State Bank of India UK

Executive Summary

The report explores the broader Operations department teamwork aspects for the State Bank of India (SBIUK). The problems have been identified using the following tools of analysis: culture, motivation, power and identity. The firm leading loses of employee productivity and attrition ratio. In the SBIUK nominal staffs stayed more than two years due to personal circumstance. The total headcount in the department, including two Assistant Managers and eight members headed by Deputy Manager. The operations department turnover ratios were high due to the lack of benefit schemes, job satisfaction, motivation and culture. There has been a lack of cultural and collaborative integration between Assistant Manager and team members of the operations department.

Get Help With Your Essay

If you need assistance with writing your essay, our professional essay writing service is here to help!

The primary concern in the department about the Assistant Manager’s engagement toward team members and a low level of attitude showed by the Assistant Manager creates a damaging effect on the team members performance. Though, all the team member did not like her beliefs that were full of negativity. Each Assistant Manager has four directly report to them. Her responsibility was to run the day to day operations and manage the team.

Daily, she complained about her team members to another department which reflected her incapability to be a good leader. The assistant manager tended to Procrastinate her work resulting in a load of incomplete work. Not only this, when she was held accountable for the same, the assistant manager dared to blame other individuals in the organisation. In specific cases in which a complaint raised regarding non-recipient of payment, she never accepted her mistake or the fact that an error could have occurred. As employees regularly work hard to bring positive and development, harsh and uncooperative observations discourage them. Effects are added worse by the deficiency of concern displayed by the manager, and her point was right, and nobody questions her.

I observed the following findings:

Two stories:

(a) The Deputy Manager was on sick leave for one day and the assistant manager was second in command. That day, the team processed double payment of £860,000 which sent to Dubai based, the customer account debited twice for the same payment.

After a couple of days, the reconciliation team sent an outstanding list to operations and she was identified and not reported to deputy manager and she went holiday silently. Then- Chief Financial Officer called operations department Deputy Manager to ask the status of this incident. He was unaware of the incident because it was not reported to him from assistant manager. After that, Deputy Manager was contacted the beneficiary bank to return the funds to us and then reported to the Risk Department for the near-miss incident. The Management instructed to perform the independent investigation for this incident and she mentioned to the investigation officer this payment was processed based on Deputy Manager’s written approval. However, that day Deputy Manager was on sick leave and she was lying to an officer and unable to produce any written approval note to Management and investigation officer and then blamed the team members for the same.

(b) SBIUK was recruiting one apprentice under Apprenticeship Programme for the operations department, and the apprentice was supposed to be reporting to her. The person was new to the banking industry, and he wanted to learn the basics of the operations department. Standard practice sending e-mails to HR requesting for actions against small mistakes instead of escalating to line manager. Despite teaching the apprentice and supporting him, she continuously taunted him because of which the apprentice complained about her to HR and reported her actions under the bullying category. Then HR arranged a meeting with the Department Head, Assistant Manager, and the Tutor from apprenticeship agency. Her stand to sack him because he is not having banking experience. The Deputy Manager bring back to the department before meeting DM asked opinion from other members about him.

Usually, her target on everyone and she tried to play with all the member one by one through emotional sentiments. She was not ready to do accept her mistake or appraisal score.

Every time she fought with Deputy Manager and because she had support from bank senior management decision-maker.

Company background:

SBIUK Bank incorporated in the UK in 1925 and have branches in the UK targeted to cater banking needs of Indian communities living in London and Midland. At present they have 12 branches across the UK. The Bank is regulated and authorised by the UK and Indian Regulators the Bank’s offering liability and asset products to customers. SBIUK has the largest branch network across the region compared to other Indian Banks in the UK. SBIUK operations department 11 employees working out of 265 employees. The department notably different ethnic background. Last three years, much attrition in the Human Resource department because of power culture.

Critical Analysis

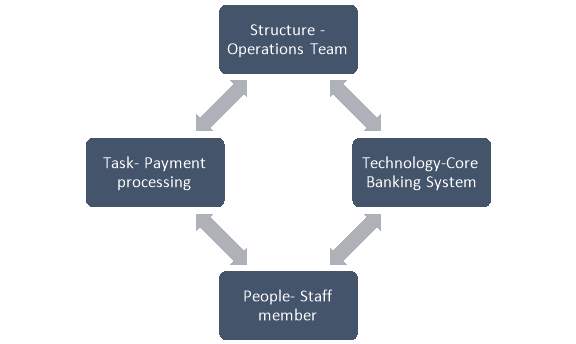

Structure Analysis: The Operations department of SBIUK is responsible for processing the payments on behalf of SBIUK corporate and retail banking customers.

