plant capacities.

- Enhancing Product Quality: the organisations may likewise utilise benchmarking to enhance item quality. Specialists now and again buy driving contenders’ items.

- Expanding Sales and Profits: the organisation that utilises benchmarking to enhance its capacities, tasks, items and administrations may appreciate increments in deals and benefits. Clients are probably going to see these changes (Suttle R, 2017)

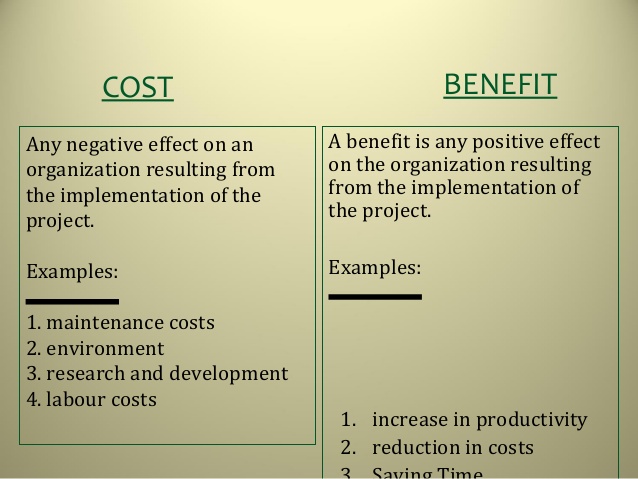

- Cost-benefit analysis: Cost-benefit analysis (CBA), in some cases called advantage costs examination (BCA), is a precise way to deal with gauge the qualities and shortcomings of choices (for instance in exchanges, exercises, useful business prerequisites or activities speculations); it is utilised to decide alternatives that give the best.

(Zoom, 2018)

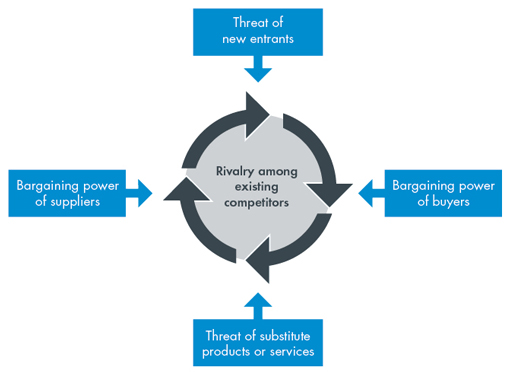

P3 Applying Porter’s Five Forces model evaluate the competitive forces of a given market sector for an organisation using BP as an example.

Framework/theory

Porter’s Five Forces of Competitive Position Analysis were created in 1979 by Michael E Porter of Harvard Business School as a basic system for surveying and assessing the focused quality and position of a business association.

This hypothesis depends on the idea that there are five powers that decide the aggressive force and engaging quality of a market. Porter’s five powers help to distinguish where control lies in a business circumstance. This is helpful both in understanding the quality or strengths of BP’s present aggressive position, and the quality of a position that BP Oil Company may hope to move into.

BP Oil Company have put in place vital examiners who regularly utilise Porter’s five powers to comprehend whether new items or administrations are possibly productive. By understanding where control lies, the hypothesis can likewise be utilised to distinguish territories of quality (strengths), to enhance shortcomings (weakness) and to maintain a strategic distance from botches.

Illustration of how BP Oil Company use Porter’s five forces of competitive position analysis:

The five BP Oil Company powers are:

1. Provider control: The appraisal of how simple it is for providers to drive up costs. This is driven by the: quantity of providers of every basic info; uniqueness of their item or administration; relative size and quality of the provider; and cost of changing starting with one provider then onto the next.

2. Purchaser control: The appraisal of how simple it is at purchasers to drive costs down. This is driven by the: quantity of purchasers in the market; significance of every individual purchaser to the association; and cost to the purchaser of changing starting with one provider then onto the next. On the off chance that a business has only a couple of effective purchasers, they are regularly ready to direct terms.

3. Aggressive contention: The principle driver is the number and capacity of rivals in the market. Numerous contenders, offering undifferentiated items and administrations, will decrease advertise engaging quality.

4. The danger of substitution: Where close substitute items exist in a market, it improves the probability of clients changing to options in light of cost increments. This lessens both the energy of providers and the appeal of the market.

5. The danger of new passage: Productive markets pull in new contestants, which disintegrates gainfulness. Unless occupants have solid and sturdy obstructions to section, for instance, licenses, economies of scale, capital necessities or government strategies, at that point benefit will decrease to an aggressive rate.

Seemingly, direction, tax collection and exchange approaches make government a 6th power for some businesses.

What benefits does Porter’s Five Forces investigation or analysis give to BP?

Five powers examination encourages BP to comprehend the variables influencing productivity in a particular industry, and can advise choices identifying with whether to enter a particular industry; regardless of whether to build limit in a particular industry; and creating aggressive procedures.

Moves to make/Dos:

- Utilise this model where there are no less than three rivals in the market.

- Consider the effect that legislature has or may have on the business.

- Consider the business lifecycle organize – prior stages will be more turbulent.

- Think about the dynamic/changing qualities of the business.

Actions to Avoid/Don’ts:

- Abstain from utilising the model for an individual firm; it is intended for use on an industry premise.

Advantage and disadvantage

Porter’s model likewise experiences issues in coordinating the complexities of the present markets with the incessant between relations and item gatherings of BP Oil Company. On the off chance that BP characterises its market section too barely to fit into the model there is a hazard that key components might be disregarded, for instance, enactment and the communications amongst vendors and purchasers.

Find Out How UKEssays.com Can Help You!

Our academic experts are ready and waiting to assist with any writing project you may have. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs.

View our academic writing services

Organisations need to react to something beyond showcase powers. They should know about, comprehend the ramifications of, and react to government enactment, corporate morals, and their social duties. The inside culture and ethos of an organisation will likewise convey essentialness while shaping a system. Poter’s model is likewise unfit to consolidate the ramifications of vital collusions or the sharing of aptitudes and assets as a more successful approach to react to circumstances.

In spite of these elements, Porters Five Forces show has a part to play in helping administration to assess and survey their present market condition. It gives a great establishment to the further research and insight gathering expected to detail an association’s future system.

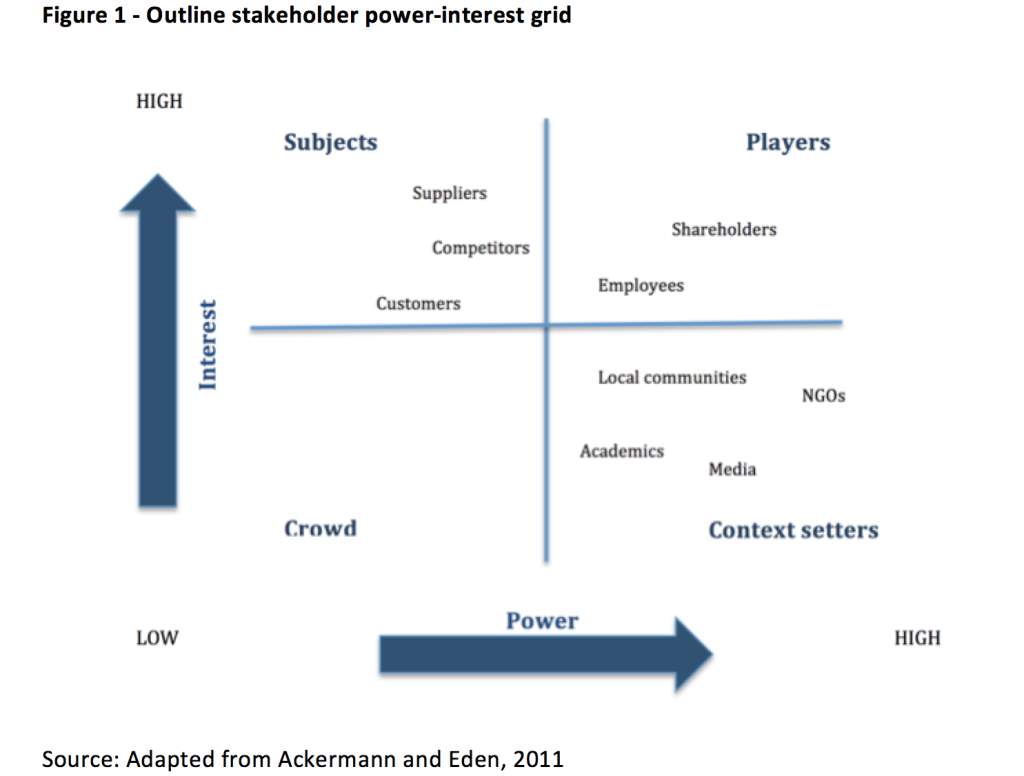

Stakeholder analysis: in compromise, venture administration, and business organization, is the procedure of the surveying a choice’s effect on pertinent gatherings. This data is utilised to evaluate how the interests of those partners ought to be tended to in an undertaking design, arrangement, program, or other activity.

Stakeholders can influence or be influenced by the association’s activities, targets and approaches. A few cases of key partners are banks, chiefs, representatives, government (and its organizations), proprietors (investors), providers, associations, and the group from which the business draws its assets.

Investors are focal in tremendous organizations, for example, huge oil organisations and inside British Petroleum they assume a crucial part since they contribute incredible measures of capital, which is basic to set up and work a business. What’s more, they get their reward from their offer of the benefits as profits (British Petroleum, 2014).

English Petroleum utilizes more than 80,000 individuals over the world. As partners, workers are influenced by the organization exhibitions, yet in addition, they impact the manner by which the organization works. The degree of representatives’ sense of duty regarding greatness and well-being and security is key to keep up British Petroleum’s unmistakable position in the part. In addition, rebelliousness can bring about lost esteem and a decrease in help from kindred representatives (British Petroleum, 2014).

Providers assume an essential part in British Petroleum’s chain of creation. The organization inserts distinctive centre esteems that are critical in each sort of task and its notoriety depends on guaranteeing that its activities mirror these qualities (British Petroleum, 2014).

One of British Petroleum’s fundamental destinations is to “comprehend buyer desires and to convey quality items to clients all through the retail arrange”. Accomplishing this point is trying as clients require an incentive for cash which implies delivering the most astounding nature of merchandise at aggressive costs. As of late, clients have relentlessly turned out to be more worried about contamination and natural harm and, thusly British Petroleum have presented more vitality effective items, for example, biofuels and renewables. This shows of how the organization can be impacted by client weight and why the organization must have the capacity to fulfil client desires (British Petroleum, 2014).

Groups found close-by the oil refineries have raised worries over their wellbeing. English Petroleum has endeavoured to address these worries and pick up believability by taking required security measures. This includes overseeing plants in safe ways and giving individuals data about crisis systems (British Petroleum, 2014).

English Petroleum works in conjunction with a scope of intrigue gatherings, for example, scholastics, government, media and NGOs. All these are connected to the organization and have fluctuating degrees of impact. Governments have high level of control over British Petroleum, see that the organization is worldwide and must pick up endorsements and licenses it needs to show that it works as indicated by the best possible measures universally. With respect to Governments, their advantage lies essentially in charge accumulation and securing key vitality supplies.

With respect to the media, it is vital for an aggressive organization, for example, British Petroleum to accumulate positive press bolster. A positive notoriety fortifies its position in the market and it is a wellspring of fascination for new clients (British Petroleum, 2014).

One of the primary obligations of the strategists and chiefs is to raise the level of enthusiasm of capable partners, to enable them to satisfy their expected part inside the platform of corporate administration (Rothaermel, 2013). While arranging the fate of the organization, strategists can move the position of particular partners towards one with more power and intrigue level. On account of British Petroleum, the position of the providers could be overhauled with the foundation of associations with new temporary workers and different accomplices in finishing the store network activity. Likewise, the enthusiasm of contenders, both opponent and reciprocal, could be expanded keeping in mind the end goal to set up mergers and procurement exercises with the point of abusing demonstrated holds and evading superfluous and hazardous drillings.

Greater engagement with NGOs could help in enhancing the organization way to deal with changing tasks and lessening ecological effect.

Transcript of Balanced Scorecard for BP

Adjusted Scorecard for BP by Brolin Slaght

Neema Khorassani

Richard Honkanen

Neville Khajotia: Objectives Measures Initiative

Increment client satisfaction, Sales/Retention rate, provide clients better administration and enhance. Promoting organisation Image, Company Name in media, Press discharges; work and give to natural associations; increment wellbeing consistence (Khojatia N, 2011)

An execution scorecard is a graphical portrayal of the advance after some time of some substance, for example, an endeavour, a representative or a specialty unit, toward some predetermined objective or objectives. Execution scorecards are generally utilised as a part of numerous ventures all through both people in general and private divisions.

M3 Devise appropriate strategies to improve competitive edge and market position based on the outcomes.

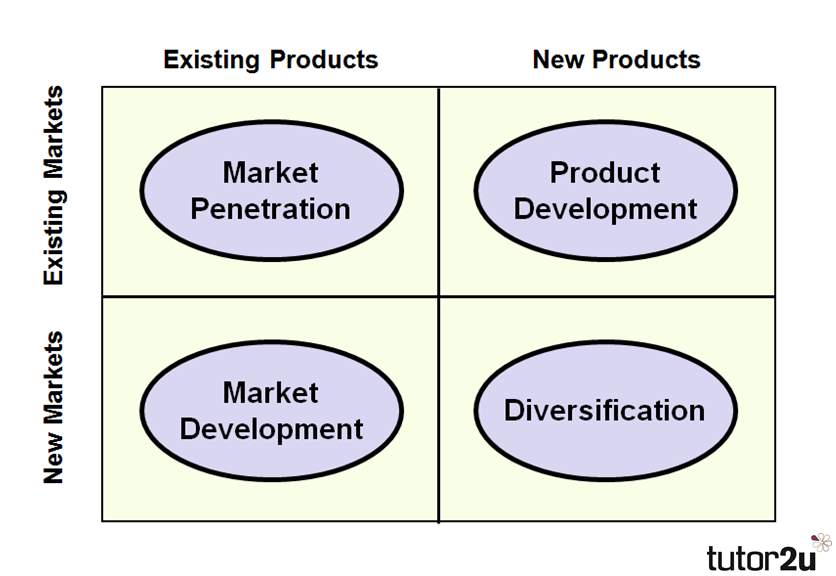

Ansoff Matrix to product

The Ansoff Growth matrix is another showcasing arranging device that enables BP to decide its item and market development system.

Ansoff’s item/showcase development framework recommends that a BP endeavours to develop rely upon whether it advertises new or existing items in new or existing markets. The yield from the Ansoff item/showcase grid is a progression of proposed development techniques which set the course for the BP system. These are depicted underneath:

Market Penetration (Infiltration)

Market infiltration is the name given to a development methodology where the business centres on offering existing items into existing markets.

Market infiltration looks to accomplish four principle goals:

Keep up or increment the piece of the overall industry of current items – this can be accomplished by a mix of aggressive estimating methodologies, publicising, deals advancement and maybe more assets devoted to individual offering

Secure predominance of development markets within BP.

Rebuild a develop advertise by driving out contenders; this would require a substantially more forceful limited time crusade, upheld by an evaluating system intended to make the market ugly for contenders

Increment use by existing clients – for instance by presenting dedication plans

A market entrance advertising system is especially about “the same old thing”. The business is concentrating on business sectors and items it knows well. It is probably going to have great data on contenders and on client needs. It is impossible, along these lines, that this methodology will require much interest in new statistical surveying (Ward D, 2018)

Market Improvement (Development)

Market advancement is the name given to a development procedure where BP tries to offer its current items into new markets.

There are numerous conceivable methods for moving toward this system, including:

New geological markets; for instance sending out the item to another nation

New item measurements or bundling: for instance

New circulation channels (e.g. moving from offering by means of retail to offering utilising internet business and mail arrange)

Diverse valuing arrangements to pull in various clients or make new market sections

Market advancement is a more unsafe methodology than showcase entrance in light of the focusing of new markets.

Item advancement (product)

Item advancement is the name given to a development system where BP plans to bring new items into existing markets. This methodology may require the advancement of new skills and requires the business to create changed items which can speak to existing markets.

A technique of item improvement is especially appropriate for a business where the item should be separated so as to stay focused. A fruitful item advancement procedure puts the promoting accentuation on:

Research and advancement and development

Itemised bits of knowledge into client needs (and how they change)

Being first to showcase

Expansion (Diversification)

Expansion is the name given to the development methodology where a business showcases new items in new markets.

This is a naturally more hazard system on the grounds that the business is moving into business sectors in which it has practically zero understanding.

The BP to embrace an enhancement procedure, accordingly, it must have a reasonable thought regarding what it hopes to pick up from the system and a legitimate appraisal of the dangers. Be that as it may, for the correct harmony amongst hazard and reward, a promoting procedure of expansion can be exceptionally fulfilling.

Ansoff’s thing/grandstand improvement system prescribes that a business’ undertakings to create depend upon whether it publicises new or existing things in new or existing markets. The yield from the Ansoff thing/exhibit network is a movement of proposed advancement strategies which set the course for the business framework. These are portrayed underneath:

Market penetration hopes to achieve four standard objectives within BP:

BP to Keep up or increase the bit of the general business of current things – this can be expert by a blend of forceful evaluating strategies, publicising, bargains progression and perhaps more resources dedicated to singular advertising secure power of improvement markets

Modify a create promote by driving out contenders; this would require a considerably more powerful restricted time campaign, maintained by an assessing framework expected to make the market monstrous for contenders

Augmentation use by existing customers – for example by exhibiting devotion designs

A market entrance promoting framework is particularly about “old news”. The business is focusing on business parts and things it knows well. It is presumably going to have extraordinary information on contenders and on customer needs. It is incomprehensible, thusly, that this system will require much enthusiasm for new measurable looking over.

Market change

Market progression is the name given to an improvement methodology where the business tries to offer its present things into new markets.

There are various possible techniques for pushing toward this framework, including:

New land markets; for example conveying the thing to another country

New thing estimations or packaging: for example

New course channels (e.g. moving from offering by methods for retail to offering using web business and mail organize)

Assorted esteeming plans to pull in different customers or make new market areas

Market headway is a more risky approach than exhibit entrance in light of the cantering of new markets.

Thing headway

Thing headway is the name given to an improvement framework where a strategies for success to bring new things into existing markets. This philosophy may require the headway of new abilities and requires the business to make changed things which can address existing markets.

A procedure of thing change is particularly fitting for a business where the thing ought to be isolated to remain centred. A productive thing progression strategy puts the advancing emphasis on:

Research and headway and advancement, ordered bits of information into customer needs (and how they change) Being first to grandstand

Development

Extension is the name given to the improvement approach where a business features new things in new markets.

This is a normally more danger framework in light of the fact that the business is moving into business segments in which it has for all intents and purposes zero comprehension.

For a business to grasp an improvement technique, in like manner, it must have a sensible idea with respect to what it would like to get from the framework and an honest to goodness examination of the risks. In any case, for the right concordance among peril and reward, an advancing strategy of development can be astoundingly satisfying.

P4 Applying a range of theories, concepts and models, interpret and devise strategic planning for a given organisation such as BP Oil Company.

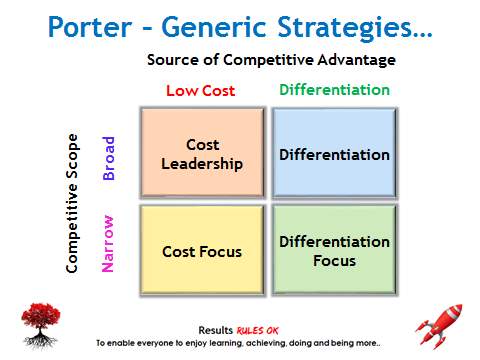

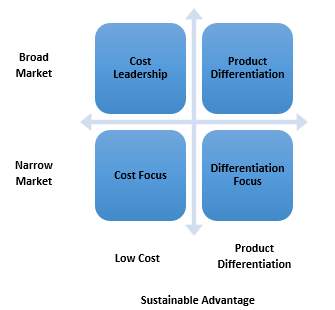

Cost and price leadership within BP

What is ‘Value Leadership’ Price authority is the point at which BP that is the pioneer in its part decides the cost of merchandise or administrations. This approach can leave the pioneer’s opponents with minimal decision yet to take after its lead and match these costs on the off chance that they are to clutch their piece of the pie.

- Dangers of Overall Cost Leadership:

Cost authority forces extreme weights on BP to keep up its position, which implies reinvesting in present day gear, heartlessly rejecting out of date resources, evading product offering multiplication and being caution for innovative enhancements. Cost decreases with combined volume are in no way, shape or form programmed, nor is harvesting every accessible economy of scale achievable without critical consideration (Porter, M. E.1980)

Some of these dangers are mechanical change that invalidates past speculations or learning; ease learning by industry newcomers or devotees, through impersonation or through their capacity to put resources into cutting-edge offices;

Differentiation strategy

Approach under which a firm plans to create and advertise interesting items for various client sections. … It is one of three non-specific advertising techniques (see centres system and minimal effort procedure for the other two) that can be embraced by any firm.

- Dangers of Differentiation

Separation additionally includes a progression of dangers: the cost differential between ease contenders and the separated firm turns out to be excessively awesome for separation, making it impossible to hold mark devotion. Purchasers along these lines forfeit a portion of the highlights, administrations, or picture controlled by the separated firm for vast cost funds; purchasers’ requirement for the separating factor falls.

Focus strategy

An advertising technique in which an organization focuses its assets on entering or extending in a thin market or industry fragment. A concentration procedure is typically utilized where the company knows its section and has items to intensely fulfil its needs. Centre technique is one of three non-specific showcasing procedures.

- Dangers of Focus

Centre includes yet another arrangement of dangers: the cost differential between wide range contenders and the concentrated firm enlarges to wipe out the cost points of interest of serving a thin target or to counterbalance the separation accomplished by centre; the distinctions in wanted items or administrations between the key target and the market overall strait; contenders discover sub-showcases inside the vital target and out-centre the focuser (Johnson, G., & Scholes, K. (1993)

Johnson, G., & Scholes, K. (1993)

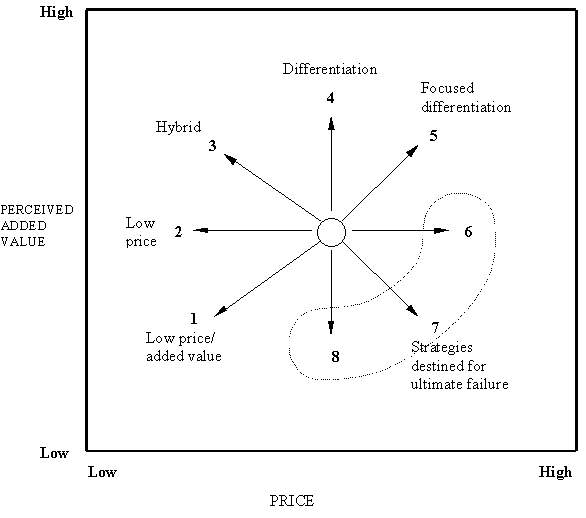

The 8 Generic Strategies of the Strategy clock (Bowman’s Strategy clock)

| Generic Strategies | Needs/risks |

| 1. Low price/low added value | Likely to be segment specific |

| 2. Low price | Risk of price war and low margins; need to be cost leader |

| 3. Hybrid | Differentiation

Low cost base and reinvestment in low price and differentiation |

| 4. Differentiation (a) Without price premium (b) With price premium |

Perceived added value by user, yielding market share benefits Perceived added value sufficient to bear price premium |

| 5. Focused differentiation | Perceived added value to a particular segment, warranting price premium |

| 6. Increased price/standard value | Likely failure

Higher margins if competitors do not follow; risk of losing market share |

| 7. Increased price/low value | Only feasible in monopoly situation |

| 8. Low value/standard price | Loss of market share |

The extended model of Bowman’s strategy clock

Bowman’s Strategy Clock is a model utilized as a part of advertising to investigate the focused position of an organization in contrast with the offerings of contenders. It was produced by Cliff Bowman and David Faulkner as an elaboration of the three Porter non-specific methodologies.

M4 Produce a strategic management plan that has tangible and tactical strategic priorities and objectives for BP Oil Company.

BIBLIOGRAPHY

Web access:

https://www.bp.com/content/dam/bp/…/bp-foi-2006-2010-introduction-and-history.p

www.businessdictionary.com/definition/strategy.html

smallbusiness.chron.com › Business Planning & Strategy › Strategic Business Plans

www.1000ventures.com/business_guide/crosscuttings/strategic_intent.html

https://www.oxfordlearninglab.com/p/pestle-macro-environmental-analysis

www.blissreturned.wordpress.com/swot

www.strategy-formulation.24xls.com/en103

smallbusiness.chron.com › running a Business › Business Success

https://www.feedough.com › Feeds

https://www.strategicmanagementinsight.com/tools/value-chain-analysis.html

https://www.cgma.org/resources/tools/essential-tools/porters-five-forces.html

Johnson, G., & Scholes, K. (1993). Exploring corporate strategy,

(Third Edition). New York: Prentice Hall. (Ch.6, Excerpts)

Porter, M. E. (1980). Competitive strategy: Techniques for analysing

industries and competitors. New York: Free Press. (Ch.2, Excerpts)

http://www.free-management-ebooks.com/faqst/porter-07

Fleisher C & Bensoussan B, 2007. Business and Competitive Analysis. FT Press. Ch12.4

Hamel and Prahalad, 1989

Foss N., 1997. Resources, firms, and strategies. Oxford University Press.

Jay B. Barney and William S., 2018. Explore the b Strategic Management and Competitive Advantage. Hesterly.

Cite This Work

To export a reference to this article please select a referencing style below: