Graphs Generated from Penn World Tables:

(Data above was compiled using the Penn World Table online access tool.)

(Data above was compiled using the Penn World Table online access tool.)

Section A

Introduction:

In economic studies based on the Solow growth model we frequently come across the term ‘convergence.’ Barro and Salla-i-Martin says if several different economies who have the same preferences and technology, given to the existence of diminishing marginal returns in the use of accumulating factors, such as capital would grow at its own steady-state however, at the same time, difference in income per capita income would tend to diminish. (Sala-i-Martin, 1995.)

This theory predicts an ongoing process of catching up, also known as conditional convergence or ‘sigma-convergence.’ The second definition of convergence is when rich and poor countries reach the same steady state of income level, meaning absolute convergence, i.e. ‘beta-convergence.’ (Sala-i-Martin, 1996)

Section B

Penn World Tables:

William Baumol study conducted in 1986 empirically analyses the convergence hypothesis against 16 different ‘industrialised’ countries. He argued convergence has shown strong GDP of industrial nations since 1870. Baumol regressed real GDP per capita over that period over a constant and the initial output per capita in 1870. (Baumol, 1986)

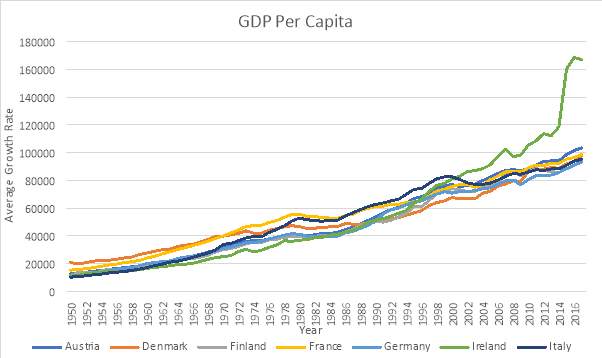

In this report we investigate growth rate between seven out of the original twenty countriesfrom theorganisation foreconomic co-operation development (OECD). Six were part of Baumol’s original 16 counties in his research. these six countries are Austria Denmark Finland France Germany and Italy while Ireland is the seventh country. We normally expect these western developed countries to have similar institutions and grow at a moderately steady state, but this is not the case. From the graph on page 2 convergence has occurred. this iswhere the poorer developed countries fromthestartof1950caught up withthepreviously advancedcountries such Austria, France and Denmark, while places like Italy were relatively close to Irelands GDP in 1950. Italy and Ireland will not cross paths again until 2001 when Ireland surpasses Italy in growth and continues to do so towards 2016. It can be said that ‘conditional convergence’ has taken place over these seven economies. This is due to these economies experiencing beta convergence but are conditional on other variables such as the population and investment rate are held constant. In this case, these variables are not being held constant. Thus, resulting in the Irish economies GDP to soar.

Section C

Advantages:

Many arguments arise after researchers suggest that countries who have low earning wages may have a future advantage in terms of worker productivity and economic growth. (Taylor, 2014) The first argument is focused on the law of diminishing marginal returns, meaning that as an economy invests and profits from their initial investment, its value will decrease as time goes by and becomes more of a developed country. (Investopedia, 2019)

Every time a country invests in capital, technology etc., they profit from it less as time goes by from their original purchase. In effect, richer economies who are already rich in capital will not see drastic growth in their economy than compared to investment poor counties. (Investopedia, 2019)

While on the other hand, poorer countries are at an advantage as they can replicate the production methods, technologies and institutions of developed countries. This is due to the developing economies having access to the technological know-how of the advanced nations, and as a result, they often experience rapid rates of growth. (Barkhordari, et al., 2018)

Developing nations can enhance their catch-up effect by opening-up their economy to free trade and developing ‘social capabilities’ or capacity to ingest innovation, pull in capital and take an interest in worldwide markets. (Lechman, 2015)

This can be seen after 1973 when Ireland joined the European Union where free trading occurs, opening them up as a potential trading partner in a large-scale market. As more countries joined the EU, the more markets that availed to Irelands growth as an economy. This factor already existed in many of the ‘land locked’ European countries as movement of goods from places like Austria, Denmark Germany, Italy and France are a lot easier and cheaper pre-European Union times.

Disadvantages:

Limitations’ to convergence however, although developing countries can see faster economic growth than more economically advanced countries, the restriction posed by a lack of capital can greatly reduce a developing country’s ability to catch up.

According to longitudinal studies by economist Jeffery Sachs and Andrew Warner, National economic policies on free trade and openness play a significant role in the catch-up effect of convergence to manifest. (Sachs & Warner, 1995)

Historically some developing countries have been successful in managing resources and securing capital to effectively increase economic productivity. Nevertheless, this has not become the norm on a global scale.

Economist Moses Abramowitz wrote about the limitations of convergence. He stated that for countries to benefit from the catch-up effect, they would need to develop and leverage what is he said to be ‘social capabilities.’ (Abramovitz, 1986) These include the ability to absorb new technologies, attract capital and participate in the global markets. This means that if technology is not freely traded or is prohibitively expensive, then convergence will not occur.

It must be highlighted that the exogenous growth theory has serious disadvantages when empirically examined. This rudimentary flaw is that the entire notion of convergence (i.e. absolute/beta convergence) is not clearly defined and tends to be confused with catching-up, i.e. conditional/sigma convergence. (Abramovitz, 1976)

Another downfall when testing this theory is that data collected is cross-sectionally examined. Issues in both cases is that results don’t allows us to make a distinction between the short term and the long term. The results do not tell us about the process profile and doesn’t distinguishes between absolute convergence or catching up.

The final issue of convergence arises when trying to describe the null hypothesis. When analysing the null hypothesis, it supports that all economies converge without taking intermediary elements into examination.

Conclusion:

The hypothesis that GDP per capita and income levels within these OECD countries have converged significantly in the post-war time frame. Although convergence has been weak since 1973 and evidence of systematic income convergence since 1950 is dependent on this sample selection, total factor of productivity catch-up stands out as the prevailing trend. This result still stands when we control for potential data bias due to cyclical differences, different measures of purchasing power parity, potential errors in the backward projection of income levels and sample selection bias. A simple model of comparative growth, incorporating TFP’s catching up as a main element is statistically sound and exhibits parameter stability.

References

- Abramovitz, M., 1976. Rapid growth potential and its realisation; the experience of the capitalist economies in the post war period. In Edmond Melinvaud, ed, Economic growth and resources, London: Proceeding of the fifth world congress of the International Economic Association.

- Abramovitz, M., 1986. Catching up; forging ahead and falling behind. Journal of Economic History, 46(1), pp. 385-406.

- Barkhordari, S., Fattahi, M. & Azimi, N. A., 2018. The impact of knowledge-based economy on growth performance; evidence from MENA countries. Journal of the Knowlege Economy, 10(3), pp. 1168-1182.

- Baumol, W., 1986. Productivity growth; convergence and welfare; what the long run data show. American Economic Review., 76(1), pp. 1072-85.

- Investopedia, 2019. Catch-up Effect. [Online]

Available at: https://www.investopedia.com/terms/c/catch-up-effect.asp

[Accessed 08 11 2019]. - Lechman, E., 2015. In: Technology Diffusion. s.l.:Springer, Cham, pp. 29-82.

- Sachs, J. D. & Warner, A. M., 1995. Economic convergence and economic policies (No. w5039).. National Bureau of Economic Research.

- Sala-i-Martin, X. a. B. R., 1995.. Technological diffusion, convergence, and growth (No. 735).. Center Discussion Paper.

- Sala-i-Martin, X. X., 1996. The classical approach to convergence analysis. The Economic Journal., 106(437), pp. 1019-10036.

- Taylor, T., 2014. Chapter 20.4 Convergence. In: R. U. Openstax College, ed. The Principles of Economics. Houston: Openstax College, Rice University,, p. 830.

Cite This Work

To export a reference to this article please select a referencing style below: