Contents

1 Introduction

1.1 Research Aim

1.2 Research Questions

1.3 Research Objectives

2. Literature review

2.1 Market creating institutions- The role of property rights/ rule of law

2.2 Market regulating institutions

2.3 Market stabilising institutions

2.4 Market legitimising institutions

2.5 Institutions of conflict management

2.5 Case study: What Can Nigeria Learn from Other Countries Economic Development

3 Research Methodology

4 Conclusion

5 Recommendations

References

1 Introduction

Nigeria is a country with many resources and potential. Nigeria is the 12th largest producer of petroleum but yet Nigeria still has not been able to harness her economic potentials for rapid economic development (Ogbole, 2010) and has been grossly underperforming relative to their enormous resource endowment and compared to its peers. Nigeria entered a recession in 2016, its first full year of recession in 25 years shrinking by 1.5% according to the National Bureau of Statistics. This was due to a series of shocks such as a decline in oil prices, foreign exchange shortages, power shortages etc. There are many factors as to why Nigeria is not where its meant to be but, in this essay, we will be evaluating whether weak institutions are the main factors responsible. Acemoglu (2006) states that if Nigeria’s institution were to improve to the likes of a similar developing country like Chile, in the long run, they could benefit from a seven-fold increase in income.

Get Help With Your Essay

If you need assistance with writing your essay, our professional essay writing service is here to help!

Nigeria could be one of the greatest countries in the world. Nigeria has been listed as one of the prospects by many different economic institutions. Jim O’Neil classed Nigeria as part of the MINT countries, which are the four countries that are seen as emerging economic giants. The acronym refers to Mexico, Indonesia, Nigeria, and Turkey. Nigeria was on track to be one of the 20 largest economies in the world, being compared with emerging Asian countries such as Thailand, China and India who were behind Nigeria in terms of GDP in 1970, however, there are many factors hindering Nigeria from being a significant global players like these countries and this may be due to Nigeria’s weak institutions. Nigeria is predicted to grow at 10-12% by sorting out corruption alone. Doubling the size of the economy in six or seven years. However, even though Nigeria is among the MINT countries and a big economy in Africa, it is still difficult for economic activity to strive in Nigeria like it is in Ghana.

Nigeria suffered a full year of negative growth in 2016

Source: Atlas Data: National Bureau of Statistics

1.1 Research Aim

The research aim of this study is to essentially examine why Nigeria has regressed and not reached where it is predicted to be today and whether this is mainly due to Nigeria’s weak institutions affecting its economic development.

1.2 Research Questions

In order to answer the study question presented, a number of primary research questions will be addressed such as ‘What are the necessary institutions required for economic development and how are these specific institutions performing in Nigeria’, ‘What did countries similar to Nigeria do that made them grow at a much higher level to Nigeria and what can Nigeria learn from these countries”.

1.3 Research Objectives

In order to ensure the aim of this study is achieved, four research objectives are set:

- To examine which institutions are most important for economic growth

- To examine what role these weak institutions, play with the lack of Nigeria’s economic development

- To compare Nigeria with countries on similar level of economic development (Chile, China, Russia, Singapore)

- To examine what Nigeria could learn from these similar countries

2. Literature review

What are institutions?

Douglass North (1990) defines institutions as formal and informal rules that govern human behavior. Institutions govern and shape the interactions of human beings and help form expectations of what people should do (Lin & Nugent, 1995). Institutions are things such as; the extent of property rights’ protection, the degree to which laws and regulations are fairly enforced, the ability of governments to protect individuals against economic shocks and provide social protection and also the extent of political protection. This essay will focus on; Nigeria’s market-creating, market regulating, market stabilising, market legitimising institutions and institutions of conflict management.

Institutions help deal with important problems that occur in basic economic transactions. Institutions create constraints through law and social norms, that way reducing transaction costs which are costs associated to simple transactions such as buying or selling, borrowing money or investing in a business (Roland G 2016). Institutions have a significant effect on the development of commerce, entrepreneurship, trade, innovation, and investment. Cross-country analysis carried out highlights empirical evidence showing that there is a positive correlation between growth outcomes and an array of measures of institutional quality (Pande R and Udry C 2005)

Nigeria’s institutions can be classed as weak because they are not fulfilling their purpose, for example Nigeria’s institutions are not able to protect property rights’, laws and regulations are not enforced properly, the government is not being able to offer social support as there’s no access to a good level of medical care and mental health support. Nigeria’s institutions are weak because their institutions have failed to build infrastructures stable for development.

2.1 Market creating institutions - The role of property rights/ rule of law

In order for economic development to occur, market creating institutions need to be instilled to present an incentive for investing and innovating in Nigeria. Market-creating institutions are things such as Property Rights, legally binding contracts and rule of law. Property rights protect assets held by an individual or firm from being taken by others which protects citizens from various forms of government expropriation or entry barriers that protect large firms. Market-creating institutions allow property rights to be secured ensuring that people retain their returns from their investment and resolve disputes (Djankov et al 2002). This encourages people to invest in themselves and in the physical capital which creates economic development. This security also creates confidence from firms to invest in human capital to improve the productivity of labour.

Through literature, it is evident that the quality of Nigeria’s market-creating institutions is weak. The Economist Global Outlook report ranks Nigeria at 76 out of 82 countries examined and identifies Nigeria’s business environment as “very poor”. The World Bank’s Doing Business 2010 ranks Nigeria at 125 out of 181 countries. Nigeria is placed ahead of the likes of India (133) and Brazil (129) however behind the more dynamic countries such as China (89), Ghana (92) and Indonesia (122) (World Bank, 2010). The business environment in Nigeria is weak due to the lack of market-creating institutions.

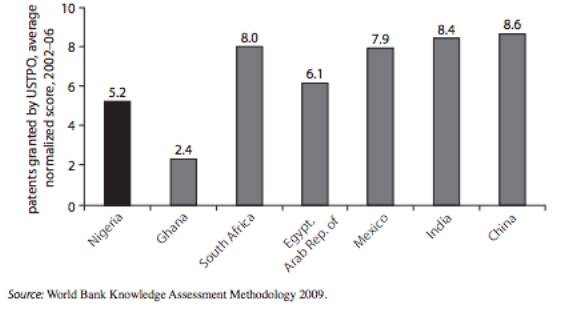

The is a lack of property rights protection in Nigeria, figure 1 displays that patents issued by the USPTO to Nigeria is lower than most countries compared to other than Ghana, highlighting that Nigeria’s market-creating institution lacks in protecting property rights.

Figure 1: Levels of Patents of developing countries

Low levels of Patents in Research

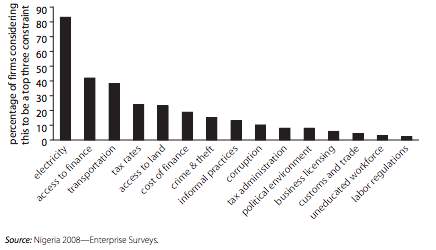

There is a lack of infrastructural development in Nigeria, there is poor electricity provision which can lead to damaged machinery and equipment because of the electricity outage and voltage fluctuations. No access to finance and poor transport links such as poor roads and train links, makes it more difficult for businesses to operate. 83% of Nigerian business owners consider lack of electricity the biggest constraint to doing business (WorldBank 2016). Poor transport links create delays in delivering and shipping products. Access to finance is vital in any economy, an efficient financial system that allocates financial resources quickly and cheaply presents an incentive for people to invest and innovate. These are major constraints to doing business in Nigeria. If Nigeria’s market-creating institutions were to improve in this area there would be a huge rise in entrepreneurship in Nigeria.

Figure 2: The major perceived constraints of entrepreneurship in Nigeria (WorldBank, 2008).

Lack of ‘Rule of law’ has hampered Nigeria’s foreign direct investment. Lack of ‘Rule of Law’ creates a fearful environment for firms as they uncertain if any disputes or cooperation and commitment problems arise, would they be solved, which could mean they have to take a loss from their investment as a result. Corruption due to a lack of values is also a constraint to investing and innovating for example when a Government contract is at stake, firms are expected to pay a percentage of its value in informal gifts or payment in order to secure it, these could be construction permits which all affects small and medium firms.

An improvement in Nigeria’s market-creating institutions will provide more opportunities for entrepreneurs especially young people. It will also make the business environment much more attractive for foreign direct investment in many other sectors, not just in oil, gas or telecom. Nigeria will also benefit from the wealth of knowledge multinational corporations bring, the employment of opportunities they provide and a development of Nigeria’s technological capabilities.

Acemoglu term property rights institutions as more important than contracting institutions for economic growth, investment and financial development- contracts can be changed and manipulated as there are loopholes in contracts especially if there are contractual imperfections.

2.2 Market regulating institutions

Market regulating institutions enforce rules for the benefit and protection of investors. They help compensate for market failures and deal with any externalities arising from fraud and anti-competitive behaviour. A regulatory environment is essential for innovations to transpire as it ensures that markets are fair, efficient and transparent. The Nigerian government has put in place regulatory frameworks to ensure the growth of the market (Figure 3). However, the quality of the market regulating institutions can be questioned.

Impose penalties and address any wrongdoings

Figure 3: List of Nigeria’s market regulating agencies

| Regulatory agency | Function |

| Central bank of Nigeria | The Central Bank Of Nigeria is the lead bank regulator who is responsible for managing the country’s currency, interest rates, money supply and ensuring price stability. |

| The Corporate Affairs Commission (CAC) | Established to regulate and supervise the formation, incorporation, reregistration, and management of companies. Conduct investigations into the affairs of any company where interest of the shareholders and public are of high demand. |

| Financial Services Regulations Co-ordinating Committee. | Implemented to supervise with the regulation of the financial sector through administering strategies that promote safe, sound and efficient practices by financial intermediaries. |

| The Securities and Exchange Commision | SEC was established to ensure the capital market Is being regulated. Responsible for registration of businesses and the regulation of public companies’ securities.

Main aim of the SEC is to maintain rationality with operations in the capital market. |

| The National Insurance Commission (NAICOM) | NAICOM is established to act as a government advisor on all insurance related issues. Ensure insurance policy-holders and beneficiaries and third parties insurance are al; protected. Guarantee adequate protection of government assets and other properties. |

There is a lack of clarity in the regulation of Nigeria’s capital markets, as stated by the chairman of the SEC committee, Oladotun Sulaiman, the Nigerian Stock Exchange is seen as an independent entity that is not under the SEC authority and therefore is not subject to their rules and regulation. Director of SEC, Arunma Oteh, articulates that as a result of this weak governance, the capital market suffers from improper behaviours such as insider trading and share price manipulation which deeply affects investors. The lack of transparency in the market due to weak market regulation creates an incentive for individuals who bend the rules to continue partaking in improper behaviour.

The regulation of the market can be strengthened through reorganising and restructuring the regulatory bodies internally, which will strengthen the reviewing, monitoring, compliance and enforcement capacity of the regulatory bodies. Strengthening the regulation of the market and making it more efficient, transparent and fair will ensure that there is rationality in the market which reduces systemic risk therefore restoring the faith of investors and making investing in the market more attractive for foreign and local investors again. Strong market regulation will also make regulatory bodies be able to evolve with the changes in Nigeria’s growing economy.

2.3 Market stabilising institutions

Market stabilising institutions are institutions that minimise macroeconomic volatility and prevent financial crises (Rodrik and Subramanian 2003). Market stabilising institutions are monetary and fiscal policies and foreign exchange regimes, collectively these institutions are necessary for the promotion of long-term economic growth. The recession Nigeria just came out of in 2016, highlighted that their market stabilising institutions are weak. The Central Bank of Nigeria is responsible for the stabilisation of the market as they implement monetary and fiscal measures.

Market imperfections and economic institutions playing a central role in the development of a country has always been seen as an important thought in the academic literature on development economics since the beginning. Banerjee and Newman (1993), and Galor and Ziera (1993) create models of how imperfect markets can impede growth and development.

Nigeria’s market volatility highlights its weak market stabilising institutions. Institutions are considered as weak when central banks are unable to protect their independence and pursue political goals and help assist governments reach these goals rather than focusing on things such as GDP growth, economic stability etc.

John Maynard Keynes recommends fiscal policy by stimulating aggregate demand which will reduce unemployment and also lead to a decline in inflation. Fiscal policy aims to stabilise the economy, increases in government spending or a reduction in taxes will pull the economy out of a recession and a reduction in spending or increased taxes slows down a boom. Whereas monetary policy regulates the money supply through manipulating the interest rates to make borrowing easier and cheaper or more difficult and costly depending on the economic condition. Ajisafe and Folorunsho state that fiscal and monetary policies “have not been sufficiently or adequately used in Nigeria”. It’s been argued that Nigeria entered a recession in 2016 due to their inability to swiftly stimulate the economy in order to prevent a recession happening.

However, Monetary and fiscal policies were used by the Central Bank to bring Nigeria out of the recession.

Through improving the foreign exchange supply and lowering foreign exchange rates which lead to a reduction in inflation from 18.72% in January 2016 to 16.10% first half of 2017 (Cowry Assets Management). This led to an improvement in the confidence levels of investors which served as a key catalyst in getting Nigeria out of the recession. The monetary and fiscal authorities prioritised the manufacturing and agricultural sectors as parts of their efforts to diversify the economy because Nigeria is too dependent on oil exports.

Businesses have become more optimistic, the business confidence report states that at Q2 2017 confidence was at -1.5 points and by Q3 2017 was at 47.5 points.

What do economic people say about market stabilising institutions

Expand on fiscal and monetary policy- specifics

Fiscal policy- automatic stabilizers- government spending or taxation that take place without any deliberate government control to dampen the business cycle.

Discretionary fiscal policies are government spending and taxation actions that have been deliberately taken to achieve specified macroeconomic goals

With effective market stabilising institutions in place Nigeria would have been able to avoid the recession. However, these institutions are helping Nigeria get out of the recession with a growth rate of 1.4% in the last quarter of 2017(National Bureau of Statistics) and the IMF predict their 2018 growth to be 2.1% and World bank predicts 2.5% but with stronger institutions, this percentage will be much higher.

The CBN need to be granted full autonomy so they can operate in line with current global trends and for the public rather than the government especially with so much corruption in government- check if CBN is autonomous

Market stabilising institutions reduce uncertainty and encourage investment and other productive long-term behaviours

2.4 Market legitimising institutions

Problems of adverse selection

Rodrik and Subramanian define market legitimising institutions as institutions who provide social protection and insurance, as well as, redistribute income and manage conflict. This institution is also regarded as an important institution required for economic development. These institutions are

Market legitimising institutions make the market more compatible with social stability and cohesion (Rodrik 2000). Which in turn leads to the markets reaching their social optimal.

Employment insurance schemes

Social funds:

the low education level of poor countries is caused due to economic institutions failing to create incentives for a parent to educate their children and by political institutions failing to incite governments to build, finance and support schools, parents, and children. Many children are stuck with the ultimatum of having to choose between going to school or providing for their family. EXPAND on Nigeria education, compare it to South Africa.

Universities in Nigeria are also costly and the government does not offer student loans if students are to obtain student loans they will have to get a loan from banks or an agency with high-interest rates. An increase in university students could make a huge impact on Nigeria making Nigeria much more competitive with other countries.

Political institutions- a form of government- Nigeria a “democracy”, the extent of constraints on politicians and political elites.

With weak political institutions, those who are relatively rich to others would push political and economic agendas that are only in their favour.

Political parties and the commitment problem

Acemoglu et al state that Political parties that put checks on those that hold power and create a balance of power in society are useful for the emergence of good economic institutions. This allows for an economic institution to benefit the whole country rather than those in power to fulfill their needs only.

Glaesar et al (2000) suggest that investing in human and social capital leads to economic growth which improves political institutions, creates a more stable and peaceful country which therefore enables Nigeria to develop economically as property rights are protected

2.5 Institutions of conflict management

Befra & the government

Conflict in the north which created problems for oil in the niger delta.

Judicial – legal system and access to justice and time and police enforcement

Managing conflict

Political – There are issues with the credibility of elections and there is a lack of political will to bring in qualified personnel to run the government as many government officials are in their position due to nepotism and cronyism.

Political institutions fail Nigeria by focusing on retaining their power rather than improving the efficiency of political institutions. Political institutions play a role in the creation of economic institutions and sometimes these economics institutions may not be designed to maximise economic growth

Social conflict arises when only a selective group or individuals benefit from the economy etc

Social conflict: institutions chosen for their distributional consequences by groups with political power

Importance of political power: the power to impose or secure social choices against the wishes of other groups

Political party creates commitment problems

- Governments can go back on their word after investments are made. Political power cannot commit to refrain from the hold-up problem

Political power has an impact on economic institutions as economic institutions are a result of those with political power making decisions for their own benefit rather than the public hence why political institutions are very important because it must make sure the majority are also at favour.

Acemoglu et al. state that better institutions are more likely to emerge when there are constraints on political elites.

Political institutions govern the distribution of political power and regulate its use. By improving market legitimising institutions as it has an influence on economic institutions, this would lead to better economic decisions being made which will be beneficial for the whole country.

Nigeria has problems of Oligarchy where the rich dominate politics- it may generate investment because the rich will have incentives to protect their own property rights. Which creates a non-level playing field and potential hold-up problem because power is monopolised by the rich.- more efficient producers do not enter and invest enough. Which highlights that there’s need for institutional reform

Find Out How UKEssays.com Can Help You!

Our academic experts are ready and waiting to assist with any writing project you may have. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs.

View our academic writing services

Weak law enforcement that fails to protect citizens and protect society; Nigeria was reported to have the worst police force in 2016 by WISPI. Nigeria is ranked on the corruption index as 136th with a score of 28 in 2016, which highlights that Nigeria faces a huge transparency problem. Institutions have become weak due to the ineffectiveness of responsible authorities to enforce laws holding people accountable for their actions.

2.5 Case study: What Can Nigeria Learn from Other Countries Economic Development

Nigeria can benefit a lot from the likes of its peers, countries that were on a similar level as Nigeria when Nigeria was classed as a future prospect. Countries similar to China, North and South Korea, Singapore, India which is at a similar level of per-capita income as Nigeria.

India’s high-quality market creating institutions has allowed India to benefit hugely from R&D and benefit as a knowledge economy. Having a strong market creating institution that provides an incentive to invest and innovate will benefit Nigeria as much as it benefited India. It has allowed India to be a knowledge hub for Multinational Corporations especially pharmaceutical corporations to carry out extensive R&D which has allowed a growing skilled and educated workforce as well as reduced their unemployment. Likewise, with Singapore, the government created a statutory board called the Intellectual Property Office of Singapore (IPOS) that regulates an entire range of intellectual property legislation which promotes great amounts of intellectual property creation, protection and minimises exploitation. Nigeria has the Nigerian Copyright Commission (NCC) and IPON however, they need to strengthen it to a similar level as these countries because it’s been highlighted that property rights aren’t well protected in Nigeria.

Acemoglu argues that countries differ in their economic success because of their different institutions, the rules influencing how the economy works and the incentives that motivate people to innovate and invest. He supports his argument by comparing the two neighbouring countries, North and South Korea and highlighting the difference in economic activity. Inclusive economic institutions such as those in South Korea and the United States are the institutions that allow and encourage participation of the mass people in the economy to make the best use of their talents and skills. Nigeria does not have inclusive economic institutions, as it does not provide a level playing field where people can exchange and contract.

Inclusive economic institutions also pave the way for two other engines of prosperity: technology and education. Sustained economic growth is always followed by technological advancements that enable people, land and existing capital to be more productive. This process is made possible by economic institutions that encourage private property, uphold contracts, create a level playing field, and encourage and allow the entry of new businesses.

Singapore leader Lee Kwan Yew and his team eradicated corruption and turned things around. They benefited greatly from the British legacy as the British had already built up a set of institutions, not greatly built but institutions were already in place (LIKE NIGERIA?) leader built upon the institutions. Nigeria or China did not have good colonial legacies to build on (RESEARCH MORE UPON), they were left with corruption, weak property rights, and various other problems. This was because extractive institutions that supported the removal of economic resources from the country to the colonial power were implemented. The quality of a country’s institutions introduced by European colonisers tended to be lasting or exploitative depending on the suitability of the country for European settlement (Acemoglu et al 2001).

3 Research Methodology

As this paper is a grand literature review the most appropriate method of research will be in-depth qualitative research, contrasting the opinions of different economic institution authors. This dissertation will include descriptive material from many interviews, newspaper articles, economic books and also data from Nigeria’s National Bureau of Statistics. Examining what other economists and policymakers believe and eventually coming to a conclusion with my own personal opinion and recommendation.

A grand literature review is suitable to assess whether weak institutions are to responsible for Nigeria not reaching its full economic potential. This research is important as Nigeria’s economy is declining and this research could potentially help aid their recovery.

The research methodology will be a applied research as this research project aims to solve the problem of Nigeria’s weak institutions and find solutions through applying research found for example applying what works for other countries to Nigeria.

Qualitative research will be most suitable for this research project compared to quantitative research however quantitative research will be used

The research design would be exploratory research as this project aims to gain an insight and understanding into the role of institutions concerning Nigeria. It does not test a hypothesis, however, aims to get a better understanding of why Nigeria is not reaching its economic potential. The research project will not be able to offer final or conclusive answers but will be able to form recommendations to improve the problem Nigeria faces.

Research philosophy- critical realism

Limitations

Some data were as old as 2010 and data would have changed by then which restricts its accuracy

Limitations of it being a literature review

Limitations of secondary data/ research

Ethical issues- can data from Nigerian government be trusted.

Quality of institutions are typically measured by survey-based perceptions (Rodrik, 2004) however with a lack of resources and not being in Nigeria made it very difficult to do hence why it’s a literature review, using the results gathered from different research studies by economist scholars such as Rodrik, Acemoglu, Johnson, and Robinson. However, specific research done to Nigeria would have made this research project much clearer…

4 Conclusion

Bad institutional problems lead to bad performance-

They lead to:

Weak property rights enforcement

Nonlevel playing field (unequal opportunities)- greater inequality

Political instability as different groups fight to take control of the state

Worse macroeconomic policies, budget deficit, high inflation

Bad institutions create instability

Bad institutions create bad incentives

There are other factors to why countries don’t reach their full potential such as geography eg climate, infectious diseases in hotter climate be so excessive that the body there will be absolute without strength”.

Malaria kills millions of children every year in sub-Saharan Africa which reduces the annual growth rate of sub-Saharan Africa economies by more than 1.3% a year, Montesquieu “the heat of the climate can.

Culture- Landes (1998), argued that the origins of the western economic dominance are due to a particular set of beliefs about the world and how it can be transformed by human endeavor, which is linked to religious beliefs. Culture is the key determinant of values, preferences, and beliefs of individuals and societies and these difference play a key role in economic development. However, culture can’t be applied when trying to understand the Korean divergence however, Nigeria is in a good position as isn’t landlocked which highlights that institutions are mostly responsible.

As stated by Acemoglu et al, there’s a hierarchy of institutions some institutions are more important and more essential for economic development but they all have to work well collectively for Nigeria to reach its full potential as just one could hold Nigeria back.

The literature on Nigeria’s institutions and the importance of institutions in economic development indicates that these institutions have a significant role to play in economic development.

Nigeria’s weak institutions create an environment that reduces motivation and productivity.

Those in power might be against implementing inclusive institutions, as there are economic losers and political losers. There are economic losers for example due to the changes in institutions monopolies income will reduce as new startups will be entering the market. There will also be political losers as some will lose their politically privileged position, (Acemoglu 2012). Multinational corporations take advantage of their power in developing countries and in some sense have more power than appointed politicians. Stronger institutions will significantly reduce the power of MNCs as markets will become more competitive. Hence why it can be argued that particular political losers are a major barrier against the emergence of inclusive institutions and economic growth (Acemoglu 2012).

One size fits all argument

Nigeria is at the “factor-driven” stage of development, according to Michael Porter’s stages of national competitive development. Developing countries at this stage tend to rely mainly on things such as natural resources and unskilled labor, while seeking to move to the “investment-driven” stage, where the transfer of technology and investment in human and physical capital allows them to prepare the ground for the “innovation” stage—the knowledge-driven economy (Porter 1991).

Areas for further research;

What roles does MNC’s play in Nigeria’s economy

Das and Quirk state that market creating institutions and market stabilising institutions are the most important in fostering economic growth and there is evidence that suggests market legitimising institutions such as democracy are not necessarily optimal for growth in poor countries, however, there are also other market legitimising institutions that are necessary for economic growth and development

5 Recommendations

How each of these institutions can be improved

The problem with fixing weak institutions is the chicken and egg problem, “Do you change your institutions first or Do you become an economically developed country first?” Yeun Yeun Ang argues that we have been getting this whole debate wrong; development is not one big arrow that goes one way, which is true. The resolution to weak institutions is making use of the existing institutions Nigeria has to stimulate market activities and further down the road institutions will strengthen as seen in countries like the US for example. Policymakers and businesses must learn to use Nigeria’s existing weak institutions to kick-start development.

Many say education is the best cure but how it impossible to educate people to reform institutions when the educational institution itself is weak. Nigeria needs to increase its social capital as that contributes to economic growth significantly. It makes it easier to create new knowledge and transmit ideas and information (Grafton, Kompas and Owen 2003)

Nigeria needs a new way of thinking. The Neoclassical way of thinking has failed. The free market argument does not work in Nigeria mainly due to the fact that because people are self-seeking, they only do things to benefit themselves leaving the majority in a bad position hence why the government needs to intervene to fix this market failure; the misallocation of resources and the income inequality. Governments need to play a heavier role and not leaving it to the free market to fix errors. (GOOGLE NIGERIA ECONOMIC BELIEF/IDEOLOGY). Out-dated policies.

The government needs to understand that it is time to focus on the creative professionals like painters, musicians, writers, artists. Creative professionals also include marketing, strategy, scientific research and development, product development, engineering. In the UK 2million of the population are employed in the creative industry (DCMS Sector Estimates: Employment & Trade, July 2017) and in 2015/16 led to 558 foreign direct investment (Inward Investment Report, September 2016). This shows that Nigeria improving the creative industry will lead to a great influx of foreign direct investment. The economy needs to diversify and move away from Oil & Gas, Technology, Telecoms, Financial services.

Need to implement market creating institutions like….

Society needs to be fixed before the economy, formal institutions get stronger as informal institutions strengthen.

Corruption is very hard to get rid of simply by implementing anti-corruption agencies and transparency accountability reforms. Nigeria’s economy can grow simple through increasing trust. Low trust discourages innovation in society (Knack & Keefer, 1997). Increasing trust will reduce the monitoring costs. Nigerians have to work to break the stigma of being known as scammers and break away from the term ‘419’. This will shape future attitudes towards investing into the Nigerian economy as there are less risk and less uncertainty.

Institutional change has to be made slowly to ensure that the system created is compatible with social institutions and to ensure that it can effectively be enforced (Aron 2000)

Nigeria’s president Buhari highlighted Some factors hindering good standards in Nigeria’s education is the misconception of what educational institutions should be like, attitudes of workers and staff which may be due to poor remuneration. This leads to workers having to find alternative sources of income which may be legal or illegal, ethical or unethical because some owners or particular government agencies do not pay monthly salaries to their staff when due.

As stressed by Odugbemi (This day 2018), universities need to be properly funded in order for them to have a solid infrastructure that attracts and retains good and great staff and also pushes out meaningful research findings

Need to diversify the economy

Many people need to follow the lead of Bosun Tunaji, the chief executive of Co-Creation Hub an incubator for businesses and social enterprises in Yaba. If Nigeria has more incubators in different states not just certain areas, there will be a lot of economic growth due to a rise of startups and newer innovations making Nigeria much more competitive. Many of these ideas are also very beneficially to the public for example ‘Wecyclers’ is an idea evolved through the incubator. Wecyclers helps the people of Lagos to make money by recycling using cargo bikes. The younger generation is very creative and have a lot of ideas but with a lack of finances, knowledge and weak institutions. They are unable to prosper. An improvement of this will lead to a diversified economy which Nigeria needs.

Growth requires Identify growth sectors- meet pressing problems such as… poverty, lack of education,

Very targeted interventions and targeted capabilities to keep social fabric together whilst growing are continuing.

Develop the critical property rights and policies required for growth- relate to Nigeria

As corruption is structural deeply embedded like China did identify most damaging parts of corruption (FIND OUT NIGERIA- expropriation)

China had hard policy on getting rid of the corruption damaging their economy (FIND OUT relating Nigeria)

It is more practical, stops from hopes being raised which will just lead to frustration and despair- should set targets that are not achievable

In conclusion leading to sustained growth that reduces poverty, fights the most damaging parts of corruption, and will allow Nigeria to start to move closer to its expected potential.

Nigerian economy very imports dependent

Nigeria has earned huge sums of money which appears to have largely gone down the sinkhole created by corruption

Nigerian government introduced whistleblowing to improve transparency

Nigerian government social investment program & currently 5.2 million primary school children in 28,249 schools in 19 states are being fed daily, & 200,000 unemployed graduates were enlisted into the N-power Job Scheme.

Acemoglu et al state that using political power to change political institutions is a useful strategy to make gains more durable, changing the political institutions from inside for the present and future.

References

“Nigeria suffered a full year of negative growth” [Online] https://www.theatlas.com/charts/ByJhM-79x

Ismail Radwan Giulia Pellegrini 2010(World Bank). “Knowledge, Power, and Innovation in Nigeria,” [Online] http://siteresources.worldbank.org/EDUCATION/Resources/278200-1099079877269/Knowledge_productivity_innovation_Nigeria.pdf

17:33, 11 February 2018

Banking regulation in Nigeria: overview, Practical Law Country Q&A

nigeria transparency ranking [online]

https://www.transparency.org/country/NGA

Oteh A, “A Roadmap for Transforming the Nigerian Capital Markets’, [online], https://www.proshareng.com/report/Regulators/A-Roadmap-for-Transforming-the-Nigerian-Capital-Markets—Ms-Arunma-Oteh/2483 Accessed 11, February 2018

Sulaiman O, “Regulating Nigeria’s Capital Market: Roadmap For The Future’ [Online],

https://www.proshareng.com/news/Capital-Market/Regulating-Nigeria-s-Capital-Market–Road-Map-For-The-Future/6181 Accessed 11, February 2018

Rodrik D and Subramanian A, “The Primacy of Institutions” https://www.imf.org/external/pubs/ft/fandd/2003/06/pdf/rodrik.pdf

World Bank “Global Economic Prospects: Sub-Saharan Africa” http://www.worldbank.org/en/region/afr/brief/global-economic-prospects-sub-saharan-africa-2018

Carvalho L, 2017 “Nigeria GDP Annual Growth Rate”

https://tradingeconomics.com/nigeria/gdp-growth-annual

Glaeser et al “Do Institutions Cause Growth” [online]

http://www.nber.org/papers/w10568.pdf

Acemoglu D et al “Institutions as a fundamental cause of long-run growth” [Online]

https://economics.mit.edu/files/4469

Ernst and Young ‘EY’S Attractiveness Program Africa@ HTTP://www.ey.com/Publication/vwLUAssets/ey-attractiveness-program-Africa-2017-connectivity-redefined/$FILE/ey-attractiveness-program-africa-2017-connectivity-redefined.pdf

Alolade S, “Doing Corporate Business In Nigeria: The Role Of Regulatory Bodies”, [online] http://www.thelawyerschronicle.com/doing-corporate-business-in-nigeria-the-role-of-regulatory-bodies/

Cite This Work

To export a reference to this article please select a referencing style below: