- Joo Hee Kim

Accounting and Financial Management

Budgeting is the Process of expressing quantified resource requirements (amount of capital, amount of material, number of people) into time-phased goals and milestones (BusinessDictionary.com, 2017). Budgets help decision makers to identify problems and to increase their understanding of the task environment (Ahrens 1997). For this reason, budgeting is “still regarded as an organizational imperative if costs are to be controlled and financial performance to be achieved” (Frow, Marginson and Ogden, 2010). The budget has historically entered the central stage of the management control system in most organizations (Otley, 1994). One of the main reasons that big companies get their budgets in the first place is to coordinate different parts of the business. By sharing accurate information publicly and based on a common set of decisions, ensuring harmonious interactions between units can lead to efficient processes, high-quality products, low inventories and satisfied customers (Jensen, 2001).

Get Help With Your Essay

If you need assistance with writing your essay, our professional essay writing service is here to help!

As such, traditionally, budgeting system has been considered to provide effectively four major benefits to the most organizations. (1) First of all, budgeting system provides the capability for managers to quantify the necessary resources and distribute these to the involved organizations prior to the beginning of the project. (2) Throughout the budget planning activities, the involved organizations will have a better interaction and communication to identify the problems, understand issues, pertaining to the tasks and then, finally allocate the necessary budgets to each organization. (3) Consequently it encourages each organization to conduct their task diligently and efficiently without wasting their resources. (4) Finally, It provides the persistent evaluation how the project performed under the budgeting planned and the great future index for the next budgeting plan.

However, under the current increased competitive global environment, requiring more dynamic and imminent resource allocation have raised the concern that the traditional budgeting systems are inefficient and incapable to satisfy dynamically changing environments and suggested the myopic decision making and budget games in which they proposed (Hansen et al., 2003; Ostergren and Stensaker, 2011). Also, Welch has described the unnecessary wage increase due to the misguided performance evaluation, inherited by the incorrect budgeting planned (Welch, 2005).

In addition to the inherited slow adaptive functionality and misguided performance evaluation. Jensen has described that the traditional budgeting process wastes time, twists decision making, consuming a huge amount of wasting executives’ time, due to the intentional false forecasts or manipulating critical information, consequently, twisting the resource allocation (Jensen, 2001; Jensen, 2003).

In addition to these human and organizational barriers, genuinely, it takes lots of unnecessary time and resources to create a proper budget, prior to the beginning of the tasks. Statistically, organizations spend 20-30% of their time in the budgeting process. Also, budgeting generally limits the likelihood of achieving high growth or significant cost savings by setting an upper limit of the allowable budgets. At the same time, budgets can hinder high growth because overspending over budget would cut costs in the short term in order to achieve margin goals, consequently, hindering long-term goals (de Waal, Hermkens-Janssen and van de Ven, 2011).

Recently, in order to overcome of the issues in the traditional budgeting system described above, a number of alternative methodologies have been proposed for the budgeting process, including activity-based budgeting, profit planning, rolling budgets and forecasts, zero-based budgeting, and beyond budgeting (Hansen, Otley and Stede, 2003). In particular, Jensen proposed a “A Linear Compensation Plan” to remedy the current budgeting process in which actual performance, regardless of budgetary goals, will be utilized to provide senior executives unbiased estimates for the planned achievable goal.

However, later, Jensen described that it can be problematical for organizations to simply adopt or implement the proposed linear compensation system. It is because Target-based bonuses are deeply ingrained in the minds of managers and in the managerial codes of most organizations. More than that, if the measures and evaluation were not correctly performed, executives will have the more risk of distorting managerial decisions, even under a linear bonus system. In addition, the positioning and slope of the bonus line are based on the prior year’s performance. Of course, it would reduce the risk of overcompensating for the performance, but it can cause the reduction of incentives for the increasing performance, which results in dropping the motivational effects of the performance targets. Also, the increased performance compensation would require companies to increase bonus caps way beyond traditional compensational levels, which can make organizations discomfort (Jensen, 2001).

In addition, more difficulties have described that the cost of changing the current budgeting process can be high due to the initial cost to implement the new system which requires the staffing time change, strategic planning, resource allocation, cost management (Neely, Sutcliff and Heyns, 2002), and eventually results in impacting on other unrecognized management processes, due to the lack of understanding of the current and future adopted systems (Waal, Jap Tjoen San and Zwanenburg, 2006).

To overcome the raised issues on the linear compensation schemes, the curvilinear schedule methodology has been proposed which actually, reintroduces a strong incentive in terms of the budget. Jensen has also later agreed that the budget process itself is not the root cause of unproductive behavior. Rather, determining the compensation should combine the budget goals to have proper performance measurements. He has also point out that performance indicators should reflect the functionality of other business units, to align with the departmental performance measures. Management flexibility, decentralization and delegation can also minimize the risk of measuring performance (Jensen, 2001).

Jensen criticizes managers for damaging their business because they lie to get more incentives. But currently, companies do not set incentives based only on manager reporting. Annual bonuses can be organized into three basic components: performance measurement, performance standards, and the sensitivity of the pay-for-performance relationship. Most companies rely on two or more measures of performance when evaluating manager performance, such as sales or revenue, earnings per share, operating profit or profit (Towers Perrin, 2005). Historically, accounting-based performance indicators are backward-looking and easy to lie, so firms can avoid cheating by using other measures such as operational or strategic performance goals, quality improvement, and scorecard-based systems.

If managers were still cheating as Jansen criticized, the incentive system would not have spread like it does today. In recent, the percentage of S&P 500 firms using multiyear accounting-based performance (MAP) incentives for CEOs increased from 16.5% in 1996 to 43.3% in 2008 (Li and Wang, 2016). There are many good reasons to explain why long-term incentives are an effective wage component. First, it provides the most direct correlation between company performance and wages. In other words, incentives can motivate directors to work hard and help them make shareholderoriented decisions. Second, long-term incentives can provide valuable human capital to the board and increase the loyalty of incumbent directors (Irani and Gerayeli, 2017).

Furthermore, there is a way to hire a compensation consultant company to get rid of the possibility of any remaining lie. Compensation consultants such as Towers Watson, the Hay Group, and Hewitt Associates can assist the board in setting up wages with knowledge of industry and other peer groups’ compensation package design. In particular, they can give advice and assistance to the compensation committee (Bender, 2007). In the UK, virtually all companies show that they hire compensation consultants (Conyon, Fernandes, Ferreira, Matos and Murphy, 2011). The existence of an independent board is also important in the process of receiving incentives. Directors must have sufficient pay-performance sensitivity (PPS) for managers (Bruce, Buck and Main, 2005).

Jensen insisted ‘Corporate budgeting is a joke.’ and ‘Corporate budgeting consumes a huge amount of executives’ time.’ But I disagree with him. Therefore, I strongly believe that instead of simply tossing off the budgeting process, the efficient budgeting system, combined with a proper performance measurements to determine the correct compensation, is necessary and essential for the company to achieve their goals in a rapidly changing 21st century international economic environment. In particular, from the Abogun and Fagbemi’s research, budgeting is still selected as a most effective and necessary tool for planning, controlling, communicating, making decisions and creating value (Abogun and Fagbemi, 2011). For instance, on the survey conducted by Libby and Lindsay, most managers have rated the budgeting as “good value” to achieve their organizational goals, regardless of budget games occurred to some extent in the organization (Libby and Lindsay, 2013). They have also agreed that the right use of budgeting is of significant value to management.

As an additional valuable evidence of the budgeting system, more than 150 organizations in North America uses frequently cost management tool to budget resources that can include everything from raw materials to human resources and facilities (Horngren, Sundem, Stratton, Burgstahler & Schatzberg, 2008). In the same opinion, at a meeting on “the traditional role of the budget in the organization” organized by CIMA and ICAEW in 2004, the budgeting and accompanying process were indispensable and also noted that the traditional budgeting processing was widespread. Significant number of European companies has a budget and continues to use this process (CIMA-ICAEW, 2004). Most of current companies in Australia, Japan, the United Kingdom and the United States prepare budgets (Anand, Sahay and Saha, 2004).

Is corporate budgeting really just a waste of time, as Jansen argues? If his argument was correct, now that more than 15 years ago, many companies would have to abandon the budgeting system. However, since the economic crisis that started in 2008, the survey and historical data have showed that the budget became more important in planning and resource allocation and companies emphasize specific budgeting features over other companies in response to economic crises (Becker, Mahlendorf, Schäffer and Thaten, 2016). In Case Study Evidence (Frow et al., 2010), the paper introduces the concept of “continuous budgeting” to emphasize how an organization can coordinate these potentially conflicting goals. By integrating the use of other budgetary controls with other management controls, the process of “continuous budgeting” encouraged management to exercise operational discretion when unexpected events occur in which it has placed a strict burden on managers to ensure that they continue to strive to achieve their financial goals. Again, it has proved that Budgeting effectively contributes to the flexibility and financial principles to implement effective strategies.

Therefore, it’s the right path to adopt alternative budgeting process rather than giving up entirely the budget. For example, continuous budgeting or traditional budgets can be supplemented by other management controls such as Balanced Scorecard (Frow et al., 2010) or Rolling Forecast (sandalgaard, 2012).

For other management controls, according to a study by Choe, Dey and Mishra (2014), analyzing diversified companies in Australia by 2004-2008, companies that rely on long-term incentives for executives have achieved even greater progress. Long-term compensation consists of options, equity and other long-term incentive payments. Most of these compensation factors are based on company-wide performance. On the other hand, short-term rewards mainly consist of salaries and bonuses. In some cases, bonuses are targeted at company-wide performance, especially CEOs. For department managers, bonuses are often based on departmental accounting performance.

Therefore, we need to develop some compromise schemes to set an upper bound of compensation, for instance, using the all department compensation difference and same time setup the ratio of long-term compensation and the short-term compensation ratio depending on the nature, scale, and profit of the company. Of course, as mentioned before, this compensation system depends on the previous year’s data to setup the compensation plan for the future potential growth. It may also be a necessary to evaluate company financial system regularly auditing from an independent accounting company that is not related to the company’s incentive system.

Corporate budgeting is like a knife. Knife would be a weapon when it is caught in the hands of robber, but it can serve as a tool for making delicious food in the hands of a cook, and it can save people when it is in the hands of a doctor. As Jensen argues, when corporate budgeting lefts in the hands of immoral managers, it is easy to become a weapon that damages the company for the benefit of the individual. But if a conscientious manager catches it, it becomes a tool for creating a happy company. If a wise CEO control it, it can also play a role in saving the company. Hence, I strongly believe that we should move toward improving the budget system by incorporating various suggestions described above.

Question 2.

Typical Executive Compensation Plan in a traditional pay-for-performance compensation plan, managers receive a hurdle bonus when they reach a certain level. The bonus will be improved until the maximum challenge is reached. When managers have a good year and performance is nearing the budget limit, there can be a desire to push the remaining profits into the future. Because they do not receive additional compensation even if they performance exceeds the cap, they will increase their chances of raising their expenses in current year or postpone their sale and gain to next year, in order to increase bonus next year.

Suppose there is the organization named ABC, which has fiscal year end December 31 and Fiscal year 2016 budget goal for research expense is $100,000 and service contract revenue is $500,000. Fiscal year 2017 budget will be the same. Currently, ABC financial reports for fiscal year 2016 shows that research expense is $20,000 and service contract revenue is $500,000. ABC research department received a request from a research engineer to purchase $50,000 equipment for beginning of January 2017 and ABC sales department expects to sign on a two months service contract with a client amount of $200,000 in December 2016, but start date could be either December 2016 or January 2017. Because of timing issue of recording expenses and revenues, the managers are able to meet budgetary targets for 2016 and 2017, if they plan to expense more in current year and record revenues in the next fiscal year. The research department manager could record $50,000 equipment expenses for Fiscal year 2016 asking a vendor to deliver the equipment and send out the bills to accounting departments few days earlier before January 1, 2017, unnecessarily, because research expense for the year 2016 already met budget goal, which means research manager still can get bonus for the year 2016 even though the research department recognizes $50,000 more expense in 2016. By doing so, the research department probably will exceed budgetary expense targets in 2017, because the department lower actual 2017 expense by $50,000. Also, sales manager could push revenue to the next fiscal year, by choosing the two months service contract start date as 1/1/17, instead of 12/1/16, because FY16 sales budget goal is already achieved. Even if the company ABC financial statement for FY16 can show more revenues if the service contract starts on 12/1/16, sales manager could take 1/1/17 start date, considering his FY16 bonus is guaranteed already, and it would be easier for him to achieve FY17 sales goal since he already achieved $200,000 out of $500,000.

It is highly unlikely that any refinements to the budgeting process will ever enable budgets to be perfect because budget is plan for future. However, I think few refinements to the budget plan can prevent Jenson’s business scenario from real business world. First, senior management can set up their budget comparison method by adopting advanced IT budget system. In Jenson’s scenario, senior management set the budgets with limited input from line personnel. Because of limited input from same personnel, the budget could be manipulated for the purpose of getting more bonuses. If senior management set up IT budget system, such as uBase and add the procedure to their budget report review procedures, comparing generated report out of uBase to the prepared budget report by limited personnel, and researching the variances between two reports and fluctuation between months, senior management might identify what are the most common unfaithful ways used for management to consistently exceed financial targets. Second, the organization uses an incremental budgeting system for a full year. If an organization changes budget period from a full year to half year, and change distributing bonus from annual basis to semi-annual basis, the organization can reduce a lot of cut off issues management used to exceed financial targets.

To avoid connecting budgets and sales goals to bonus, Jensen proposed Linear Compensation Plan is an incentive system that compensates for actual performance regardless of your budget goals. Administrators will receive the same bonus for some level of performance even if the budget target is set below or above that level. By eliminating kinks, the unit manager no longer collects cash beyond the target and would not need to make lower the target by putting false information into the budgeting process. As a result, senior management receives unbiased estimates of what they can achieve in the future, and the quality of planning and coordination is significantly improved. In order for Jensen’s proposed linear compensation scheme to be successful, we need to obtain the following refinements:

First, when using multiple performance indicators for individual managers, companies must carefully set up a single, well-defined measure of overall business success, such as economic value added. Ratios such as sales margins or asset returns inevitably result in games. Second, management tends to concentrate in the short term. If you earn a high bonus within a year, it will be harder to get a higher bonus next year, so you will lose incentives to improve performance. A better way is to look at the future in more detail by setting a line of bonuses over the years based on long-term forecasts of growth and profitability. Finally, define the upper limit of compensation as a salary. Also, we need to set absolute objective criteria such as activity-based costing to determine performance by how many tasks have been done in certain time, rather than how many hours an employee worked.

< Part Two >

Question 1.

(1) Answer is d.

(2) If Sanjay Ltd sells all 1000 units, it needs not pay for scraping costs, so the minimum price is $ 2. But if it cannot sell all of them, it has to add $ 500 to its sales because it shoud pay for scraping costs. For example, if it sells 100 units, $ 5 is added per unit, so the minimum price is $ 7. However, if it sell 500 units, it will add $ 1 per unit, so the minimum price is $ 3. In the worst case, if Sanjay Ltd cannot sell any units, it’s better to give them away for free.

(3)

Total cost = DM(Direct materials) + DL(Direct labour) + OH(Overhead)

$25,000 = $20,000 + DL + 1.5 – DL

$5,000 = DL + 1.5 – DL = 2.5 – DL

DL = $2,000,

$25,000 = $20,000 + $2,000 + Overhead

As the result, Overhead is $3,000.

(4)

Total costs = Direct material + Direct labour + Overhead

= $1,475 + $1,500 + {50(labour hour=$1,500/$30) – $35}

= $1,475 + $1,500 + $1,750 = $4,700

As the result, Total costs is $4,700.

(5)

Profits = Total sales – Fixed costs – Variable costs

Profits ($100,00) = Total sales(Selling price – 500,000) – Fixed costs($400,000)

– Variable costs(0.75 – Selling price – 500,000)

$100,000 = Selling price – 500,000 – 400,000 – 0.75 – Selling price – 500,000

$500,000 = 0.25 – Selling price – 500,000

$500,000 = 125,000 – Selling price

As the result, Selling price should be $4.

(6)

Total Manufacturing Costs ($ 900) = Direct Materials ($ 455) + Direct Labor ($ 300) + Variable Manufacturing Overhead ($ 45) + Fixed Manufacturing Overhead ($100)

Target Sales Price ($ 1440) = Total Manufacturing Costs ($ 900) + {Total Manufacturing Costs ($ 900) – Mark Up 60% ($ 540)}

It does not need to pay Fixed Manufacturing Overhead if Diamond Interiors accepts Mr. John Lee’s one-time only special order, because of Diamond Interiors has an excess capacity. In this case, Fixed Manufacturing Overhead should be excluded when calculating Total Manufacturing Costs. But Mr. Lee wants the cabinet in a metallic finish rather than laminate, so direct materials will increase by $30 per unit.

Total Manufacturing Costs ($ 900) – Fixed Manufacturing Overhead ($100) + additional direct materials ($30) = 830

Therefore, the minimum selling price is $830.

(However, this minimum selling price did not include the mark up fee. Therefore, the actual selling price may vary depending on the seller’s decision.)

(7)

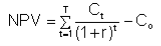

The net present value (NPV) is the difference between the present value of the cash inflow and the present value of the cash outflow. NPV is used in capital budgeting to analyze the expected investment or profitability of the project.The following is the formula for calculating NPV:

where

Ct = net cash inflow during the period t

Co = total initial investment costs

r = discount rate, and

t = number of time periods

{20,000/1.1 + 25,000/(1.1)2 + 30,000/(1.1)3 +15,000/(1.1)4 + 12,000/(1.1)5 } – 75000

= {18181.8 + 20661.2 + 22539.4 + 10245.2 + 7451.1} – 75000 = 79078.7 – 75000

Net Present Value of the computer system is $ 4078.7

A positive net present value indicates that the projected income generated by the project or investment (in present dollars) exceeds the projected cost (also in present dollars). In general, investment with a positive NPV is a profitable investment, and investment with a negative NPV is a net loss. It is the basic element of the net investment value rule that a project or investment must be performed only if the NPV value is positive. Since the NPV of the computer program in question is positive, it is a wise choice for the mayor to purchase this computer program.

(8)

The cost of equipment is the item’s purchase price. Knowing the internal rate of return and the expected life of the equipment, the cost of equipment purchase can be calculated using the following formula.

15,000/1.12 + 15,000/(1.12)2 + 15,000/(1.12)3 + 15,000/(1.12)4 + 15,000(1.12)5

= 54071.7

As the result, Cost of the equipment is $ 54,071.7

(9)

Return on investment is a simple rate of return without a concept of time. The IRR is calculated by compounding the time it takes to enter a profitable point. There is a limit to the evaluation by simple profit rate calculation that does not consider time.

Internal rate of return (IRR) is the interest rate at which the net present value of all the cash flows (both positive and negative) from a project or investment equal zero. Internal rate of return is used to evaluate the attractiveness of a project or investment. If the IRR of a new project exceeds a company’s required rate of return, that project is desirable. If IRR falls below the required rate of return, the project should be rejected (Investinganswers.com, 2017). When a minimum desired rate of return is 12%, the present value of project is calculated as $ 1,646. Because the IRR is positive, Imperial Airways Ltd. should accept this project.

75000/1.12 + 75000/(1.12)2 + 75000/(1.12)3 + 75000/(1.12)4 + 75000/(1.12)5 + 75000/(1.12)6 – 280000 – 50000/(1.12) 4 + 10000/(1.12)6

= 308355.6 – 280000 – 31776 + 5066.3 = 1645.9

As the result, Present Value of the Project is $ 1,646.

When a minimum desired rate of return is 12%, the present value of project is over than zero (calculated as $ 1,646). Thus, the internal rate of return is more than 12%.

(10)

Year1 Inflow1 + Year2 Inflow + Year3 inflow = $22,000

Inflows from Year1 to Year 4 = $28,000

The payback period is between Year 3 and Year 4.

Accurately calculated

PBP = minimum period + shortage of inflows / inflows in event

= 3 + 3000 / 6000 = 3.5

As a result, payback period is 3.5 years.

REFERENCE

Abogun, S. and Fagbemi, T. (2011). The Global Debate on Budgeting: Empirical Evidence from Nigeria. International Business Research, 4(4).

Ahrens T. (1997). Strategic interventions of management accountants: everyday practice of British and German brewers The European Accounting Review 6(4), 557-588

Anand, M., Sahay, B.S. and Saha, S., 2004. Cost management practices in India: An empirical study. ASCI Journal of Management, 33(1-2), pp.1-13.

Becker, S. D., Mahlendorf, M. D., Schäffer, U. and Thaten, M., 2016. Budgeting in times of economic crisis. Contemporary Accounting Research, 33 (4), pp.1489-1517.

Bruce, A., Buck, T. and Main, B.G., 2005. Top executive remuneration: A view from Europe. Journal of Management Studies, 42(7), pp.1493-1506.

BusinessDictionary.com. (2017). What is budgeting? definition and meaning. [online] Available at: http://www.businessdictionary.com/definition/budgeting.html [Accessed 15 Jan. 2017].

Choe, C., Dey, T. and Mishra, V., 2014. Corporate diversification, executive compensation and firm value: Evidence from Australia. Australian Journal of Management, 39(3), pp.395-414.

CIMA & ICAEW, (2004). A report on Better Budgeting Forum. July, 2004. Retrieved December 16, 2008 from http:// www.icaew.com./index.cfm/route.

Conyon, M.J., Fernandes, N., Ferreira, M.A., Matos, P. and Murphy, K.J., 2011. The executive compensation controversy: A transatlantic analysis.

de Waal, A.A., Jap Tjoen San, R. and Zwanenburg, E. (2006), “Budgetteren in Nederland:

stand van zaken en ontwikkeling”, Tijdschrift Controlling, Vol. 3, pp. 8-11.

De Waal, A., Hermkens-Janssen, M. and van de Ven, A., 2011. The evolutionary adoption framework: explaining the budgeting paradox. Journal of accounting & organizational change, 7(4), pp.316-336.

Frow, N., Marginson, D. and Ogden, S. (2010), “Continuous budgeting: reconciling budget flexibility with budgetary control”, Accounting, Organizations and Society, Vol. 35 No. 4, pp. 444-61.

Hansen, S.C., Otley, D.T. and van der Stede, W.A. (2003), “Practice developments in budgeting:an overview and research perspective”, Journal of Management Accounting Research, Vol. 15, pp. 95-116.

Hope, J. and Fraser, R. (2003), How Managers can Break Free from the Annual Performance Trap, Harvard Business School Press, Boston, MA.

Horngren C. T., Sundem, G. L., Stratton, W. O., Burgstahler, D. & Schatzberg, J. (2008). Introduction to Management Accounting. (14th Ed.). New Jersey: Pearson Prentice Hall.

Investinganswers.com. (2017). Internal Rate of Return (IRR) Definition & Example | Investing Answers. [online] Available at: http://www.investinganswers.com/financial-dictionary/investing/internal-rate-return-irr-2130 [Accessed 21 Jan. 2017].

Irani, M. and Gerayeli, M.S., 2017. Relationship between Corporate Governance and CEO Compensation among Listed Firms in Tehran Stock Exchange. International Journal of Economics and Financial Issues, 7(1), pp.285-292.

Jensen, M.C. (2001), “Corporate budgeting is broken – let’s fix it”, Harvard Business Review, Vol. 79, pp. 94-101.

Leahy, T. (2001), “The top 10 traps of budgeting”, Business Finance, Vol. 7 No. 11, pp. 20-34.

Libby, T. and Lindsay, R.M., 2010. Beyond budgeting or budgeting reconsidered? A survey of North-American budgeting practice. Management Accounting Research, 21(1), pp.56-75.

Li, Z. and Wang, L., 2016. Executive compensation incentives contingent on long-term accounting performance. Review of Financial Studies, 29(6), pp.1586-1633.

Neely, A., Sutcliff, M. and Heyns, H. (2002), Driving Value through Strategic Planning and Budgeting, Research Report, Cranfield School of Management and Accenture, Cranfield.

Ostergren, K. and Stensaker, I. (2011), “Management control without budgets: a field study of ‘beyond budgeting’ in practice”, The European Accounting Review, Vol. 20 No. 1, pp. 149-81.

Otley, D.T., 1994. Management control in contemporary organizations: towards a wider framework. Management Accounting Research 5, 289-299.

ROZENFELD, G.C., 2017. CHAPTER FOUR DISSIDENT OPINIONS ON BUDGETARY CONTROL SYSTEMS IN THE 21ST CENTURY: EVIDENCE FROM A MULTINATIONAL RETAIL ORGANISATION LOCATED IN THE UK. Dissident Voices in Europe? Past, Present and Future, p.41.

Zhang, C., Wang, S., Gao, Z. and Zhao, X., 2015. Study on the Manipulation Effect of CEO Power on Executive Compensation Level: A Literature Review.

Cite This Work

To export a reference to this article please select a referencing style below: