Introduction

Internal auditing is a consulting activity on a company that is independent. It aims at helping a company/ form evaluate its managerial system, identify issues in the firm and control the process of governance. Therefore an internal audit helps in supporting the board in their duties of completing important businesses in the company. The main issues faced by the auditor is whether research and development costs expensed in establishing technological feasibility were properly expensed or capitalized when appropriate. A good audit plan when implemented improves business performances and increases sales in a company.

Definitions

- An internal audit is a tool used in firms to evaluate how effective its management system is and its quality.

- An internal auditor is any person who is qualified enough to have a responsibility of performing the audit process

- Nonconformance is the situation where the practice of a company is in disagreement with the standard practices

KCN Analysis of the Audit Strategies

|

Section |

Purpose |

Audit Strategy |

|

OBJECTIVES OF THE ENGAGEMENT |

This lists the services to be provided by the audit firm to KCN. |

The aim of this process is to define Keyton Computers & Networks Ink’s internal audit for the purpose of evaluating the company’s effectiveness.This is the audit of KCN’s financial statements for the year ended December 31, 2015, and the issuance of a letter of engagement. |

|

BUSINESS AND INDUSTRY CONDITIONS |

To evaluate KCN’s business and the industry it operates in |

KCN sells and services micro-computers, networking hardware and software to different businesses. |

|

PLANNING MEETINGS |

Shows the meetings that have been made with the clients and CPA team |

One meeting so far held with client and one with engagement team |

|

OWNERSHIP AND MANAGEMENT |

Shows/ indicates who owns and manages the company. |

Owners: Terry Keystone, Mark Keystone, John Keystone, Keith Young, and Rita Young. Managers: Terry and Mark Keystone |

|

OBJECTIVES, STRATEGIES AND BUSINESS RISKS |

This establishes client’s goals, how they planned to achieve it, and the commensurate risks, and how they planned to overcome these risks. |

The main aim is to increase revenues 110% and increase net income to112% for each of the next 3 years. To achieve this there will be need to: (1) advertise aggressively, sell to customers with higher risk profiles, and to develop new software. The primary risks involved are not being able to produce the desired results and exceeding increased sales with credit losses. Another possible risk is not producing products in the software development. |

|

MEASUREMENT AND REVIEW OF FINANCIAL PERFORMANCE |

These are the ways used for performance evaluation. |

The procedures include inventory and receivables turnover, aging of accounts receivable, and the total inventory balance. |

|

PROCEDURES TO ATTAIN AN UNDERSTANDING OF CLIENT AND CLIENT’S OPERATING ENVIRONMENT |

This tells the procedures to be done so the auditors can understand the client and the client’s environment. |

For this audit strategy, the auditor needs to 1) review the prior year’s audit, 2) make inquiries from management, 3) analyze KCN’s minutes of its board of directors’ meetings, 4) evaluate performance reports, 5) analyze company website, 6) appraise industry reports, and 7) assess business newspapers including the Wall Street Journal. |

|

AUDIT APPROACH |

This defines the general plan to be taken. |

Just like last year’s audit, the accountants assigned to KCN’s audit have to make a plan about the company’s tests of controls to gauge whether its control risks are below the maximum for the identified assertions. |

|

SIGNIFICANT RISKS |

Primary risks identified by the auditors. |

The primary risks involved are not being able to produce the desired results and exceeding increased sales with credit losses. Another possible risk is not producing products in the software development, and analysis of the quarterly results showed significant bonuses awarded to officers. |

|

SIGNIFICANT ACCOUNTING AND AUDITING MATTERS |

This are matters of concern in accounting and auditing |

Two primary concerns exist: whether accounting for extended warranties is done properly and cost of software. |

|

PLANNING MATERIALITY |

The auditor computes the materiality threshold. |

Review of sales, total assets, and pretax net income, to plan for materiality, $70,000 was established as the measure. |

|

SCHEDULING AND STAFFING PLAN |

This is the audit’s schedule. It also identifies the human resources assigned to the engagement. |

This includes the target dates for each major section of the audit starting from the interim audit work up to the updating of the management letter.The firm budgeted 118 hours for the engagement. |

KCN Risks

RiskImplications and Response

|

This increases the risk of bad debt expense misstatement and the corresponding allowance. The auditors can revise their estimates on the value of an account, and ignore the procedures previously done. |

|

There could be an increase in the risk of quarterly results misstatement to extract the maximum bonus for officers.Also this motivates the officers to work more for more bonuses. The auditors may respond by reducing the number of the staff as long as they can handle their duties, to reduce number of people receiving bonuses. |

KCN Capitalization of Software Development Costs

For KCN, the auditor has to determine whether research and development costs including those expended to establish technological feasibility have been properly booked as expenses or capitalized wherever appropriate.The audit firm will then identify the point of feasibility for the software product.The primary risks involved are not being able to produce the desired results and exceeding increased sales with credit losses by selling to high risk customers. The implication of this factor is that it creates a chance for misstatement of bad debt expense and the allowance for bad debts.

Moreover, auditors will either increase or decrease their evaluation of the worthiness of the accounts receivable and avoid relying on previously done procedures.

KCN Ratio Analysis

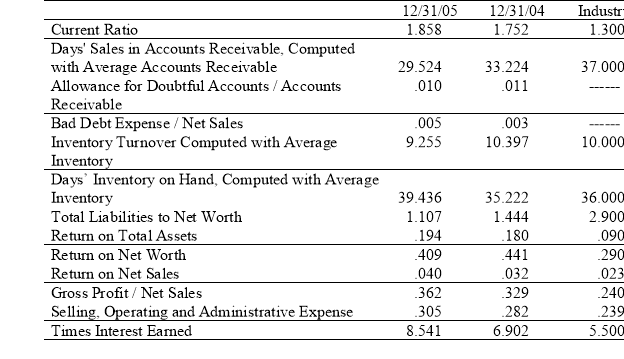

Keystone Computers & Networks, Inc.

Analytical Review of Financial Ratios

For the Period Ended December 31, 20X5

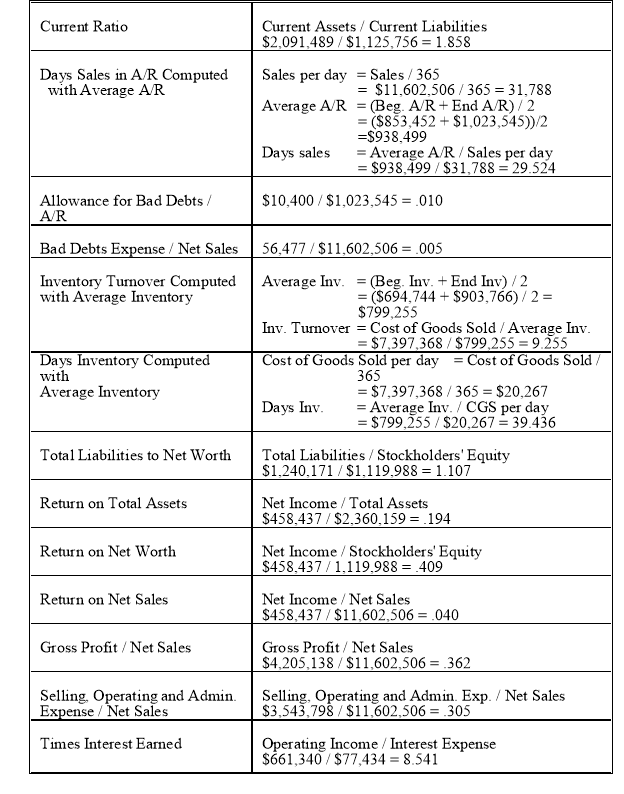

Details of Computations of 2005 ratios

Ratio analysis may be difficult when there are no major changes in ratios. However, the following might be considered:

Number of Sales in Accounts per day

- Changes in credit policy and customer mix

- Improved economic conditions

- Exaggerations of sales

- Understatement of purchases

Turnover of Inventory

- Change in the policy of the inventory

- exaggeration of inventory

- Understatement of the commodities bought by the company

As KCN competes with companies that are much larger than itself and some even older in the computer and software business, the economic pressure is a lot. Whether bor not the company succeeds depends on how it handles the competition, for example, being able to attain and maintain a qualified market. This may increase its growth in the software sector by up to 6%.

Conclusion

The audit process is an important part of a company. Using the ratios and factors above, the Keyton company auditing process was carried out. The increased profitability level resulted to a number of ratios with significant changes.As mentioned in the first part of this discussion paper, the auditor needs to determine whether research and development costs are properly expenses or capitalized when appropriate. The auditors determined that accounting for research and development was followed and all it needs to do is to identify when the software product became technologically feasible.

As stated above, implementing these policies from the auditor’s reports will increase the sales for example, up to 6% in software alone. This supports our thesis statement.

References

Chesler, L. (1981). Baseline audit plan. Santa Monica, Calif.

Kagermann, H. (2008). Internal audit handbook: Management with the SAP-Audit Roadmap. Berlin: Springer.

Pickett, K. H. S. (2006). Audit planning: A risk-based approach. Hoboken, N.J: Wiley.

Cite This Work

To export a reference to this article please select a referencing style below: