How should developing countries finance university education? Explain your answer with cross reference to developed country experiences of financing University Education.

Word Count: 4023

1. Introduction

Education, its nature, purpose, its provision, and most importantly, its funding, are major topics of cultural and ideological debates which remain a central point of concern even today. Till the 1980s, the social democratic consensus, in England and New Zealand for example, considered education to be a public good, and therefore an indispensable service, provided by the state, to all citizens equally, without direct charge. The New Zealand Treasure writers’, for example, argue that education doesn’t belong to the marketplace. It should be considered a ‘Natural Sphere’ and a public good which needs state intervention (The New Zealand Treasury, 1987). However, New-Right arguments of the 1980s challenged this school of thought, asserting education is a commodity which should be left to the market forces with minimum state intervention (Grace, 1994). Barr (1993), for example, asserts education is not a public good since it does not exhibit the three reflections of public goods: non-rivalness, non-excludability and non-rejection (Barr, 1993). This lead to the dilemma of financing higher education: How should countries finance higher education?

Get Help With Your Essay

If you need assistance with writing your essay, our professional essay writing service is here to help!

This essay begins with a theoretical framework, looking at the human capital theory to understand why education is important followed by a brief discussion on the key issues concerning financing higher education to understand why cost sharing has become a popular phenomenon over the years. Major alternatives to state financing are discussed using examples from different countries followed by a conclusion and a brief policy recommendation.

2. Theoretical Framework

2.1 Human Capital Theory

Education is considered to be, both, a consumer and capital good (Okemakinde, 2008), because not only does it offer utility to a consumer, but also acts as input towards the production of other goods and services. It is, therefore, also considered to be highly effective and even necessary, to bring about an improvement in the production capacity of a country. (Okemakinde, 2008)

With the increase in economic development and structural change the requirement for skilled workers is increasing across all economies, resulting in an increasing demand for employees with higher education ( Department of Education and Training, 2015).

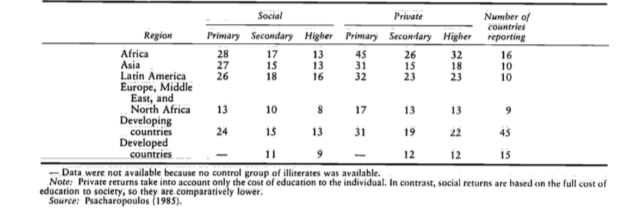

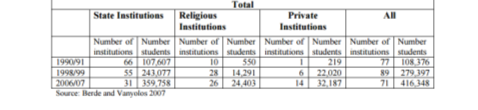

Authors including Okemakinde (2008 ) and Psacharopoulos (1986) consider formal education to be an investment in human capital (table 1). The human capital theory, thus, encourages investment in education both in developing and developed countries (I. Fägerlind, 2002).

Figure 1 Returns to investment in education by country type and level (Psacharopoulos, 1986)

Education and development policies have largely been based on the theoretical framework of the Human Capital Theory, which stresses on the high returns of education, in terms of productivity and efficiency of workers, and eventually economic development (Ozturk, 2001).

2.2 State funding and the need for alternatives

Countries with socio-political ideologies consider education to be a public good and, consequently, should be free or considerably subsidised. This ideology claims the society to be the major beneficiary of higher education and asserts substantial taxes can be raised, progressive in nature, if there is political will and proper leadership. Such taxes will cover costs of education, allowing students, especially among the poor, to have equal access to education (Johnstone, 2003).

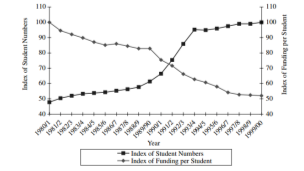

Previously, higher education in most developing countries was predominantly financed and provided by the government (Psacharopoulos, 1986), such as majority of Sub-Saharan Africa (Teferra, 2013) (McGavin, 1991), India (Tilak, 1995) and China (Cheng, 1995). However, Psacharopoulos (1986) argues such a system lacks sustainability, efficiency and quality. In fact, till the 1960s most universities in the UK were funded by the state. As seen in figure 2, the shift away from public funding has increased the participation rate in higher education in the UK (Haynes, 2003).

Figure 2 Index of student numbers and public funding for higher education, 1980/1-1999/2000 (Haynes, 2003)

A dominant theme of higher education throughout the world in the 1990s has been financial distress (Johnstone, 1998). The upsurge in the demand for financing higher education (Johnstone, 2003), coupled with constrained public budgets, has been a major challenge faced by governments in both, developing as well as developed countries (Woodhall 2007, Akpochafo 2009). However, as the number of students enrolled in higher education increased, the subsidies introduced when enrollments were low proved to be unsustainable (Woodhall, 2007).

According to Woodhall (2007), with the expansion of higher education systems and the difficulty addressing the costs of higher education through public expenditure, the last twenty years have seen major changes in how higher education has been financed worldwide. These include; an introduction of tuition fees in countries where higher education was free, a substantial increase in tuition fees and a shift towards student loans (Woodhall, 2007).

Therefore, parallel systems of financial assistance and cost sharing have been introduced so that students and parents aren’t burdened by the cost of university education and equality and accessibility isn’t compromised (Johnstone, 1998).

3. Alternative Methods of Financing Higher Education

3.1 Tuition fees, selective scholarships and grants

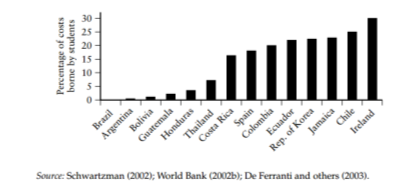

Most developed countries shifted costs of education from taxpayers to students, in the form of tuition fees, decades ago. Tuition and fees in public and private universities have established in the US for a long time (Johnstone, 1998).The tuition fees for UK full-time undergraduates at a university in the UK were paid from public funds until 1998, when tuition fee was introduced (Barr, 1998). This trend is now being followed by developing countries as well (Johnstone 1998, Salmi 1998, Hans de Wit 2005). Chile, Colombia, Costa Rica, Ecuador, and Jamaica have higher levels of student financing, similar to those seen in Ireland, the Republic of Korea, and Spain. (Hans de Wit, 2005)

Figure 3 cost recovery at public universities in Latin America and the Caribbean (Hans de Wit, 2005)

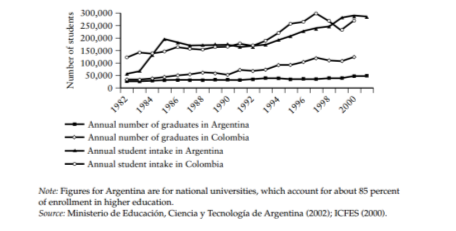

In countries like as Bolivia, Guatemala and Thailand, cost recovery is low, or nonexistent like Brazil and Argentina, as seen in figure 3. It is important to note the drop-out rates in these countries. According to Hans De Wit (2005), the annual number of graduates in Columbia has risen over time as opposed to Argentina, where education is publically funded and drop-out rate is higher (figure 4).

Figure 4 annual number of students admitted to and graduated universities in Argentina and Columbia, 1982-2001 (Hans de Wit, 2005)

Johnstone (1998) notes higher education in Hungary faced problems like inefficiency, inequality and lack of responsiveness to the market economy. The public sector was financing higher education, spending 86% per capita GDP on higher education in 1993 alone. This, compared to 45% in OECD countries and 30% in Germany, is a considerably high amount. As a result, the need for a shift in cost burden was felt. In 1995 full-time students paid a monthly tuition fee of HUF 2000 in public universities, while part-time students paid up to HUF 8000 per month. In order to ensure equality in access, tuition fee was fully or partially waived, based on academic merit or financial need, for one-fifth of the students (Johnstone, 1998).

Figure 5 Higher education in Hungary, 1990/91 versus 2006/07 (Marcucci, 2008)

The state support per student was 40 % lower in 1998 than it had been in 1990. Reforms in 2005 recommend state funding for at least 35% of graduate students and 10% for doctoral students and in 2007 the Ministry of Education allotted 60% of its scholarship funds to merit based students and 35-40% to students in need of financial aid (Marcucci, 2008). This shift of the cost burden away from the government resulted in an increase in overall participation rate in Hungary (figure 5).

According to Rosovsky (2001), during the 1990s, Makerere University in Uganda moved from a situation where the government covered all running costs and students did not pay for education to one where more than 70 % of the students paid, resulting in twice the amount of student enrolment and development of infrastructure.

While imposing tuition fee is considered to shift the burden of financing higher education away from the government, it is argued that tuition fees or increasing it at a rapid rate might exclude potential students from disadvantaged families. (Johnstone, 2003), thus compromising on the access and equity of university education.

3.2 Loans and deferred payment schemes

Financial aid such as loans, means-tested grants and selective scholarships are being introduced to preserve equity and access to university education (Psacharopoulos 1986, Johnstone 1998). Comparing grants and scholarships to loans and other types of deferred payments, the latter tends to relieve the burden of the cost of higher education on the government and raise the university’s revenue. Loans are also more likely to encourage the involvement of market forces, thus leading to efficiency and increased responsiveness of the university (Johnstone, 2003). Furthermore, the problem of exclusion associated with rising tuition fees can be met with the availability of loans and deferred payment schemes that don’t consider the financial worth of students and their families (Johnstone, 2003).

Student loans in Hungary, sponsored and guaranteed by the government, were introduced by a student loan company owned by the Hungarian State, Diákhitel Központ, in 2001 (Marcucci, 2008). These loans cover tuition fees and living costs, are not means-tested and are available to all students enrolled in public and private higher education institutions in Hungary or the European Economic Area (ibid), thus ensuring equity and access.

Other forms of deferred payments, where students bear a certain share of the cost burden and repay the amount gradually, once they have been employed, are also an alternative to recovering expenses. (Johnstone 1998, 2003). Examples of such payment schemes are graduate taxes, a concept never fully adopted (Barr, 1998), the ‘income surtax’ implemented in Australia (Johnstone, 1998, 2003), and the ‘drawdown’ pension payment system implemented to repay the student loan fund in Ghana (Johnstone, 2003).

In the graduate tax system, the current cost burden incurred by the government for the support of education is not immediately relieved. However, over time, future income surtax payments, which are collectively (potentially) sizeable, albeit highly uncertain, shift the ultimate financial burden away from the government (Johnstone, 1998). In this system, students incur low or no tuition and living costs. However, once they start earning they have to pay more income tax than they would have otherwise (ibid). The more one earns the more one pays back, thus argued to be progressive in nature and believed to prevent high debt rates among graduate students (BBC, 2010).

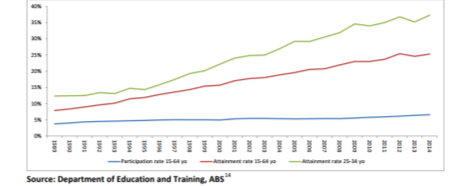

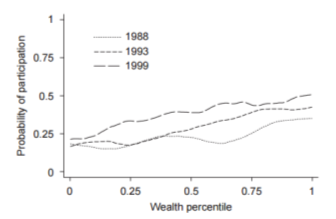

The Australian Higher Education Contribution Scheme launched in 1998 provided income contingent loans through the Higher Education Loan Programme to help students pay their tuition fee (Johnstone, 1998). Students start repaying the debt once their income is above a certain amount ($54,126 in 2015-2016). The amount is readjusted on a yearly basis to reflect any changes in Consumer Price Index, thus maintaining the real value of the debt. Participation levels of domestic students in higher education have increased from 3.7% of the population between the ages of 15 to 64 in 1989 to 6.6% in 2014 ( Department of Education and Training, 2015). Figure 6 and 7 show a sharp increase in participation of students after income contingent loans, or graduate taxes, were introduced.

Figure 6 Domestic higher education participation and bachelor or higher attainment 1989-2014 ( Department of Education and Training, 2015)

Figure 7 University participation by SES: 1988-99 persons (Chapman, 2005)

However, such schemes are also critiqued to be inefficient and politically costly (Johnstone, 2003). High earners might choose to work out of the country to avoid the graduate tax. Not only will this result in tax being evaded but also may lead to a “brain drain” (BBC, 2010). Other than student emigration, payments are often lost due to high defaults and lack of tax records. As Johnstone (1998) notes, applicability of graduate tax to developing countries depends on the degree to which the income tax system can be trusted. Additionally high costs associated with servicing and collecting make such schemes a less attractive option (Johnstone, 2003).

According to Psacharopoulos (1986), loans encourage expenditure on education. If the returns to investment in university education are high, loans will help students invest in education, or human capital, consequently increasing the demand for higher education and the flow of private resources into the sector (Psacharopoulos, 1986).

However, problems associated with lending loans, such as high collection costs and substantial cases of evasion, have discouraged the development of effective schemes for financing higher education in developing countries. Private banks find the risks and costs of lending too large to incur without charging a prohibitive interest rate, resulting in the governments providing or funding loan programs for students (Psacharopoulos, 1986). Repayment, especially in developing countries, is a major cause of concern associated with lending loans. According to Tilak (1995), only 5.9% of the investments made on student loan programmes in India during 1963-64 to 1987-88 were recovered. Furthermore, according to Johnstone (2003), the willingness to borrow and lend is important since students prefer their financial aid to be non-repayable

3.3 Expansion of private universities

Since most developing countries have a highly centralised education sector, stringent rules and barriers restrict the operation and contribution of community run and private institutions. Easing these controls and decentralising management will allow mobilisation of private and local resources in the education sector, reducing the fiscal burden on the government (Psacharopoulos, 1986). The lack of available places in state universities led to the establishment of private universities (Oyebade, 2008).

Romania had no private universities before 1989. Laws passed in 1990 resulted in the creation of 70 private institutions, almost all of them claiming university status and enrolling one-third of total enrolments in higher education (Johnstone, 1998).

In 1981 in Chile the number of private and public universities charging tuition fees increased. In 1990, 52.4% of the total enrolment was provided for by private universities with no funding from the state. The state, previously incurring all costs, financed only 27% in 1990. The increasing number of private universities helped meet the rising demand for university education, increased access to higher education and increased diversity, with no costs incurred by the government. However, this change also resulted in an increased tuition fee, falling quality and an uncontrolled rise in the number of private institutions (Johnstone, 1998).

Oyebade (2008) finds private universities in Nigeria have increased from 3 institutions in 1999 to 24 in 2006. However, Oyebade adds, the cost of private university education and the poverty level may lead to problems like lack of access and equity. With 90 million people living in absolute poverty in Nigeria, the enrolment of students in private universities is effected considerably. Only one of the seven universities operational in 2005, were fully enrolled and the remaining six, despite being functional for over six years, were not.

Private institutions are widely criticized for their lack of quality, as seen in Chile in 1990, and equity, as seen in Nigeria. Additionally, Johnstone (1998) adds, their sustainability is also questionable since their major source of revenue is tuition fees alone.

4. Entrepreneurial Activities

Another alternative to finance higher education is generating income through entrepreneurial activities such as selling services, contracting research and renting out facilities. Exploring new ways of generating revenue is a great way for universities to improve quality, be more innovative and increase their relevance in the society by providing services in response to the society’s needs (Hans de Wit, 2005).

Universities in Mexico began to realise the need for internal revenue generation since government support was not likely to grow, consequently, turning towards entrepreneurial activities, involving faculty and students to raise extra income. Different departments began to generate revenue by providing services and specialised courses (Johnstone, 1998).

According to Rena (2006), the University of Zambia and Eduardo Mondlane University in Mozambique have benefited from entrepreneurial activity in the form of improved capacity, information and revenue by establishing and linking internet nodes to local electronic networks and selling their subscriptions. Rena (2006) also adds Ghana and Nsukka’s initiatives of consulting activities have proven to be a successful entrepreneurial activity. Ghana claimed a profit of 9% on total revenue of US$22700 in 1991 by providing consultancies through their consultancy centre. Nsukka indicated a profit of US$35,238 through its consultancies between 1982 and 1991. With an income of US$90,398, the consultants received 50% of the profits while the university received 30% and the department received 20%.

In Makerere University in Uganda, where previously the government incurred all costs of education, recent entrepreneurial activity generated more than 30% of revenue (Rosovsky, 2001). Makerere has raised revenue through evening classes, commercially running their bookshop and bakery and establishing a consultancy bureau with staff where a portion of the generated revenue goes back into the university (ibid).

Universities in China generated income through university enterprises, commissioned training programs and educational services, research (Cheng, 1995) and consultancies and logistic services (World Bank, 1997). According to World Bank’s report (1997) revenue generated from universities contribute to around 3.7% of total higher education revenue in China. In Shanghai, 50 universities ran approximately 700 enterprises with the total revenue of Y 1 billion in 1992 alone. Fudan University’s entrepreneurial activities raised a total revenue of Y 20 million, out of which Y 2 million was invested back into the university (World Bank, 1997). Commissioned training, an effective way to earn additional revenue due to the rising demand for skill upgrading, was the second largest source of revenue, constituting around 2.3% of total higher education revenue. Provision of educational services added up to about 1.1% of the total revenue. For example, the Department of Law of Peking University generated revenue by providing short training courses on recently implemented laws to employees belonging to public and private organisations. Income from research and consultancy added up to 1.3% of the revenue in 1992. Income from research in 36 national universities added up to Y1.12 billion. Additionally, logistical services such as running dining halls and hostels, although not highly lucrative, constituted around 0.7% of the revenue (ibid).

Find Out How UKEssays.com Can Help You!

Our academic experts are ready and waiting to assist with any writing project you may have. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs.

View our academic writing services

According to Johnstone (1998), most risks associated with entrepreneurship in developing countries can be overcome by ensuring the activities are legalised and are supported with clear regulations and transparency and efficiency in management and procedures. Entrepreneurial activities, such as those carried out in China, Africa and Mexico, have not only benefitted the universities by raising extra revenue, but also benefitted the economy by increasing responsiveness to consumer needs.

5. Philanthropic:

Philanthropic activities and initiatives targeted towards higher education can build up funds for scholarships and grants in public and private universities. Although many cultures and societies have a strong tradition of charity, however, these contributions often ignore higher education since it is either considered a private good or the responsibility of the government (Johnstone, 2003)

The Aga Khan University and the Lahore University of Management Sciences, top ranking universities in Pakistan (HEC, 2016), are good examples of successful philanthropic initiatives, established and partly operated through private philanthropy (Rosovsky, 2001).

Donations made to educational institutes in china are either used as merit scholarships for students, for faculty training overseas or construction of university buildings bearing the name of the donor (World Bank, 1997).

However, most initiatives cannot depend on such financial generosity in developing countries (Rosovsky, 2001). Small provincial universities in underdeveloped, far-flung areas are rarely the recipients of such donations, augmenting the problem of rising disparity between universities and inequalities (World Bank, 1997).

6. Part-time employment for students

According to Johnstone (2003), many American students hold jobs that require 20 to 40 hours a week. The encouragement and financial support of the Federal Work-Study Program, which partially subsidises education, and an economy that has an abundance of summer and term-time, part-time employment opportunities, has allowed students in the US to finance their education to a great extent. However, for this to be possible, a robust economy with widespread availability to such low-paying but readily available jobs is necessary. This feature may be largely absent in many countries, especially in developing countries (ibid).

7. Distance learning

The trend of distance education has quickly spread across various countries including Bangladesh, China, India, Indonesia, Korea, Pakistan, Sri Lanka, the Philippines, and Thailand (Johnstone, 1998). China, for example, has a network of provincial universities, and a television university, for distance learning programs and education (Johnstone, 1998). After the 1986 National Policy on Education in India, open and distance universities became a means of overcoming the problem inequity and unmet demand for higher education (Tilak, 1995). Approximately 3 million part-time students and 4 million full-time students in India were enrolled in correspondence courses (Johnstone, 1998), which are considered to generate revenue much above the correspondence costs (Tilak, 1995). Distance education and open learning programs can be an effective way of increasing access to university education at moderate costs (Johnstone, 1998).

8. Policy recommendations and conclusion

Psacharopoulos (1986) posits generous scholarship schemes covering tuition costs and living expenses are not suitable in the long run because over time, as lower income students start to enrol in higher education, the cost of providing grants and scholarships will become a burden on the government.

An increase in the role of private actors in the provision of, and contribution to, higher education is a popular recommendation (Psacharopoulos 1986, Johnstone 1998). However, some oversight and regulation may be needed to ensure standards are maintained fraudulent operators are kept at bay. As Johnstone (1998) suggests, privatisation should be used as a tool to increase access to education, however, the government should continue to provide monitoring and regulation. Additionally, a greater role of private and community-run schools will encourage competition, eventually leading to higher efficiency and managerial accountability (Psacharopoulos, 1986). Furthermore, Oyebade (2008) stresses on the need for effective student aid programmes, like loan facilities that have a repayment system that is easily traceable, so that students are able to incur the costs of private university education.

Psacharopoulos (1986) emphasises on complementing the shift towards increased private financing with the provision student loans and limited selective scholarships, thus not compromising on access of education. Loans allow students to finance their current studies so that those with limited funds aren’t denied selection into higher education. Furthermore, to further avoid selection bias and ensure access, the Psacharopoulos (1986) suggests the use of selective scholarships granted on the basis of financial need and academic merit. This will not only provide students with an incentive to perform better but also ease the financial burden of students belonging to poor families, thus minimising inequalities in access to university education.

Johnstone (1998) suggests the introduction of private higher education supported through tuition fees, thus shifting the cost away from the government. He further suggests the introduction of loans and means-tested grants to ensure equity and access to higher education. Psacharopoulos (1986) recommends developing a credit market for higher education, where access to education can be augmented through widely available loans and deferred payment schemes. In countries where collection of loans poses a problem, an alternative being used is repayment in kind through national service (Psacharopoulos, 1986).

Educations institutions can raise significant income by offering various products and services such as training programs, marketing the expertise of faculty, carrying out laboratory tests, renting facilities, research and consultancies and centralised programs for teacher training (Rosovsky, 2001). In recent years, it has become possible and permissible for companies to pay for manpower supplied by higher education, for example commissioned training where employers pay a fee in return for a training course for their employees. Another means is rewarded allocation where institutions ask for a fee from the employers in return for the employment of a graduate. The fees being a compensation for the training cost of the manpower provided (Cheng, 1995). Policies encouraging such activities will not only generate additional revenue but encourage innovation and allow educational institutions to provide products and services the society needs.

Lastly, part-time and seasonal jobs should be encouraged through state policies and programs, such as the Federal Work-Study Program in the US. Part-time jobs should be readily available for students so that they are able to finance their studies. Additionally, this method not only shifts the cost burden of higher education away from the students’ families but also decreases the dependency of students on other means of financing such as state funding, loans, scholarships or grants.

References

Department of Education and Training, 2015. Higher Education in Australia.

Barr, N., 1993. The economics of the welfare state.

Barr, N. A., 1998. Economics of the Welfare State.

BBC, 2010. Tuition fees and graduate tax: What’s the difference?, s.l.: s.n.

Bruce Chapman, C. R., 2005. The access implications of income-contingent charges forhigher education: lessons from Australia.

Cheng, K.-m., 1995. A Chinese model of higher education? Lessons from reality. In: L. B. a. K. King, ed. Learning from Experience: Policy and Practice in Aid to Higher Education. s.l.:s.n.

Grace, G., 1994. Education is a Public Good: On the Need to Resist the Domination of Economic Science . In: Education and the Market Place. s.l.:Psychology Press.

Hans de Wit, I. C. J. J. G.-Á. a. J. K., 2005. Higher Education in Latin America: The International Dimension.

Haynes, D. G. a. M., 2003. Funding Higher Education in the UK: The Role of Fees and Loans.

HEC, 2016. 5 th Ranking of Pakistani Higher Education Institutions (HEIs) 2015.

I. Fägerlind, L. J. S., 2002. Education and National Development: A Comparative Perspective. s.l.:s.n.

Johnstone, B., 2003. Cost Sharing in Higher Education: Tuition, Financial Assistance, and Accessibility in a Comparative Perspective.

Johnstone, D. B., 1998. The Financing and Management of Higher Education: A Status Report on Worldwide Reforms.

Marcucci, M. S. a. P., 2008. Higher Education Finance and Cost-Sharing in Hungary.

McGavin, P. A., 1991. Reform in the Financing of Higher Education in Papua New Guinea.

Okemakinde, D. O. a. T., 2008. Human Capital Theory: Implications for Educational Development.

Oyebade, G. I. a. S., 2008. From Public University Dominance to Private University Policy Initiatives in Nigeria: The Push and Pull Factors.

Psacharopoulos, G., 1986. Financing Education in Developing Countries: An Exploration of Policy Options..

Rena, R., 2006. Higher Education in Africa – A Case of Eritrea.

Rosovsky, D. B. a. H., 2001. Higher education in developing countries: Peril and promise..

Salmi, J., 1998. Strategy for Higher Education Development in Latin America: Executive Summary..

Teferra, D., 2013. Funding Higher Education in Africa: State,Trends and Perspectives.

The New Zealand Treasury, 1987. Government Management: Brief to the Incoming Government 1987 Volume II Education Issues.

Tilak, J. B., 1995. Higher education in India at a cross-roads. In: L. B. a. K. King, ed. Learning from Experience: Policy and Practice in Aid to Higher Education. s.l.:s.n.

Woodhall, M., 2007. Funding Higher Education: The Contribution of Economic Thinking to Debate and Policy Development.

World Bank, 1997. China – Higher education reform. A World Bank country study..

Cite This Work

To export a reference to this article please select a referencing style below: