I. Introduction

The rise of the number of start-ups in Bristol positively contributes to the city's net job creation and productivity growth. 1 What drove this growth and how did the rest of the United Kingdom compare?

Given the nature of innovation, the individual/company which develops an innovation will be able to access profits above the opportunity cost of capital (the amount of income an investor could have received by investing the unit of capital elsewhere)2. Innovation can also improve the productivity of workers by producing more for the same amount of time, therefore the value of individual workers rises and they can demand higher wages which can stimulate the whole economy by higher consumer spending.

After discussing the scope of this report with my peers one fact became clear and that was that no one sought to examine how PE/VC groups helped build the city's start-up scene, therefore after doing extensive research into the matter, this became a primary pivot point of this report because of the sheer amount of untapped potential.

1 "How startups help cities measure their economic development ...." 24 Oct. 2019, https://www.brookings.edu/research/how-startups-help-cities-measure-their-economic-development-frontier/. Accessed 17 Nov. 2019.

2 "The Economy - CORE Econ." https://www.core-econ.org/the-economy/. Accessed 20 Nov. 2019.

The reader should note that any discussion involving data regarding the number of business start-ups is per 10,000 population.

The reader should note that PE/VC = Private Equity/Venture Capital.

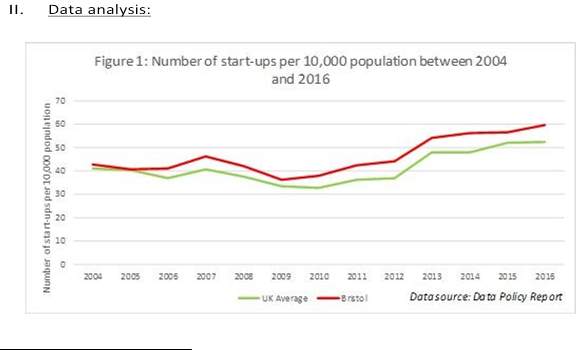

Figure 1 shows that the number of business start-ups in Bristol rose from 42.66 (2004) to 59.51(2016). The period immediately after the financial crisis in 2008 and 2009 saw a fall in business start-ups. Since the economy was in a recession, it was harder to obtain capital through debt and equity financing as investors were looking to hedge (protect) themselves against the bearish (downward) market and risk management did not allow them to fund risky startups.[1]

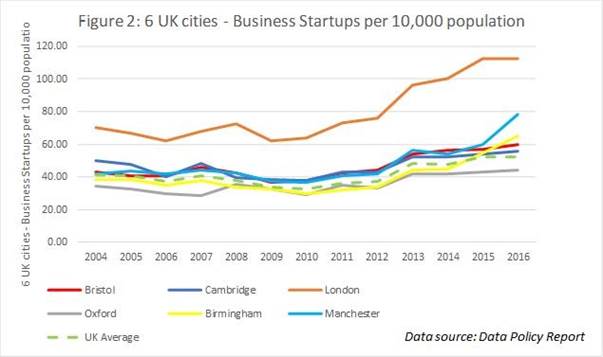

Figure 2 compares the data we observed in Figure 1 with 5 selected cities as well as with the UK Average.

It can be observed that not only did the number of start-ups in London rise faster, but that there are more start-ups there per 10,000 population than anywhere else observed. The other cities performed very similarly, although Manchester came out on top of them with a sharp 30% increase from 2015 to 2016. One striking difference can be observed between Oxford and Cambridge where both cities have similar demographics and provide investors with world-class talent. This difference could be explained by Cambridge's stronger start-up history with more efficient networks such as Cambridge Angels or Cambridge Innovation Capital[2]

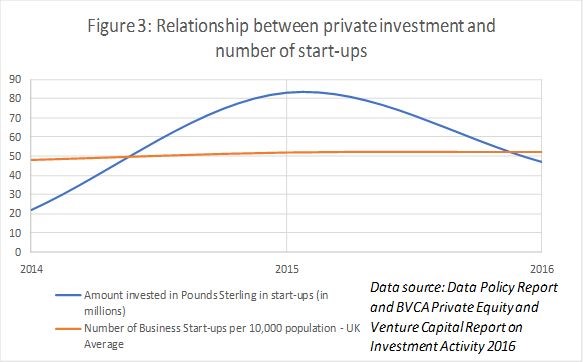

Figure 3 examines the relationship between the average number of business start-ups in the UK and the amount invested in start-up companies(in GBP, in millions).

The data comes from the British PE&VC Association[3]. The amount invested in Pounds Sterling in start-ups grew in the observed period by an astonishing 113%.

III. Innovation in Bristol

Recent 2019 data shows that innovation investments in Bristol continue to follow the trend that was set in the past years. By April, £611,000 out of £3m were invested in local business start-ups.[4] Jerry Barnes, the founding member of the Bristol Private Equity Club remarked: "Everything has got tech in it, and in terms of growth it is the tech companies that will deliver growth," he said. "AI is obviously flavour of the year, or the decade, but it does seem to make a difference, that's something we are talking to companies about."6 Inductosense, a company founded in 2011 by three professors at the Ultrasonics and Non-Destructive Testing group of the University of Bristol, provides us with a taster of what sort of a market PE/VC groups look into. It is a company which manufactures wireless sensors which then later use AI to detect cracks, corrosion and defects in buildings and structures without interfering with their structural integrity.[5] Inductosense received £210,000 from BPEC following a previous investment in 2017 of £217,000.6

Get Help With Your Coursework

If you need assistance with writing your coursework, our professional coursework writing service is here to help!

One of the main factors that help the start-up scene in Bristol grow are the city's strong higher education institutions which support innovators and entrepreneurs. The commitment of the University of Bristol to build its newest campus in the Temple Quarter[6][7] (as of the writing of the report the completion date is not set and can be subject to change) and to focus it on innovation and start-ups further exemplifies the spirit of Bristol which has always been centered around progress and innovation. 9

IV. The future

The current political landscape makes us wonder what the future holds for private investments in the UK. On one hand we have the uncertainty of Brexit which could slow (and has slowed) Britain's economic growth (which could off-set potential investments as explained previously)[8][9] and on the other hand we could have a government which could regulate the current private equity industry and seriously hamper the ability of angel investors to support up-and-coming start-ups. In the November of 2018, private equity funds were seeking detailed legal advice on how to deal with the potential regulation of their business if Labour was to form a government. [10]

PE/VC firms also help non-monetarily by providing strategic assistance, mentoring or by introducing start-ups to larger networks12. The start-up industry is heavily dependant on them and efforts to regulate the industry could potentially hamper the future of start-ups.[11]

V. Conclusion

The idea to pivot this report around the importance of venture capital and private equity in funding innovation and start-ups came after reading some of Elisabeth Warren's (a frontrunner for the Democratic Party in the 2020 Presidential Elections) comments[12] on her plans to change how the industry works. We sought to examine the importance of private investing in start-ups and how it has influenced the start-up landscape in Bristol.

Find Out How UKEssays.com Can Help You!

Our academic experts are ready and waiting to assist with any writing project you may have. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs.

View our academic writing services

Start-ups create a 'virtuous cycle' which fuels the economy, pushes wager higher and improves our products. As per our report, we can see that start-ups in Bristol relied on PE/VC groups for their funding and that at this stage start-ups look to them not only for capital, but also for help with their strategy, business model and outlook. However, given the scope of this report and lack of resources available we were not able to quantify how much 'value' private investments created in Bristol.

[1] "The Risk And Rewards Of Investing In Startups (GOOG)." 25 Jun. 2019, https://www.investopedia.com/articles/personal-finance/041315/risk-and-rewards-inves ting-startups.asp. Accessed 19 Nov. 2019.

[2] "Tom Hulme: Cambridge has edge over Oxford on tech ...." 17 Sep. 2017, https://www.businessinsider.com/tom-hulme-cambridge-edge-over-oxford-startups-20 17-9. Accessed 20 Nov. 2019.

[3] "BVCA Private Equity and Venture Capital Report on ...." https://www.bvca.co.uk/Portals/0/Documents/Research/Industry%20Activity/BVCA-RIA2016.pdf. Accessed 20 Nov. 2019.

[4] "Bristol private equity backs tech startups for growth ...." https://www.techspark.co/blog/2019/04/11/bristol-private-equity-backs-tech-startups-f or-growth/. Accessed 20 Nov. 2019.

[5] "Who we are | Inductosense." http://www.inductosense.com/who-we-are/. Accessed 20 Nov. 2019.

[6] "Temple Quarter Enterprise Campus - University of Bristol." https://www.bristol.ac.uk/temple-quarter-campus/. Accessed 20 Nov. 2019. 9 "What makes Bristol a startup haven? - Gravitywell." 6 Feb. 2019, https://www.gravitywell.co.uk/insights/what-makes-bristol-a-startup-haven/. Accessed

[7] Nov. 2019.

[8] "Brexit is like a slow puncture for the UK economy | Financial ...." 11 Apr. 2019, https://www.ft.com/content/af091af4-5ba6-11e9-939a-341f5ada9d40. Accessed 20 Nov.

[9] .

[10] "UK hedge, private equity funds seek legal advice on life under ...." 27 Nov. 2018, https://uk.reuters.com/article/uk-britain-hedgefunds/uk-hedge-private-equity-funds-se ek-legal-advice-on-life-under-labour-idUKKCN1NW1Q3. Accessed 20 Nov. 2019. 12 "A Guide To Venture Capital Financings For Startups - Forbes." 29 Mar. 2018, https://www.forbes.com/sites/allbusiness/2018/03/29/a-guide-to-venture-capital-financ ings-for-startups/. Accessed 20 Nov. 2019.

[11] "How Does Policy Uncertainty Affect Venture Capital? by Xuan ...." 3 Feb. 2017, https://papers.ssrn.com/abstract=2910075.. Accessed 20 Nov. 2019.

[12] "Warren's private equity crusade faces resistance at House ...." 19 Nov. 2019, https://www.politico.com/news/2019/11/19/warren-private-equity-house-hearin g-071649. Accessed 20 Nov. 2019.

Cite This Work

To export a reference to this article please select a referencing style below: