Introduction

What is the banking and finance services sector?

Definition of banking and finance gives information of definition of banking and definition of finance. Finance means circulation of capital such as money and currency, or procurement and management of the capital, in connections with financing activities. Finance and banking service is Services and products provided to consumers and businesses by financial institutions such as banks, insurance companies, brokerage firms, consumer finance companies, and investment companies all of which comprise the financial services industry (InvestorWords, 2015). Two of both sectors are related to each other.

Get Help With Your Essay

If you need assistance with writing your essay, our professional essay writing service is here to help!

What does this sector mean to the Singapore economy?

Banking and Finance of Singapore economy is finance and banking services. In recent years, Asian countries are receiving attention from the world because they have an infinite of possibilities and capabilities such as enormous number of population, geographical position and abundant natural resources. Most of all, Singapore have grown up and developed rapidly. Since 1970’s, Singapore was called ‘four Asian dragons’ with several Asian countries, which are Hong Kong, Taiwan and South Korea because Singapore and those countries could become rapidly industrialized by cheap and plentiful labor and active export policy. Especially, Singapore have been developed by finance and banking services.

Contribution of these sectors to the national economy

Singapore economy could be developed by contributions of finance and banking services sector such as Job market and Financial Hub and attracting foreign direct investment and so on.

Especially, the reasons of developing is that Singapore is a huge financial hub and attracting foreign direct investment. Early Singapore was limited land space and natural resources. To overcome those disadvantages, Singapore pursued trade liberalization. And to make the best use of a geographic benefit, this country intermediated trade. Therefore, Singapore is able to be a finance hub and attract foreign direct investment.

Nowadays, Singapore is an international major financial trading hub to lift up its head in dealings of foreign exchange and the domain of asset management. Foreign-exchange market of Singapore is ranked top five in the world after London, New York, Zurich and Tokyo. And then, there is 110 number of foreign banks. The scale of asset management is about S$ 1trillion. Recently, Singapore is pushing forward a business of Islam finance.

For attracting foreign direct investment, Singapore is a trade liberalization because there is a transport center by its conditions of a location. Because of using this benefit, there is total 5 container terminals and 45 berths. This container port processes one-fifth amount of international transhipment. Moreover, Singapore airport ‘Chang-I’ is connecting with 200 cities in 60 countries. There is 85 airlines.

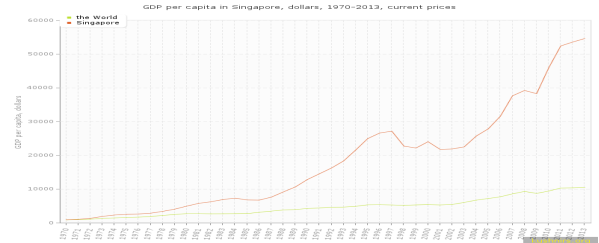

Second contribution is Job Market. According to improving Singapore’s finance and banking services, there is the number of foreign banks and businesses. It means that getting job in Singapore is able to be easy. And then, GDP per capita in Singapore also will increase. Below graph is GDP per capita in Singapore from 1960 to 2013.

-GDP per capita of Singapore (GDP of Singapore, bln. Dollar, 1970-2013)

According GDP per capita in Singapore line graph, the GDP per capita was rising steadily from 1970 to 2013. In 1960, the GDP per capita is only 925 USD. It is the lowest GDP per capita from 1970 to 2013, ranked 74th in the world. For example, the figure measured lower than GDP per capita of Indonesia (86 USD) and Malaysia (343 USD), which are Singapore’s neighbor countries, and then one of developing countries in the Asia currently. On the contrary, the highest GDP per capita was a near 54,649 USD in 2013. The measured value of GDP (54,649 USD) per capita is higher than some developed countries such as U.S.A (5126 USD) in about 6 times, Japan (2016 USD) in 2 times, and Germany (2712 USD) in 3 times. Generally, this graph is drawn by upward curve. (Kushnir, n,d)

Challenges facing by this sector in the future

Singapore economy has been improved by banking and finance services. However, the sector is able to face challenges such as dependency of global economy and other regional financial hub in the future. Singapore is the biggest Asia finance hub. Thus, economy of Singapore is exposed and influenced by global economic conditions. And then, it is shown by GDP of Singapore.

GDP of Singapore, 1970 to 2013 (GDP per capita in Singapore, bln. Dollar, 1970-2013)

The Above line graph illustrates GDP of Singapore from 1970 to 2013. Generally, GDP of Singapore draws upward curve. In 1970, GDP of Singapore was an estimation of 1.9 billion USD (United States Dollar). It is ranked 74th in the world. By 1980, the GDP slowly increased to about 12.08 billion USD. Moreover, after 1980, the GDP took a sharp increased from to 1997. However, from 1997 to 2004, the graph of GDP is generally decreasing by Asia economic crisis. The issue appeared from South Korea. Some of Asian countries tried to be capital decontrol. But without capital, the countries should take out a loan from IMF (International Monetary Fund). Thus, Singapore economy was also affected from Asia economic crisis. Eventually, most companies in Singapore ought to restructure with layoff, and is under threat of bankrupt. Nevertheless, once again, it steadily increased to the year 2013. In 2013, the GDP was about 297.94 billion USD. (Kushnir, n,d)

According to GDP, after 2004, Singapore economy has been grown. However, from 1997 to 2004, had been decreasing because of Asia economic crisis in the period. It means that the same economic condition will be happened by global and regional economy in the future.

Other challenge in Singapore is competitive from other regional financial hub. The number of Asian international financial centers (IFCs) such as Seoul in South Korea, Tokyo in Japan and Shanghai in China want to become international financial hub. Nowadays, the international financial centers of those cities are developing and making an effort, and then each cities are competitors of Singapore financial center. For example, one of the competitor, Seoul in South Korea, establish the Korea National Committee for Pacific Economic Cooperation (KOPEC). In 2007, KOPEC had a convention of an international conference in Seoul with 3 Asian countries such financial centers (Hong Kong, Seoul, Shanghai, Tokyo and Singapore).

Find Out How UKEssays.com Can Help You!

Our academic experts are ready and waiting to assist with any writing project you may have. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs.

View our academic writing services

Another microeconomic challenge is a ‘Shortage of skilled talent’. In Singapore, is already international financial hub, there is the number of business and banks are having competitions. If employees in organization have shortages of skill and talent, they would not survive in the rapidly changing world economic situation. For example, ‘Accounting and writing skills are crucial’, ‘International talent in High demand at money-center banks’, ‘Marketing types wanted’, ‘Days of easy hours long gone’ and then ‘MBA optional’. They should develop their own skills and talents, and then may follow the economic flow. (Hean Hoo, 2015)

Strategic planning by this sector in the present and the future

In Singapore’s finance and banking services sector, there is the number of competitors such as banks and businesses as well as financial centers from other Asian cities. Singapore should have strategic planning such as training and education, and global innovation.

Training and Education

Most of organizations should train and educate their employees for the rapidly changing world economic situation for employees’ effective, accurate and practical performance of tasks. After training and education, the employees would be more developed. One of way in effective training and education is E-learning by developed technology. When organizations open online lecture, the employees may get the organization’s training and education through their Smart-Phone and Tablet PC. This kind of training for adults looks helpful and effective for them that they can be able to learn all of the necessary things that they need in improving their skills and techniques. (Stephanie, 2014)

Stress testing and risk management

Stress testing for risk management is one of the useful method for identifying how a portfolio would be fair during a period of financial crisis. One of the most general used ways of stress testing is ‘The Monte Carlo’ simulation. Moreover, this simulation technique is also used to be aware of how several risks will influence an organization and industry. Before an economic a financial crisis, using the simulation is able to detect and predict future economic crisis with solutions. Therefore, countries and organizations ought to do stress testing and manage future risks.

Conclusion

How the MAS supports this sector?

The Monetary Authority of Singapore (MAS) is a Singapore central bank, a kind of Singapore government department. MAS has authority of regulation and supervision of Singapore finance and banking, and then it issues money and drafts a law of financial and banking policy. This department focuses on exchange rate rather than interest rate otherwise other central banks. According to developing Singapore, Singapore is complicated by the number of bank works with finance, so the government established ‘Monetary Authority of Singapore Act’ in January, 1991. (Monetary Authority of Singapore, 2014)

What is the outlook for the future of this sector in Singapore?

Nowadays, Singapore is one of the most developed countries in the world, as well as in Asia because of the finance and banking services. Through the GDP and the GDP per capita from 1970 to 2013, the graphs are illustrated that it has increased and grown up in the future. In the end, Singapore finance and banking services will be more by several contributions. However, Singapore will also face several challenges in the future, so the country should have strategic planning of the sector, and predict and manage future risks.

References

- InvestorWords (2015) InvestorWords. Availanle at: http://www.investorwords.com/19080/financial_services.html [Accessed 15 May 2015].

- Kushnir, I. (n.d) World macroeconomic research, 1970-2013. Available at: http://kushnirs.org/macroeconomics/gdp/gdp_singapore.html [Accessed 15 May 2015].

- Kushnir, I. (n.d) GDP of Singapore, bln. Dollar, 1970-2013. Available at: http://kushnirs.org/macroeconomics/gdp/gdp_singapore.html [Accessed 16 May 2015]

- Kushnir, I. (n.d) GDP per capita in Singapore, bln. Dollar, 1970-2013. Available at: http://kushnirs.org/macroeconomics/gdp/gdp_singapore.html [Accessed 16 May 2015].

- Hean Hoo, W. (2015) Economics Policy and the Global Environment LECTURE SLIDES. Kaplan/Dublin: Veritas.

- Stephanie, R. (2014) ‘Workplace Training and Education: Effective Methods for Training Adults’, Human Resources Blog, 17 Feburary. Available at: http://tribehr.com/blog/workplace-training-and-education-effective-methods-for-training-adults [Accessed 18 May 2015].

- Monetary Authority of Singapore. (2014). Monetary Authority of Singapore. Available at: http://www.mas.gov.sg/about-mas/overview.aspx [Accessed 17 May 2015].

Cite This Work

To export a reference to this article please select a referencing style below: