Abstract

This study aims to evaluate the influence of audit quality (auditor size and auditor tenure), political connection, and institutional ownership toward real earnings management. Purposive sampling was conducted and 83 manufacturing companies registered in Indonesian Stock Exchange during 2010-2014 were acquired as the samples. For testing the hypotheses, panel data regression random effect model was used. The results showed that auditor size and institutional ownership had positive influence toward real earnings management, while audit tenure and political connections did not influence real earnings management. The control variable testing showed that leverage and loss had negative influence toward real earnings management, while cash ratio had positive effect towards real earnings management. These result have implication for the investors to pay attention to operating cash flow average, because there is still a possibility of real earnings management, although the company auditors were from the big-4 auditors.

Keywords: real earnings management, audit quality, auditor size, audit tenure, political connections, institutional ownership..

INTRODUCTION

Managers can apply accrual earnings management and real earnings management to achieve the desired profit (Fisher and Rosenzwig, 1995; Roychowdhury, 2006). The real earnings management is impose bigger long-term costs, because it has negative consequences toward future cash flow which reduce firm value (Roychowdhury, 2006; Cohen et al., 2008; Cohen and Zarowin, 2010). Graham et al., (2005) and Cohen et al., (2007) clarify that the reasons why a company using real earnings management is to avoid auditors’ and regulators’ detection. The real earnings management is more difficult to detect because it is almost similar to a company’s operational activity (Kim et al, 2010).

Get Help With Your Essay

If you need assistance with writing your essay, our professional essay writing service is here to help!

Becker et al. (1998); Johnson et al.( 2002); Balsam et al.,(2003); Chen et al. (2011), and Inaam et al. (2012) showed that audit quality (auditor size and auditor tenure) reduce accrual earnings management. Therefore, companies that want to conduct earnings management will shift from accrual earnings management to real earnings management (Chi et al., 2011). Auditor size positively affect real earnings management (Chi et al., 2011; Inaam et al., 2012). Meanwhile, Nihlati and Meiranto (2014) showed that the auditors size negatively impact real earnings management. Chi et al. (2010) found that auditor tenure had positive influence toward real earnings management. While Inaam et al.(2012), Herusetya and Pujilestari (2013) found that auditor tenure did not affect real earnings management.

Inaam et al., (2012) conducted a research about the influence of audit quality toward the real earnings management in Tunisia and suggested that the future research can include political connection and institutional ownership as independent variables. Pollitically connected companies have bad reporting quality (Chaney et al., 2010). Meanwhile, Batta et al. (2014) found that political connection positively affect the reporting quality. The phenomena of pollitically connected companies in Indonesia is state-owned enterprises became disorganized after were interfered by political parties (Muqoddas, 2012). Indonesian Corruption Watch data showed that there were 48 legislators who were entrepreneurs that were exposed for corruption case (Gabrillin, 2014).

Shleifer & Vishny (1986); Bathala et al. (1994); Velury & Jenkins (2006); Mehrani et al. (2016) showed that institutional ownership reduce accrual earnings management. The institutional investors monitoring toward managerial process and accounting information accuracy are stronger. For avoiding detection by the institutional investors, companies will shift from accrual earnings management to real earnings management.

The aim of this research is to evaluate the influence of audit quality, political connection and institutional ownership toward real earnings management. This study contributes in adding political connection and institutional ownerships as independent variables, as suggested by Inaam et al. (2012). Up to now, studies about real earnings management in Indonesia are rarely conducted and, if any, they have not correlated political connection and institutional ownerships toward the real earnings management study yet, so this study will fill in that gap.

As the structure of this paper, literature review and hypotheses development will be discussed on the next part. The research method will be discussed in the third section. This is followed by result and discussion and the final section concludes the study.

LITERATURE REVIEW AND HYPOTHESES DEVELOPMENT

Auditor Size and Real Earnings Management

Earnings management can be applied through accrual and real activities (Roychowdhury, 2006; Zang, 2007; Cohen and Zarowin, 2010). The methods of real earnings managements are sale manipulation, overproduction, and reducing discretionary expenses (Roychowdhury, 2006). DeAngelo (1981), Becker et al. (1998) and Krisnan (2003) found that big size auditors have better audit quality than small auditors. The Big-4 auditors is considered to be more competent than the non Big-4 auditors if seen from their education, training, and experience (Amijaya and Prastiwi, 2013), their independencies (Zou and Elder, 2003) and their good reputation (Christiani and Nugrahanti, 2014). Big-4 auditors’ competency will ease the earnings management detection. Therefore, companies tend to choose real earnings management, so it will be more difficult to be identified. Cohen and Zarowin (2010), Chi et al. (2011), Inaam et al. (2012) found out that auditor size positively influences real earnings management.

H1: Auditor size has positive influence toward real earnings management.

Auditor tenure and Real Earnings Management

Auditor tenure is the number of years of an auditor being assigned by a company (Myers et al., 2003). The longer engagement duration, the higher auditor’s knowledge about that company, so it ease in detecting earnings management (Giri, 2010). The company will shift from accrual earnings management to real earnings management so that it will not be detected easily. The real earnings management tends to be out of the auditors’ supervision (Chi et al., 2011) and it will be hard to detect because it is almost the same as company’s daily operational activity (Kim et al., 2010). Cohen and Zarowin (2010) and Chi et al. (2011) found that auditor tenure has positive influence toward real earnings management.

H2: Auditor tenure has positive influence toward real earnings management.

Political Connection and Real Earnings Management

A company can be called politically connected if the biggest shareholder (has minimum 10% of voting rights) or top officers serves as the parliamenterian, minister, or has close relation with a politician or political party (Faccio, 2006). A company which has political connection will get the benefit such as capital allocation (Fisman, 2001; Goldman et al.,2010), better business opportunities (Fisman, 2001), and bailouts from the government (Faccio et al., 2006).

If a company is not able to maintain its reputation and profit, It will loose special previlege from political connection (Braam et al., 2015). For increasing their performance, the companies tend to perform real earnings management. Earnings management detection would lead decreasing in company’s reputation, increasing in political cost and the company’s external interventions (Watss and Zimerman, 1990; Faccio, 2006; Ramanna and Roychowdhury, 2010; Kothari, 2012). For avoiding that detection, the company will shift the accrual earnings management to real earnings management. Chaney et al., (2011) found out that politically connected companies tend to conduct earnings management.

H3: Political connection has positive influence toward real earnings management.

Institutional Ownership and Real Earnings Management

Institutional investors generally have a big number of shares, so they carry out strict monitoring to the companies’ performance and companies’ information quality (Velury and Jenkins, 2006; Pound, 1988; Shleifer and Vishny, 1986). Bushee (1998) and Potter (1992) found out that institutional investors were too focus on the short-term performance, so they force the managers to achieve that short-term profit. For improving their performance and for avoiding the detection from institutional investors , the managers will prefer real earnings management than accrual earnings management.

H4: Institutional ownership has positive influence toward real earnings management.

RESEARCH METHODOLOGY

Samples and Source of Data

This study used the manufacturing companies listed in Indonesia Stock Exchange during 2010-2014 periods. The criteria for purposive sampling method are the companies published annual report sequentially during that periods and the annual reports were finished on the December 31st. There were 83 companies were selected as the samples, so there were 415 firm year observations.

The annual reports acquired from the Indonesia Stock Exchange website. The political connection data were acquired from (1) annual report and tracing down the Board of Directors and Board of Commissioners’ biography from the sites in Google, (2) the Indonesian Republic National Portalwebsite (indonesia.go.id), the Indonesian Republic House of Representative website (www.dpr.go.id), and Tokoh Indonesia – Indonesian Leaders (www.tokohindonesia.com).

Variables

Real Earnings Management (Dependent Variable)

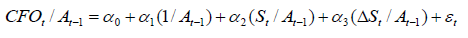

Abnormal Cash flow from operation will be used as proxy of real earnings management. When the companies apply real earnings management, the average of CFO will be negative (Roychowdhury, 2006; Chi et al., 2011., Inaam et al., 2012 and Ratmono, 2010).

CFOt= operating cash flow of company i in year t

At-1= the total asset of company i in t-1 year

St= the total sales of company i during year t

εt= abnormal cash flow from operation (regression residual, real earnings management proxies, REM)

Independent Variables

Political connection, auditor size, auditor tenure and institutional ownership are the independent variables.

Table 1: Independent Variables’ Measurement

|

Independent Variables |

Measurement |

|

Political Connection ( |

Political connection variable will be measured by calculating the number of Board of Directors and Board of Commissioners, both the chiefs and the members who are also the House of Representative members, ministers or vice ministers, or related to prominent politicians and political party members (Braam et al., 2015) |

|

Auditor size (AUDSIZE) |

A Dummy variable, 1 if the firm was audited by a Big 4 auditor, 0 otherwise (Chi et al., 2011; Inaam et al., 2012.,Christiani and Nugrahanti, 2014). |

|

Auditor Tenure (TENURE) |

The number of engagement years or auditing period assigned in which the auditors from the same Public Accountant Firm conduct audit engagement to the auditee during 2010-2014 periods (Chi et al., 2011; Inaam et al., 2012) |

|

Institutional Ownership (INSTOWN) |

The percentage of shares owned by the institutional investors (Velury & Jenkins, 2006; Mehrani et al., 2016; Wiranata and Nugrahanti.,2013) |

Control Variables

Leverage, company’ loss and cash ratio were used as control variables in this study. Leverage/ LEV (the total debt/ the total asset) positively influence the REM (Herusetya and Pujiletari, 2013). The loss of the company is measured using a dummy variable, 1 if company has net loss and 0 otherwise (Herusetya and Pujilestari, 2013). One of the reasons why a company applies real earnings management is to cover up the company loss (Roychowdhury, 2006). Cash ratio (CCE) is the ratio of the cash and cash equivalents toward the total asset (Herusetya and Pujilestari, 2013). The higher CCE ratio, the faster company’s cash flow, so it will ease the manager in utilizing the available cash to have earnings management (Herusetya and Pujilestari, 2013).

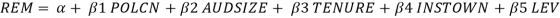

Regression Model

Panel data regression analysis was chosen to perform the hypotheses testing because this study used data combination of time series and data cross section (Winarno, 2015). Hypotheses H1, H2, H3, H4 and control variable in this study will be tested using empirical model as follows:

RESULT AND DISCUSSION

Descriptive Statistics

Table 2 below showed descriptive statistics used in this study.

Table 2 Descriptive Statistics (Pooled Sample, n= 415)

|

Variable |

Mean |

Maximum |

Minimum |

Std .Deviation |

|

REM |

-0.006352 |

0.659900 |

-1.217470 |

0.188328 |

|

POLCN |

0.245783 |

2 |

0 |

0.468655 |

|

AUDSIZE (dummy variable) |

– |

1 |

0 |

0.485552 |

|

TENURE |

2.554217 |

5 |

1 |

1.381844 |

|

INSTOWN(%) |

70.4841 |

100 |

0 |

19.61332 |

|

LEV |

0.470906 |

4.189190 |

0.000265 |

0.321157 |

|

LOSS (dummy variable) |

– |

1 |

0 |

0.339475 |

|

CASH |

0.102345 |

0.500295 |

0.000078 |

0.122287 |

From 415 firm years, 157 companies (37.8%) used the big-4 auditors and 258 companies (62.2%) used the Non-Big 4 auditors. Besides, there were 55 companies (13.3%) reported a loss.

Real Earnings Management (REM) Testing

Wilcoxon Signed Ranks Test was conducted to confirm whether REM are validly applied in the sample companies. The result of this test are presented in appendix 1. If the average abnormal CFO was negative, the companies were assumed to apply REM in operating cash flow (Oktorina & Hutagaol,2008). The Wilcoxon Signed Ranks Testing result showed that the mean of abnormal CFO was -0.006352 and its significance value was 0.046, so it was confirmed that those companies applied REM through operating cash flow.

Panel data Model Testing

Chow Test and Hausman Test for determining the appropriate estimation method were presented in appendix 2. Based on the Chow Test and Hausman Test results, the estimation method applied in this study was panel data regression using random effect model.

Hypotheses Testing

The results of hypotheses testing using panel data regression random effect model within 5% alpha level were presented in Table 3.

Table 3 Hypotheses Testing Results

|

Variable |

Expected sign |

Coefficient |

Probability |

Conclusion |

|

Intercept |

-0.077146 |

0.0997 |

||

|

AUDSIZE |

+ |

0.084373 |

0.0031*** |

H1 accepted |

|

TENURE |

+ |

-0.008594 |

0.0968 |

H2 rejected |

|

POLCN |

+ |

0.001902 |

0.9380 |

H3 rejected |

|

INSTOWN |

+ |

0.001100 |

0.0372** |

H4 accepted |

|

LEV |

+ |

-0.075769 |

0.0071*** |

|

|

LOSS |

+ |

-0.067431 |

0.0083*** |

|

|

CASH |

+ |

0.268174 |

0.0043*** |

|

|

Dependent variable Real earnings management (REM) R-squared 0.119266 Adjusted R-squared 0.104118 F-statistic 7.873503 Prob(F-statistic) 0.000000 **significant on alpha 5% ***significant on alpha 1% |

||||

Auditor Size and Real Earnings Management

The H1 testing shows that auditor size positively influence REM. This result is in line with Chi et al. (2010), Cohen and Zarowin (2010), Inaam et al. (2012), Nihlati and Meiranto (2014). The big-4 auditors are assumed to have better skills compared to non big-4 auditors, regarding from their educational backgrounds, trainings, and experiences (Amijaya and Prastiwi, 2013), their independencies (Zou and Elder, 2003) and their good reputation (Christiani and Nugrahanti, 2014). The big-4’skills will ease the auditors in detecting the accrual earnings management. Hence, companies will cover up the earnings management from the auditors and prefer to apply real earnings management. Real earnings management is harder to be identified than accrual earnings management since it is almost the same as the companies’ daily operational activity (Kim et al., 2010, Graham et al., 2005; Gunny, 2010; Badertscher, 2011).

Auditor tenure and Real Earnings Management

The H2 testing result shows that auditor tenure did not had an effect toward REM. This result consistent with Inaam et al.(2012), Herusetya and Pujilestari (2013), Nihlati and Meiranto (2014). Gul et al. (2009) categorized the audit placement period into three categories, the short term (2-3 years), medium term (4-8 years), and long term (9 years). Table 2 show that auditor tenure average is 2.5 years, and the short auditor tenure had not been able to influence real earnings management.

Find Out How UKEssays.com Can Help You!

Our academic experts are ready and waiting to assist with any writing project you may have. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs.

View our academic writing services

By limiting auditor tenure, there will be a gap between the auditor and the company. In order to verify a company, auditors had to identify in advance the companies’ characteristics and managements, and it usually took quite a long time (Kono and Yuyetta, 2013). Amijaya and Prastiwi (2013) stated that why audit tenure did not have any influence toward earnings management was the auditors’ incapability in identifying earnings management.

Political Connection and Real Earnings Management

Based on Table 3, it can be seen that political connection did not had an effect toward REM. This result is in contrast with Braam et al. (2015). Political connection did not had an effect toward real earnings management because the numbers of political connections in the samples was few, which was 27.71% (23 out of 83 companies). There were only one person in board of directors and board of commissioners that were involved in political connection, so political connections did not influence real earnings management.

Institutional Ownerships and Real Earnings Management

The H4 testing result indicates that institutional ownerships positively influence REM. The institutional ownerships’ mean was 70.48%. Institutional investors who had a big number of shares will strictly monitor company’s performance and company’s information quality (Velury and Jenkins, 2006; Pound, 1988; Shleifer and Vishny, 1986). The strict monitoring made the companies that want to apply earnings management shift from accrual earnings management to real earnings management. Institutional investors were too focus on short term performance, so they urged the managers to fulfill that short term profit (Bushee,1998; Potter, 1992). For increasing their performance and for avoiding institutional investors’ detection, the managers would prefer real earnings management to accrual earnings management.

Leverage, Company Loss, Cash Ratio and Real Earnings Management

The testing results of control variables show that leverage negatively influenced REM. If a company has high levels of debts, it has to pay principal and high debt interest. The obligatory of those payments limit managers in using cash flow, including for real earnings management (Zamri et al.,2013).The company loss negatively influences REM. This finding is in line with Herusetya and Pujilestari (2013) and Roychowdhury (2006). When the company reported positive earnings, the company was assumed that they were covering up the loss through REM. If the company reported negative earnings, the company would be assumed that they did not apply REM, and the company was considered to not cover up the loss (Herusetya and Pujilestari, 2013). Cash ratio positively influence REM. The higher cash ratio, the better company’s liquidity, so it would ease the managers in utilizing the provided cash for real earnings management (Herusetya and Pujilestari, 2013).

CONCLUSION

Although a study about audit quality and real earnings management has been conducted before, this study contributes in adding new independent variables, which are political connection and institutional ownerships. The testing results show that the auditor size and institutional ownerships can increase real earnings management. Meanwhile, audit tenure and political connection do not influence real earnings management. The testing toward control variables showed that leverage and company loss negatively influence real earnings management, while cash ratio had positive influence. The applied implication of these result is the investors need to see the operating cash flow average , because there is still a possibility of real earnings management, although the company auditors were from the big-4 auditors.

The limitation of this study was a few number data of political connection although depth investigation had been carried out by looking at the name of legislative members/ ministers and vice ministers/ kinships to members of political parties. For the future study, the political connection criteria can be added by including the Indonesia National Forces retirees or ministry officials (for example the secretary general, directorate general, staff member of ministry, assistance of ministry). The future study may also add corporate governance mechanism as independent variables, such as managerial ownerships, auditing committee, and independent board of commissioners.

REFERENCES

Amijaya, M, D., Prastiwi, A., 2013. The impact of audit quality towards earnings management. Diponegoro Journal of Accounting 2 (3), 1-13.

Ahsen, H., 2011. Audit firm industry specialization and audit outcomes: insights from academic literature. Research in Accounting Regulation 23 (1), 114-129.

Badertscher, B.A., 2011. Overvaluation and choice of alternative earnings management mechanisms. The Accounting Review 86 (5), 1491-1518.

Balsam, S., Krishnan, J., Young, J., 2003. Auditor industry specialization and earnings quality. Auditing: A Journal of Practice & Theory 22 (2), 71-97.

Bathala, C. T., Moon, K. P., Rao, R.P., 1994. Managerial ownership, debt policy, and impact of institutional holdings: an agency perspective. Financial Management 23 (3), 38-50.

Batta, G., Heredia, R., Weidenmier, M., 2014. Political connections and accounting quality under high expropriation risk. European Accounting Review 23 ( 4), 485-517.

Becker, C., DeFond,M., Jiambalvo, J., Subramanyam, K.R., 1998. The effect of audit quality on earnings management. Contemporary Accounting Research 15 (1), 1-24.

Braam, G., Monomita N., Weitzel, U., Lodh, S., 2015. Accrual-based and real earnings management and political connection. International Journal of Accounting 50 (2), 111-141.

Challen, A. E., Siregar, S. V., 2011. The Effect of Audit Quality on Earnings Management and Firm Value, Working paper.

Chaney, P.K., Faccio, M., and Parsley, D., 2010. The Quality of Accounting Information In Politically Connected Firms. http://paperas.ssrn.com, accessed 10.11.2016.

Chen, H., Chen, J.Z., Lobo,G., Wang,Y., 2011. Effects of audit quality on earnings management and cost of equity capital: evidence from China. Contemporary Accounting Research 28 (3), 892-925

Chi, W., Ling L.L., Pevzner, M., 2011. Is enhanced audit quality associated with greater real earnings management? Accounting Horizon 25 (2), 315-335.

Christiani, I., Nugrahanti, Y. W., 2014. The effect of audit quality towards real earnings management. Accounting and Finance Journal 16 (1), 52-62.

Cohen, D., Dey, A., Lys, T.Z., 2008. Real and accrual based earnings management in the pre- and post sarbanes-oxley periods. The Accounting Review 83 (3), 757-787

Cohen, D., Zarowin, P., 2010. Accrual-based and real earnings management activities around seasoned equity offerings. Journal of Accounting and Economics 50 (1), 2-19.

DeAngelo, L. E., 1981. Auditor size and audit quality. Journal of Accounting and Economics 3, 183-199.

Faccio, M., 2006. Politically connected firms. American Economic Review 96 (1), 369-386.

Fischer, M., Rosenzweig, K., 1995. Attitudes of students and accounting practitioners concerning the ethical acceptability of earnings management. Journal of Business Ethics 14 (6), 433-450.

Fisman, R., 2001. Estimating the value of political connections. The American Economic Review 91 (4), 1095-1102.

Gabrillin,A., 2014. Indonesia corruption watch: 48 legislators were exposed for corruption case. www.kompas.com accessed 10.12.2016

Graham, J., Harvey, Rajgopal, 2005. The economic implications of corporate financial reporting. Journal of Accounting and Economics 4 (1), 3-73.

Giri, F. E., 2010. The effect of auditor tenure and auditor reputation towards audit quality. Proceding National Conference Symposium XIII, 1-26.

Goldman, E., Rocholl, J., So, J., 2010. Political connection and the allocation of procurement contracts. Review of Finance 17, 1617-1648.

Gul, F. A., Fung, S. Y. K., Jaggi, B., 2009. Earnings quality: some evidence on the role of auditor tenure and auditors’s industry expertise. Journal of Accounting and Economics 47, 265-287.

Gunny, K., 2010. The relation between earnings management using real activities manipulation and future performance: evidence from meeting earnings benchmarks. Contemporary Accounting Research 27(3), 855-888.

Herusetya, A., Pujilestari, R., 2013. The impact of audit quality toward real earnings management- revenue recognition strategy. Accounting and Finance Journal 15 (2), 75-85.

Inaam, Z., Khmoussi, H., Fatma, Z., 2012. Audit quality and earnings management in the tunisian Context. International Journal of Accounting and Financial Reporting 2(2), 17-33.

Jensen, M.C., Meckling, W.H., 1976. Theory of the firm: managerial behavior, agency cost and ownership structure. Journal of Financial Economics3 (4), 305-360.

Johnson, V., Khurana, A., Reynolds, K., 2002. Audit-firm tenure and the quality of financial reports. Contemporary Accounting Research 19 (4), 637-660.

Kim, B. H., Ling, L., Pevzner, M., 2010. Debt covenant slack and real earnings management. Working Paper.

Kono, F.D.P., Yuyeta, E.N., 2013. The impact of fre cash flow, auditor size, auditor specialization, auditor tenure and auditor indepency toward earnings management. Diponegoro Journal of Accounting 2 (3), 2337-3806.

Kothari, S.P., Mizik, N., Roychowdhury, S., 2012. Managing for the moment: the role of real activity versus accruals earnings management in SEO valuation. Working paper.

Krishnan, G., 2003. Audit quality and the pricing of discretionary accruals. Auditing: A Journal of Practice & Theory 22(1), 109-126.

Mehrani, S., Moradi,M., Eskandar, H., 2016. Institutional ownership type and earnings quality: evidence from iran. Emerging Markets Finance & Trade 53, 54-73.

Muqoddas, B., 2012. State-owned enterprises in Indonesia became disorganized after were interfered by people from political parties. Tempo.co accessed 10.12..16.

Myers, J., Myers, L., Omer,T., 2003. Exploring the term of the auditor-client relationship and the quality of earnings. The Accounting Review 78 (3), 779-799.

Nihlati, H., Meiranto, W., 2014. The effect of audit quality towards earnings management. Diponegoro Journal of Accounting 3 (3), 1-10.

Oktorina, M., & Hutagaol, Y., 2008. Operating cash flow analysis for detecting real earnings management and this impact toward market performance. Proceding National Accounting Symposium XI, 1-28.

Pound, J., 1988. Proxy contests and the efficiency of shareholder oversight. Journal of Financial Economics 20, 237-265.

Ramanna,K., Roychowdhury, S., 2010. Elections and discretionary accruals: evidence from 2004. Journal of Accounting Research 48 (2), 445-475.

Ratmono, D., 2010. Acrual and Real Earnings Management: can qualified auditor d

Cite This Work

To export a reference to this article please select a referencing style below:

Give Yourself The Academic Edge Today

- On-time delivery or your money back

- A fully qualified writer in your subject

- In-depth proofreading by our Quality Control Team

- 100% confidentiality, the work is never re-sold or published

- Standard 7-day amendment period

- A paper written to the standard ordered

- A detailed plagiarism report

- A comprehensive quality report

Essay Writing Service

Essay Writing

Service

AED558.00

Approximate costs for Undergraduate 2:2

1000 words

7 day delivery

Order An Essay TodayDelivered on-time or your money back

1858 reviews