Key Strength: Specialization leads to operational efficiencies because of their expertise in the payments area with core skills perform tasks quickly and efficient manner with less error ratio.

Fundamental Weakness: Communication with other departments in SBIUK it was inflexible because of team ways of operating and the high degree of personality issues because this makes the decision-making process slow and ineffective. The department was more bureaucratic; operations unit was often not accountable to each other, and poor horizontal coordination within the department. It was affecting company goals and employee’s motivation. The department was performing with a high level of efficiency. The level of cooperation with each other sometimes conceded. Such a group of the staff very difficult working well with each other as they may be territorial and unwilling to cooperate. The occurrence of infighting within the team caused delays, reduced commitment due to competing interests, and wasted time, making payment/process fall behind turnaround time. Ultimately brought down production levels.

Culture Analysis

The operations department consists of two major units and they have a different unique style of working and thinking process. The level of entry for this department is slightly different from other departments. The staff members belong from different ethnic backgrounds.

I believe that the SBIUK culture is currently missing in the organisation, from top to bottom, as they are not actively involved in encouraging the staff to come up with innovative new ideas aligned to values and overall objectives of the bank.

Top three weaknesses were identified including limited delegation of power to a low-level staff member, lack of clear vision about culture management and resistant stubbornness in own style of operations observed; all the affected the staff productivity and motivation factors.

|

Area of organizational culture |

SBIUK |

|

Mission and Goals |

The bank not carrying transparent communication between senior management and employees. The mission and vision statement not reflecting innovation and values shared by the board. |

|

Psychological contract |

The bank culture was problematic and some of the staff members, including HR team raised whistleblowing unfair practices and assorted variety issues were affected by the Human Resources policy and processed the fizzled workers. Some time management is expecting the operations department to work long hours but no recognition from the management. Last week of March 2018 around 250 payments for a value of £3 Million went wrong due to system implementation and The Operations team members put extra hours including bank holidays sort the issues quickly but She was not ready to put extra mile to achieve the result. |

|

Authority and Power |

The significance of authoritative culture has for some time perceived. Currently, an informal culture very much visible in the organisation. The formal power under Deputy Manager but she had informal power from senior manager because she knows a person was the central decision-maker. The senior management supposed to gather information and response based on MBF ‘Managing by Facts’ and MBB ‘Managing by Behaviour’ form the relevant department before taking any action or changes in the departmental level. |

|

Qualities of members should not have |

Core skilled employees are the heart of the department; any new process creation acts as the backbone for the project. The first bank should identify existing knowledge base- any new process implementing without formal intimations. The Operations department played double hating role while forming a subsidiary. The Deputy Manager managed a team with existing staff capacity without her because she went sick leave for three months. |

|

Rewards and punishments |

SBIUK does not have “The Key Performance Indicators and system-based appraisal reporting model.” The Operations Department including deputy manager worked long hours without any extra pay, rewards and additional staffs and She was not ready to work as a collaborative approach. The HR does not have any proper policy and procedures for employees and they are not ready to take any decision. Formal bonus and promotion process not in place |

|

Communications and Interactions pattern |

The Assistant Manager was not ready to discuss or take responsibility for communication with another department. Give away as little as she possibly can. Junior team members were so proactive to handle all the situation with the proper channel. The bank should carry transparent communication between senior management and employees. |

Motivation Theory X and Y

The Assistant Manager1 has been working in the operations team from last two years. She did not know anything about international remittance which was a part of her job description. She tended to suppress her team members and to pressurize them to complete the work without providing extra support to them but picking every small issue and playing with the way of emotional. I believe she fell under ‘theory X’.

The Assistant manager2 was working he was decent to support team members as on when required and positive feedback to staff members and he fall under ‘theory Y’.

|

Area |

Theory X-Assistant Manager1 |

Theory Y-Assistant Manager2 |

|

Attitude |

She disliked working and try to avoid everything. Very stubborn and try to create inter-group conflict. She was not ready to say hello to anyone and stayed in isolation mode. She does not have capabilities such as knowledge and skills to perform. |

Work as per team requirement |

|

Direction |

The Deputy Manager forced to take right effort or corrective action. No short- and long-term direction Not ready for improving efficiencies and encouraging the innovate ideas from the team. |

Well prepared for short term and long term directions |

|

Responsibility |

Avoid responsibly and accountability |

Accept and seek responsibly for betterment of the department. |

|

Motivation |

Lack of self-motivation and concentration. |

Self-motivated and long-term realization value. |

Herzberg’s Motivation- Hygiene Theory

I went the content theory of hygiene factor (Herzberg’s) for SBIUK and found a lot a factor for dissatisfaction to affect employee productivity and increase the attrition ratio.

|

Hygiene Factors / Enablers of dissatisfaction |

Motivators / Enablers of satisfaction. |

|

Policy: Fair & transparent policy and procedures not in place for Human Resource related matter as fundamentals expectation. |

Achievement: A job gives a minimal employee a sense of achievement because a focus on India based staff instead of local staff. |

|

Supervision: The majority of team leader performed micromanagement and no autonomy to team members. |

Recognition: The praise and recognition to limit choice for local staffs. |

|

Working Conditions: Majority processes are manual and team members were working without support from the Assistant Manager. Some of the days they worked long hours without Assistant Manager. |

The work itself: The Operations department work very fascinating, varied, and challenges |

|

Salary: A pay structure framework not in line with industry and there was no role-based salary structure in the Bank. |

Responsibility: All the team member other than Assistant Manager holding responsibility for the day to day work. |

|

Relations with peers: The India based staffs are always carrying Indian style of attuited and many times bullying and harassment. |

Advancement: Limited advancement potential for local employees |

|

Status: It has appeared a lack of equality in place in the department and company as well. |

Growth: The staffs can learn new skills through training and some sponsored training available to limited staffs with conditions. |

|

Personal Life: Sometimes, the staff needs a flexible working timing to fulfil the personal commitment and Assistant manager not ready to approve flexibility. |

Personality (Big five core dimensions of personality) – OCEAN

I evaluated the Assistant Manager by interviewing the respective team members to identify the issue. I told members this process was anonymous way and summary as follows:

|

Big five dimensions |

Results |

|

Openness |

Assistant Manager1: Less open to a new idea and inflexible and resistant to change. Assistant Manager2: Flexible and creative |

|

Conscientiousness |

Assistant Manager1: Irresponsible and undependable.

Assistant Manager2: He was dependable and self-discipline. |

|

Extroversion |

Assistant Manager1: She was mingling with a limited member from another department for talkative and sociable.

Assistant Manager2: He was very good with an outgoing, talkative and sociable with team members and other departments. |

|

Agreeableness |

Assistant Manager1: Unhelpful, short-tempered and unfriendly noncompliance Assistant Manager2: Pleasant, friendly compliance and adaptable. |

|

Neuroticism |

Assistant Manager1: She was having a high level of unfriendliness and Watchfulness. Assistant Manager2: He was a high level of emotional stability and clam. |

Post feedback from peers and the Deputy manager tried to swap the assistant manager job responsibility but no further improvement from the Assistant Manager1.

Power Analysis

Pluralist perspective, the Operations department is formed of several sub-teams with shared (success of SBIUK) and conflicting interests between two assistant managers.

|

Dimension |

Analysis of Operations |

|

Decision Making |

Both Assistant Managers have significant decision-making power. A power struggle between Assistant Managers and push for influence in decision making. |

|

Non-Decision Making |

Deputy Manager was leading the team; they able to control the decisions made and available for discussion by coverup evidence. |

|

Symbolic |

Deputy Manager relies on the authentic power provided by the management. Assistant Manager1 has informal symbolic power from the management based on personal relationship and standing in the SBIUK. |

|

System |

The Operations department has an accepted reputation and culture of uncontrolled issues in the department because legacy members working in the team for more than three decades. The SBIUK informed the department to straight-through process encourages a reduce for manual intervention and staff redundancy. |

Interpersonal sources of power theory

|

Source |

Analysis of Operations |

|

Reward |

Deputy Manager has the power to reward through salary raises and bonuses, praise, recognition, and promotion but to unable to exercise the fully because Assistant Manager1 tried to stop through a known source. |

|

Coercive |

Deputy Manager has challenged the compliance department and compulsory to follow their procedures for payments. She does not understand about company policy or procedures and go as per her style of operations. |

|

Expert |

Deputy Manager and team members have all the core skills and in-depth knowledge about remittance concept and process. She was worked the department last year is her understating in the remittance area less the clerk level. |

|

Referent |

Deputy Manager and Other team members: Charismatic, worthiness, treat others with respect, work honestly, expertly and collegially with employees and others. Transparent and always act with integrity and values. Assistant Manager1: Moneymaking minded and no reputation in the company other than her know circle. |

|

Legitimate |

Deputy Manager: Power through the hierarchy of the Organisational Structure and Assistant Manager1: Originates power through links with Senior Management. |

Identity – Individual (Assistant Manager)

I looked out the operations department under two critical aspects of identity and a lot of negative issues.

|

Management point of view for targeting identity |

Social Identity |

|

Typically, the company identifies the individual based on success and failure in the process and teamwork. The Assistant Manager1 was working, but many mistakes which led to financial loss and customer complaint. However, she survived due to personal influence with senior management. |

Assistant Manager1 classified as a separate group with a variety of attachment with other team members and she always offered minor support in the team. Her main consider work to be part of earing for monthly salary only and primary attention social identity from the group outside the SBIUK. |

The main challenges faced in the operations in three segments

|

Area |

Analysis of SBIUK |

|

Individual |

The individual does not feel safe to speak up to Assistant Manager.

|

|

Team |

The overall team morale went down such as group productivities, teamwork and process efficiencies. |

|

Organisation |

The employee attrition will increase, low output and financial loss. The company image will affect the industry and peer banks. |

Conclusion

- I have critically evaluated the teamwork in the operations department of the SBIUK. The team possessed some awful characteristics in terms of culture, motivation and job satisfaction.

- The team went through many obstacles like staff shortage, unavailability of Assistant Manager and insufficient support from the Human Resource department.

- Assistant Manager failed to comply with the company standards and was not willing to work with a team under a collaborative method in the operations department, which led to interpersonal risk.

- The team leader did not utilise the unique talents of individuals and potential to build pleasant atmospheres in the workplace.

- The Blame Game with team members and line manager it was created an undesirable situation in the department with a negative result.

- Team leader demonstrated the autocratic leadership style, which the team perceived as team member suffering from emotional fatigue and incompetence to work for operations.

- Usually, her style of operations micromanagement and did not like to put an extra mile to achieve some good result.

- Team members questioned her team leadership style with over failing process and support. She expressed unskilfulness of guidance and lack of acceptance.

- It was affected by the department overall productivity and quality. The number of customer complaints increased because of delays in processing the remittance, which impacted company reputation with parent bank and correspondent bank.

- Deputy Manager understands that as a leader need to have a 360-degree view of surrounding (Business) and work in an organised environment for the benefit of the department and people.

- Thus, Deputy Manager tries to redesign and improve the culture, motivation and communication with them to gain the desired results.

- (Page307), K. a. W., 2017. Introducing Organizational Behaviour and Management. Third Edition ed. UK: David Knights and Hugh Willmott.

- Al, H. e., 1971. Strategic Con tingencies Theory Sub-Unit or Department Power. In: Structural Sources.

- Al-Malki, M. and W. Juan (2018). “Leadership styles and job performance: a literature review.” Journal of International Business Research and Marketing 3(3): 40-49.

- Edmonson, 2012. The Teaming Challenge. In: Teaming.

- Edmonson, A. C., 2008. The competitive Imperative of Learning. In:

- Hardy, L. a., 1974 and 1994. Dimensions of Power. In

- Herzberg’s, 1959. Motivation – Hygiene Theory.

- McGregor, D., N.D. Theory X and Theory Y.

- personality, B. F. C. D. O., 1993. Goldberg. In:

- Raven, F. A., 1959. In: Interpersonal Sources of Power.

-

State Bank of India UK, 2019. State Bank of India UK. [Online]

Available at: https://www.sbiuk.com/ - Bradley, J. H. and F. J. Hebert (1997). “The effect of personality type on team performance.” Journal of Management Development 16(5): 337-353.

- Cohen, S. G. and D. E. Bailey (1997). “What makes teams work: Group effectiveness research from the shop floor to the executive suite.” Journal of management 23(3): 239-290.

Cite This Work

To export a reference to this article please select a referencing style below: