Introduction

Waqf refers to Islamic public charity or trust for socio-economic causes, whereby the object or property is perpetually non-transferrable. An object, under this type of charity, is donated so that the beneficiaries can enjoy it, or the trustee of the charity is required to give the income of it to them. It has a significant important in Islamic economic principles with reference to redistribution of wealth and elimination of poverty. There are several verses in the al Quran has explains that such spending has an expansionary or multiplying effect to the economy (al-Baqarah 2:261). There are also hosts of the Prophet’s hadith encouraging charitable giving. “Guard yourselves against hellfire even by giving half of a date, and if you have none to give, speak a kindly word” (Sahih al Bukhari, n.d-a)

Get Help With Your Essay

If you need assistance with writing your essay, our professional essay writing service is here to help!

Meanwhile, there is an emerging new Islamic financial product which is known as a cash waqf, with high potential to be Islamic financial product for the investors in the future. Cash Waqf is an Islamic investment product that emphasizes the social responsibility rather than purely profit-based. This is because the products have the characteristics of perpetuity which is the money that had invested is always there and is held by the trustee.

[1]An advantage of cash waqf is largely beneficial to all parties, including the banking and financial institutions, investors and society. Cash waqf typically focused on land or buildings but not many investors have the assets for endowed and instead introduced a cash endowment. In the cash waqf, investors still can benefit from the returns on their investments and the money invested can be used by the community after the investor dies. Thus, the banks are indirectly encouraging socially responsibility when cash waqf is encouraged in investment, in addition it is a charity among investors. This product has good potential in the future when its investment promises high returns in preparation for retirement income.

The Management of Cash Waqf

Nowadays, Waqf of buildings and lands were the most popular forms of Waqf. But the new Islamic financial product, Cash Waqf has become increasingly well-known particularly because of its flexibility which allows distribution of the Waqf’s potential benefit to the society.

[2] Cash waqf is a special type of endowment and it differs from the ordinary real estate waqf in that its original capital, asl- al- mal or corpus consisted, purely or partially of cash. It is usually formed as a financing method to develop waqf property or to support and build an educational institution which is schools or universities or orphanage houses. The waqf will receive cash instead of property or land and will use it for the financing instead of relying on banks or financial institutions.

The history of cash waqf started during the period of eight-century until the fifteenth. In the Islamic world, there was a huge gap of knowledge concerning the history of this type of waqf. According to Cizakca (1998), cash waqf played important role in the economic and financial aspects of the empire. Further, cash waqf has a function as a capital distribution for the borrowers who were mostly come small consumers. It is also mentioned that cash waqf has become popular because people without much (immovable) property wish to get the benefits of the waqf system and the banking system prefers it because it is easier to handle than property or other endowments. There have been examples where endowed capital was distributed as credit to a number of borrowers and the return from this investment was spent for religious and social purposes. If the return exceeded the expenses, the remainder was then added to the original capital of the endowment the following year.

The majority of Malikis allowed cash and food stuff as waqf though some held to be makruh. The Hambalis are deemed to have not allowed cash but according to Ibn Taymiyah the various rulings on the invalidity of cash waqf are based on the opinions of al- Khiraqi and those who who followed him. According to Ibn Taymiyah, cash may be a valid subject of waqf.

In Malaysia, the cash waqf is also known as share waqf (waqf saham). The cash endowments are pooled and the money is used for pious purposes such as helping the poor and needy and as educational aids. Malaysian Islamic National Council Ruling (Majlis Kebangsaan Hal Ehwal Agama Islam Malaysia) which met from 10 to 12 April 2007 at Kuala Terengganu agreed to allow the implementation of cash waqf. In addition, State Islamic Religious Council (SIRC) has identified shortage of funds as a major problem faced in developing the waqf assets. The same problem has also been identified by the Department of Awqar, Zakat and Hajj (JAWHAR). [3] The Asset Rich Cash Poor scenario has also been identified as a major hindrance to excellent waqf assets development in most Muslim countries. [4] The Federal Government also has allocated RM256.4 million to develop 17 waqf projects in the Ninth Malaysia Plan (9MP) and RM109.445 million in the Tenth Malaysia Plan (10MP). The fund is definitely not sufficient since the budget proposed by SIRC for the development of waqf properties across the country is more than RM1 billion.

So SIRC must provide a complete infrastructure which could conveniently promote the community to endow moveable assets (manqul). Hence, it will increase the number of waqf assets and this concept should not be just limited to cash only, but it should also be extended to bonds. Besides, another approach which can be adopted to widen the waqf property concept is by introducing Waqf Shares Scheme as implemented by the State of Johor Islamic Religious Council and the State of Penang Islamic Religious Council. The waqf share will encourage more individuals to purchase waqf properties in the form of share units. The individual share units can be accumulated and be used to buy other properties such as land or buildings. [5] It is evident that the adoption of this concept has resulted in an increase of the annual waqf fund and has managed to gain an impressive response towards waqf fund-raising projects.

For instance, Permodalan Wakaf Pulau Pinang Sdn. Bhd. which is a subsidiary company owned by the State of Pulau Pinang Islamic Religious Council (MAIPP) was established by the State of Pulau Pinang in order to increase the wealth of waqf. Other states which have adopted similar approach are Johor, Malacca, Pahang and the latest is Negeri Sembilan. Majlis may establish any waqf scheme by offering waqf shares for sale, or by issuing waqf bonds or any other instruments for valuable securities as waqf, to any person, association or institution based on the Section 11(1) (b) of Negeri Sembilan Waqf Enactment 2005. Section 11(1) (a) of Negeri Sembilan Waqf Enactment 2005, a new waqf scheme to be introduced in Negeri Sembilan in which an endowment can be made in the form of cash money which involves the collection of cash which will be used to purchase an asset or for any other charitable purposes as permitted by Islamic law.

The Penang Waqf Fund can be purchased at the State of Pulau Pinang Islamic Religious Council (MAIPP) and at all Zakat Management Centers. In addition, the Muslim society can also receive the National Cash Waqf Scheme, which has been offered by the Yayasan Wakaf Malaysia (YWM) at the minimum price of RM10. The availability of cash waqf can also be obtained at the Yayasan Dakwah Islamiah Malaysia (YADIM) at the minimum price of RM10. The development of technology has changed people’s perception toward waqf. The utilization of technology has facilitated the implementation of waqf in a more user friendly manner, for instance, Bank Islam and Maybank through Yayasan Restu Waqf and Maybank Waqf, respectively, have made it possible to contribute to the waqf fund by sending a short message send (SMS) using a mobile phone. According to Muhammad Salleh (2009), Penang state has a very high potential to develop a cash waqf fund because of its planning and marketing strategy that are used for the promotion of the cash waqf funds.

The State of Pulau Pinang Islamic Religious Council (MAIPP) was established in 1959 with the subjects of Islamic matters. The waqf section is one of the six main sections under the Penang SIRC. The effective promotions and utilization of the online services including cash waqf facilitates publics in updating and engaging with the activities held by the council. The inception of waqf fund (cash waqf) has increased the credibility of the Penang SIRC. The online services such as the facility and updates of the data of waqf appropriators show the transparency of the council in providing the best public service.

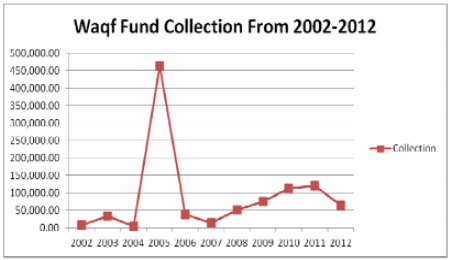

Source: Penang SIRC 2013

Based on the graph, in the year 2005 there were high participations towards waqf. This is due to the corporate launching by leaders, corporate and organizations and effort made by Penang SIRC in promoting waqf to publics.

Furthermore, Baharuddin Sayyin et al. (2006) corroborated the cash waqf implementation through Selangor Waqf Shares Scheme, which has a high potential growth. This scheme has encouraged Muslims to implement waqf via cash money while purchasing share units offered by the Selangor State Religious Council (SSRC). The waqf funds collected by the SSRC will be used for the benefit of the Muslim society instead of giving a fair chance for the poor to implement waqf. The State of Johor Islamic Religious Council (MAIJ) also introduced Skim Saham Wakaf Johor in 1993 to encourage the Muslims to perform waqf which can be bought at RM10.00 per unit. All of the money obtained from the scheme is channelled to Projek Saham Wakaf.

The scheme uses an on-line system and the payment can be made using credit cards, money orders, cheques and FPXs (financial process exchange). It is also open for the non-Muslims who can make endowment through Skim Saham Wakaf Johor. The fund has been successfully channelled to a number of projects such as Wakaf Bangunan Perniagaan at Fortune Point and Taman Perindustrian Nusa Cemerlang, Nusajaya. The fund has also been used to finance Mushaf Al Quran waqf project which involved the purchasing of 30,000 copies of Mushaf Al-Quran at a cost of RM1, 485,000.00. The Qurans were distributed to religious schools in Johor. Besides, the funds has been used for building religious school and construction of the hostel for Johorean students in Egypt (Laporan Tahunan Johor Corporation, 2010).

Meanwhile, Federal Government has channelled RM30 million to the Yayasan Wakaf Malaysia (YWM) for high impact small projects development programs in selected mosque areas across the country. YWM has completed two types of waqf iconic projects in the country which are Bazar Wakaf Rakyat as a retail space provided for Muslim entrepreneurs and the poor to run various types of businesses in order to increase their income and Wakaf Mart as a halal grocery store which provides a variety of daily household goods at a competitive price. Moreover, a total of 69 projects are now being run in selected mosque areas across the country as shown in table below.

Source: Bazar Wakaf Rakyat, 2013, https://www.ywm.gov.my/projek/dana/bazar.

Issues Related to Cash Waqf

[6]There is limited programs scope conducted by SIRCS in Malaysia. It is only focus on programs involves religious activities and the traditional charitable avenues of orphanage and relief to the poor whereas the awareness and education of waqf especially cash waqf are very few except in Selangor where it has involved in education (building a computer lab for a national school) thus benefiting a wider portion of community (Alina, 2011). In terms of sources of funds, Malaysia public could only think the Islamic Bank is the only resource to reward part of their shares as cash waqf in order to perform their corporate social responsibility.

Find Out How UKEssays.com Can Help You!

Our academic experts are ready and waiting to assist with any writing project you may have. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs.

View our academic writing services

Other than that, there is still lacking in the response of the Malaysia public towards cash waqf. Eventhough the amount of cash waqf collected is quite considerable but the response received is still not there (Mohsin, 2009). It still needs more effort in the development because a goal to strengthen a waqf as a third sector in Islamic economy still at low level. Response is always associated with understanding and awareness. The understanding of Malaysia public toward waqf is too narrow where they only linked it with the construction of mosque and waqf land for cemetery despite a wider function and roles of waqf itself (Arshad, 2011). According to Alina (2011), the local preference for example Malaysia is only for religious purposes. This is supported by Laldin (2005) that was stated the understanding of Malaysian on waqf is only for donation for the purposes of building mosque and sites for graveyard. Furthermore, the donors are not aware of diversifying their contribution under waqf properties are wider compared to zakat and sadaqah.

Study shown that most of the problem occurred in managing waqf depends on the unqualified mutawali (Waqf manager). For instance, the asset of waqf can be left idle without anyone who can process it, corruption in waqf money, and there is no other income to cover the operational cost from the planned project. The issue that lies for function of waqf is that the institution acted as capital distribution instead of capital accumulation. The institution lends money to the borrowers and mostly come from small consumer which more or less has similar process with the conventional bank. The transaction between lender and borrower was very close to riba which is prohibited in Shariah.

The Implications to the Economy

Good governance is required from the waqf institution that will ascertain the practice and the procedure of waqf in line with the objective. With the availability of good governance system there will be no problems such as corruption and unorganized management. Further, the insufficient operational cost for the planned project can be settled. For instance, by create secondary projects to produce a regular flow of incomes. Suppose a school or hostel is the primary project. Some secondary projects such as hospitals can be constructed by raising organized voluntary cash waqf in order to finance the expenses of the school or hostel. The earnings generated from the secondary projects can be used for the operation of the primary projects.

Moreover, istiqlal could be avoided in the mudarabah transaction as the modern Islamic banker has created an innovative way how cash waqf and Islamic bank can work together through Dynamic Cash Waqf model. Islamic Bank will supervise and oversee the collection of waqf fund, investment and distribution of profit to the charity as an act of a trustee. In addition, Cash Waqf fund can be used in many activities. Loan could be provided to small and medium enterprise (SME) by Islamic banks, plus to portfolio investment in IFI’s securities and for emergency needs. The waqf fund could be used for micro finance as well.

Finally, charities activities may increase as the donor could distribute profit and contribute donation according to their will. Bank could also responsible by distributing in three ways which are to charity such as mosque, social activities, marriage for poor couple, to management includes maintenance, future development and capital enhancement, and lastly is marketing, the manager could advertise through television, radio or newspaper in order to raise money from the donator, when there is a natural disaster.

Conclusion and Recommendation

In conclusion, efficient and systematic management of waqf plays a very significant role in ensuring equal distribution of wealth, lessening the government’s liability, improving and strengthening the economy of the Muslim community. The waqf assets could be developed in a more creative and innovative way which is the most relevant and significant in the current scenario. A few issues should be carefully addressed in order to ensure that cash waqf would be able to be used as a tool to improve the development and management of waqf lands and other assets in Malaysia

As a long lasting charity, efficient management of cash waqf should be given an attention to ensure that endowment of property which has a very high commercial value could be preserved to protect the interest of the endowers and to educate the public about the importance of waqf.

According to the intention of the endowers as well as be able to generate income and revenue to MAIN and strengthen the economy of Muslims, a Waqf Management Committee and Baitul Mal should be formed to ensure that all of the waqf assets can be benefitted.

The adoption of Waqf approaches are very suitable to be implemented in this country which could promote endowments to be made from various methods such as shares and other contemporary. Thus, any endowment should not be narrowed to lands or buildings only. Instead, the Muslim community should also be encouraged to practice emerging cash waqf in order to generate more income and expand the assets and properties of the Muslim community. A proper master plan which is in line with Vision 2020 could also be developed which on the basis of any proposed waqf development projects to ascertain the funds spent on the development of waqf will have strong impacts to the economy of the Muslim community.

References

- Mohammad Tahir Sabit Haji Mohammad, October 2011, Towards an Islamic Social (Waqf) Bank. International Journal of Trade, Economics and Finance, Vol. 2, No. 5.

- Hisham Yaacob, 2013, Waqf History and Legislation in Malaysia: A Contemporary Perspective. Brunei Darussalam: Journal of Islamic and Human Advanced Research, Vol. 3, Issue 6.

- Murat Cizakca, 1998, Awqaf in History and Its Implications for Modern Islamic Economies. Islamic Economic Studies Vol. 6, No. 1.

- Abdul Hamid Mar Iman, Mohammad Tahir Sabit Haji Mohammad, 2014, Waqf Property: Concept Management and Financing. UTM Press.

- Siti Mashitoh Mahamood, 2006, Waqf in Malaysia: Legal and Administrative Perspectives. University of Malaya Press.

- Magda Ismail Abdel Mohsin, 2009, Cash Waqf: A New Financial Product, Pearson Malaysia.

[1] Dr.Abdul Ghafar Ismail, Professor of Banking and Finance,Islamic Economics Research Group and Finance, School of Economics, National University of Malaysia.

[2] Nahar and Yaacob (2011), “Accountability in the sacred context: The case of management, accounting and reporting of a Malaysian cashawqaf institution”, Journal of Islamic Accounting and Business Research, Vol. 2 Iss: 2, pp.87 – 113

[3] Zarqa, M.A., 1994

[4] Mohd, A., 2012, Pembangunan Wakaf, Pengalaman Malaysia

[5] Hassan, N.M.N., 1998

[6] Alina, (2011), “Determinants of cash waqf giving in Malaysia: Survey of selected works”.

Cite This Work

To export a reference to this article please select a referencing style below: