- Reshni Jeshika Lata

New Zealand is a small economy with an income level that places it among the richest countries in the world. As an open economy, New Zealand has vital links with the rest of the world via trade, migration flows, historic, diplomatic, sporting and cultural affiliations and market connections in products, components and financial flows. Forecasting the future performance of the economy is a mix of science and art.

The economy is complex and its parts are interrelated. As a result, simplified models of the economy often require judgments to reflect current economic trends and likely surprises. However, unexpected events often occur and cannot be accounted for ahead of time.

Hence, the report will introduce the topic Economic in the introduction and the reason of the report followed by the findings through lecture and desk research. The report begins with explaining analyze how government affect the macro economy and the effects of international trade and change in the globe economy on New Zealand Moreover, the report enlightens and discusses the factors which affects the government and also covers current economic development.

The report is requested by my Tutor at Aotearoa Tertiary Institute and is carried out as an assessment of the paper 520 The Economic Environment –Cooperative Assignment. The purpose of the report is to explain the current economic development by government in New Zealand.

Furthermore, the report shows and illustrates using graphs and explanations the relationship between the topics that comes under: how government affects the macro economy and the effects of international trade and changes in the globe. Lastly, the whole report is summary in conclusion and recommendation.

Contents

Article 1: Indicators forecast economic growth

1.0 Article: Govt tax revenue jumps 6%

2.0 Article: Inflation news firms up interest rate hike expectations

4.0 Article: Balance of payments closer to truth

5.0 Article: Hiring plans on 5 year high

6.0 Article: NZ income gap at crisis level

Role of New Zealand in international trade

Article: 2 Drought Hits NZ Current Account

Article: 3 Kiwi Hits four-year Aussie high

Article: 4 Kiwis can be proud NZ has leading role in trade talks

Introduction

We may never have studied economics before, and yet when we open a newspaper you read n a report from our economic correspondent.’ We turn on the television news and we see an item on the state of the economy. We talk to friends about the price of this or that product, or whether we have got enough money to afford to do this or that.

It is a fact that economic affects our daily lives. We are continually being made aware of local, national, and international economic issues: whether it be increase, interest rates changes, fluctuation in exchange rates, unemployment, economic recessions or the effects of globalization.

Many people think that economic is about money. To some extant this is true – economic has a lot to do with money: with how much money people are paid, how much they spend; what is costs to buy various item, how much money firms earn, and how much money there is in total in the economy. But despite the large number of areas in which our lives are concerned with money, economic is more than just the study of money. Economic is concerned: production and consumption.

Find Out How UKEssays.com Can Help You!

Our academic experts are ready and waiting to assist with any writing project you may have. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs.

View our academic writing services

The circular flow of goods and income shows the interrelationship between firms and households in a money economy. Firms and households come together in markets. In goods markets, firms supply goods and households demand goods. In the process, money flow from households to firms in return for the goods and service that the firms supply. In factor markets, firms demand factors of production and households supply them. In the process, money flows from firms to households in return for the service of the factors that households supply.

THE ROLES OF GOVERNMENT

The government (or public) sector is a large part of the New Zealand economy. The New Zealand government is involved in the economy in a variety of different ways. The major one are as follows: regulator, as a gather of taxes, as an owner of enterprise, and as a provider of service of income.

The government regulates the interactions of people and firms while doing the business with each other. It is the most common activity which is found in New Zealand. General laws bring people together in the business and civil laws summaries individuals civil rights and duties relative to every one other for example law of contract. New Zealand court system enforces laws through judicial arm of government. The parliament passes the regulation in the form of laws.

Government has three economic roles which are follows:

- To promote an efficient allocation of resources (including by providing public goods)

- To ensure a fair distribution of income

- And to provide macroeconomic stability

- Taxes can be powerful tool which may affect people’s behaviour.

- Around $32 billion taxes are collected by the government every year.

- The fund is used for government programmes like to build public infrastructure, to pay debts and health and education.

As owner

- A value of $95 billion assets are owned by the New Zealand government. The physical assets are hospitals, schools, police stations and military equipment.

- A majority of the shares are in Air New Zealand and other businesses like New Zealand Post.

- The businesses owned by the government are highly mannered.

As provider

- They are the provider of public of goods and services are inverse as tax gatherer.

- The direct provisions of services are police force, education and health services.

- The direct provision of income transferred to individuals each year through transfer payments is about $12 billion.

Reference

http://www.decisionmaker.co.nz/guide2003/hgw/govtrole.html

Article 1:

Summary

Economic Theory

Implications

Conclusion

Reference

Article 7: NZ dollar jumps a cent after Fed says it is concerned about strong US dollar

Foreign Exchange

- The New Zealand dollar has jumped a cent after Federal says that they are concerned about US dollar strong.

- The kiwi was trading at 78.97c at 8.00am having reached a high of US 79.14c in early trading.

- Fed’s major concern was about the strong currency will affect the exports echo from other central banks including New Zealand and Australia.

- When New Zealand dollar was weak for past four to five years they faced a lot of consequences which highly affected the foreign exchange.

- ASB’s Kelleher said he expected the kiwi to have greenback, with the New Zealand dollar pushing as high as US 81c by next couple of weeks.

- As New Zealand dollar rose to 89.38, Australians cents from 88.82c which is way ahead of Australian employment data.

- The local currency advanced to 62.02 euro cents from 61.64 cents which has gained 48.87 British pence from 48.50 pence and rose to 85.41 yen from 84.41 yen.

Economic theory

Foreign Exchange: Exchange rate is determined by the demand and supply of currencies.

Relationship between foreign exchange and import and exports

- High interest rates encourage inflows of money from abroad which drives the interest rate.

- A higher exchange rate makes domestic goods expensive relative to goods made abroad.

- This can be very damaging for export industries and industries competing with imports.

- Many firms in New Zealand have suffered badly in recent years from a high exchange rate, caused partly by higher interest rate in New Zealand than in other countries such USA and the euro zone.

- High import prices also increases the price of goods which people are not able to afford due to less or no income which makes the market weaker.

Relationship between foreign exchange and monetary policy

- Monetary policy works through interest rates and their impact on savings, borrowing, consumption, investment and exports (through the exchange rate). Every six weeks the Reserve Bank decides on changes on interest rates.

- Monetary policy refers to the use of financial instrument to influence variable such as the quantity of money in the economy, in the economy, interest rates and the exchange rates. These variables in turn affect spending, saving and investment decisions that government takes.

- The fact is that changes in interest rates have gained a central significance in macro-economic policy.

- Monetary policy is seen as having a major influence on a whole range of macroeconomic indicators.

Implications

- A falling exchange rate is a problem because it pushes up the price of imports and may fuel inflation.

- For instance, if the exchange rate fluctuates, this can cause great uncertainty for traders and can damage international trade and economic growth.

- If a country’s monetary policy is not well maintained then there will not be any control on the pricing and interest rate which will cause a rise in inflation rate. This will also sweep the investors away and in local business will invest outside to generate a better return for their investment.

- Export may rise but the cost of producing goods may rise as the raw materials are imported resulting in less income from export. Exports are further stimulated when the exchange rate is low.

- As mentioned in the article that strong currency will affect the exports echo from other central banks including New Zealand and Australia.

Graph

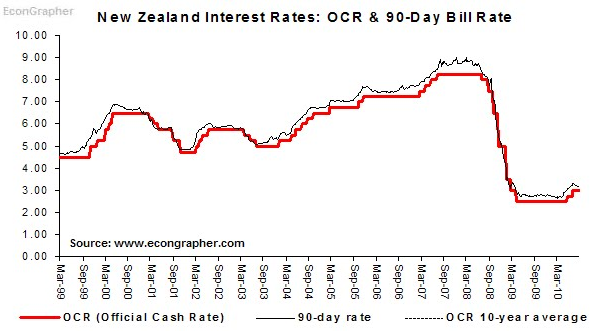

- The graph above shows that the current New Zealand’s official cash rate (OCR) is 4.5 and the 90 day bill rate is always around OCR. The monetary policy, by influencing interest rates indirectly influences the exchange rate.

Conclusion

Cite This Work

To export a reference to this article please select a referencing style below: