Brief description of the product

This Z cider business is based in Hawkes Bay as it represents half of NZ apple harvest and home to 40% of NZ's summer fruit. Through a small cidery producer in Hawkes Bay, the business is with big ambitions. Z is its flagship cider, a hand- crafted traditional cider that uses freshly pressed NZ apple juice and all-natural ingredients from the rich and fertile Hawkes Bay, creating an authentic New Zealand cider with a drier, crisper flavour. The cider champions all things NZ; freshness, environmentally conscious manufacturing and reflecting all things clean and green. This Z Cider has always enjoyed a local following, although it has struggled to gain distribution further afield. The cider market has become highly competitive and Team A is commissioned to come up with a plan to focus on Z Cider's value proposition and to help it achieve export growth, especially in the fastgrowing Chinese market.

Get Help With Your Essay

If you need assistance with writing your essay, our professional essay writing service is here to help!

Statement of the offering value proposition in the target market

Unlike many brands that produce cider from concentrate loaded with sugar, Z Ciders use natural juice from freshly crushed Hawke's Bay apples. Taking advantage of New Zealand's isolated location protected by natural barriers, as well as the temperature extremes moderated by surrounding ocean, Z cider boasts for its natural ingredients from the world's most ideal climate and soils.

Outside of the award-winning core red and green apple range, Z also produces world-leading, "new world" style ciders such as hopped and apple crumble ciders, using innovative local ingredients like kawakawa and NZ hops. Z Cider also produces nine varieties of cider.

Consumers of craft products imported into China often measured the worth of a product by the perception of authenticity in regards to its origin as well as the product's overall shelf appeal.

Z cider will differentiate itself by focusing on its authenticity, prestige, and visually appealing design.

3. Analysis of the market leader in the target market

The cider market is experiencing rapid international growth with the global market picked to grow from US$10.7 billion in 2016, to US$16.3 billion in 2023. Here at NZ, cider is one of the fastest growing alcohol categories with grocery sales alone now reaching $54m per annum.

Anheuser-Busch InBev NV/SA is the leading player in the Chinese beer & cider market, generating a 26.4% share of the market's value. China Resources Enterprises accounts for a further 18.2% of the market.

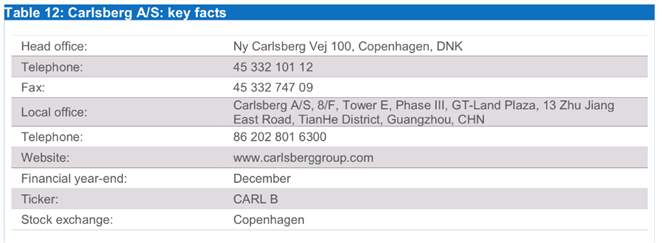

Within the cider market, the largest company in China market is Carlsberg A/S, the company behind the Somersby brand, which held 27% of China's market share in 2017. Heineken NV, which produces the Strongbow brand, was the second largest company in the market and held a market share of 23.6% in mainland China in 2017.21 22

Somerby came to mainland China in 2016 and instantly became the leading brand, due in large part to the company's promotion strategy. Carlsberg focused on major cities where people prefer a relatively slower pace of life (specifically Chengdu, Guangzhou, and Chongqing) and collaborated with the Strawberry Music Festival, which is popular among the young and creative demographic who are often social media influencers.

CARLSBERG A/S

Source: Company Website

Carlsberg A/S (Carlsberg) is a brewing company that is involved in the production, marketing and sale of beer under more than 140 brands. The company's brand portfolio includes well-known international premium brands such as Carlsberg, Tuborg, Kronenbourg, 1664, Grimbergen and Somersby, and strong local brands such as Ringnes in Norway, Baltika in Russia, FIX ANEY in Greece and Lvivske in Ukraine. Apart from beer, the company also produces soft drinks and other beverages. Carlsberg serves customers in more than 150 markets. The company manages the duty free and travel retail business among leading operators in airports, airlines, ferry lines, border trade and more.

The company operates through three geographic segments: Western Europe, Eastern Europe and Asia.

The Asia segment of Calsberg comprises business operations across Cambodia, China, Hong Kong, India, Laos, Myanmar, Malaysia, Nepal, Singapore, and Vietnam. Carlsberg operates through a network of 42 breweries in Asia, with majority of them in China alone. In FY2017, Laos and Cambodia each accounted for 47 liters of per capita beer consumption, followed by Vietnam (43 liters), China (27 liters), Hong Kong (24 liters), Singapore (22 liters), Myanmar (8 liters), Malaysia (6 liters), Nepal (3 liters) and India (2 liters).

In China, the company sells its products under Dali, Somersby, Carlsberg and several other brand names.

Source: Company Website

Source: Company Website

Source: Company Website

For the beer & cider market, the international brands are driving growth but there are also domestic companies entering the market. While international cider producers are mostly from the beer or wine industries, new Chinese producers come primarily from the fruit processing industries. The Chinese company Shaanxi Lan Hai Fruit Co, which produces Malan Mountain Cider, was originally in the apple trading and storage business. Their cider, which advertises it's organically grown raw materials and specified origin, is only one area of apple product development for the company.23 24

4. Industry analysis of the product sector in the target market

Craft beer is relatively new to China, cider is an even newer introduction. The volume of the Chinese beer market is stagnating. Even though China's consumption per capita is comparable to the world's average, this average and China's enormous population makes it the largest beer market in the world . It is twice the size of the US beer market in volume.

The Chinese beer & cider market recorded moderate growth during the period 2013-2017. It remained at a value of $75,384.8 million in 2017. In 2022, the market is forecast to have a value of $95,531.6 million, an increase of 26.7% since 2017. The growth of the market is expected to accelerate over the forecast period of 2017-2022.[1]

The cider segment consists of apple cider, flavored cider, pear cider and seasonal cider. The market is valued according to retail selling price (RSP) and includes any applicable taxes.

The Chinese beer & cider market remained at a value of $75,384.8 million in 2017.

The compound annual growth rate of the market in the period 2013–17 was 4%.

Beer is the largest segment of the beer & cider market in China, accounting for 99.9% of the market's total value. The Cider segment accounts for the remaining 0.1% of the market.

Five forces analysis

The beer & cider market will be analyzed taking manufacturers of beer as players. The key buyers will be taken as retail and on-trade companies, and producers of malted grain, hops and bottles or barrels as the key suppliers.

Competitive Rivalry

High fixed costs and a fairly consolidated market work to drive up rivalry, although moderate market growth has served to alleviate this somewhat.

Buyer Power

Buyer power in this market is driven up by low switching costs and the large size of many buyers, but tempered by buyers' need to stock a wide variety of beers in order to remain competitive.

Supplier Power

Many suppliers in this market, particularly hop growers, are small and numerous, limiting their ability to influence market players. Larger breweries are usually also capable of some degree of vertical integration, weakening suppliers' positions further. Raw materials are important to this industry though, and not all suppliers depend on the beer industry primarily; both of these factors strengthen supplier power.

Threat of New Entry

For new entrants, the heavy investment required in production capacity constitutes one barrier and government regulation another. Higher-end beers can command higher prices, however, which can allow smaller players an initial foothold in the market as a microbrewery.

Threat of Substitution

Switching costs in this market are fairly low which increases the risk of substitutes, and alternatives such as wines or spirits are often cheaper and easier to store and transport. On the other hand, most buyers will need to stock a range of alcoholic and non-alcoholic beverages, making it difficult to forego beer completely.

Instead of the commonly used standard, premium and super-premium segmentation for beer & cider markets, I have used a different one that represents in a more accurate way the Chinese market.

I have divided the market into 3 segments:

- Mass-consumed Chinese beer

- Leisure beer & cider

- Craft beer and foreign brands on tap

Mass-consumed Chinese beer

- Chinese brands domestically brewed.

- Low-priced – Beginning at circa 1.0 Euro per liter* both in foodservice and retail.

- 600 ml returnable bottles the most common format in foodservice. 330 ml and 500 ml cans in retail.

- Consumed by people across all income levels, everywhere in China

- Homogeneous pale lagers with low alcohol percentage (around 3%)

- Largest brands: Snow, Tsingtao, Yanjing and Harbin

- Mature market, decreasing 3% annually for the last 3 years

- Consumed along with meals

Leisure beer & Cider

- Foreign brands, domestically and internationally brewed

- High-price – Price on average 12.6 Euro per litre* in bars

- Served in 330 ml bottles, or 500 ml if produced abroad (e.g. Franziskaner)

- Consumed by urban and high-income consumers

- Consumed mostly in T1 and T2 cities

- All sorts of beer types

- Many brands competing in this segment

- Growing market. Largest part of the import total that grew 38% in 2017 corresponds to this segment.

- Stand-alone consumption or with finger food, at home and bars

Craft & foreign beer on tap

- Domestically and internationally brewed

- Very high-prices – 13.8 Euro average per litre in bars*

- Typically served in 400-500 ml glass

- Consumed by urban, young, high-income consumers

- Mostly T1, then T2

- Many different beer types, though Ales prevail

- There are few options yet, more widely available beers are acquired and distributed by AB InBev

- Market is growing exponentially

- Consumed either with Western-style meals or stand-alone.

MARKET SEGMENTATION

5. Resources and capabilities analysis in the target market

Two beverage products in New Zealand emerge as "growth stars" for export – cider and other flavoured beverages – from an evaluation of ten years of product-level trade growth.

Cider exports are growing and the product leverages New Zealand's strengths in apples and other fruit; performance of peers suggest stronger growth is possible in this rapidly developing category.

Chinese consumers respond well to the use of natural ingredients and lack of artificial colors and flavorings. They assume international brands are a guarantee of quality, especially with help of award winning, and have beautiful presentation. They like authenticity, prestige, and visually appealing packaging. Foreign ciders have a certain amount of prestige attached to them. Female Chinese drinkers are moving more towards fashionable alcoholic fruit sodas as an alternative to other alcoholic drinks.

|

Key Strategic Capability |

||

|

Resources |

Competence |

|

|

Islands in the middle of the South Pacific that have the area of Italy, but with only the population of Singapore; therefore relatively unspoilt Ready supply from nearby apple growers in Howkes Bay. Great quality water supply. Strong and growing success in premium/super-premium wine, beer & cider. Closer shipping distances to Asia compared to European competitors. Demonstrated capabilities in beverage production. Leading craft cider brand, the largest independent, dedicated cider producer in New Zealand. |

Physical |

Currently export to nine markets around the world. Experienced with developing offshore sales representatvie team to penetrate local markets. State-of-the-art site with the capacity to produce over 2 million litres of cider per annum. Strong domestic distributor that drive domestic growth by 72% Strong in digital marketing execution. Internationally awarded quality. |

|

Strong sales growth 70%, from $1.6m to $2.8m in 2017. Estimated 10m revenue by 2021. |

Finance |

Strong capability of raising fund. successful capital raise of $1.2m in March 2017 & 2.4m in 2018. |

|

Passionate founder-led team has strong ability to execute. |

Human |

Team with extensive wine and cidermaking experiences and has a wide-ranging production skill set and specialises in new product development. |

6. Entry Strategy to the target market

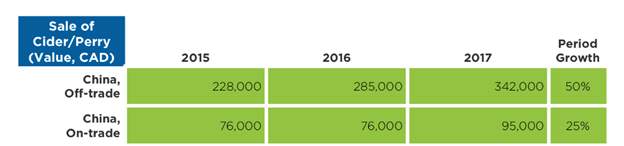

While craft beer is relatively new to China, cider is an even newer introduction. The current demand for cider in Hong Kong is much larger than the demand in mainland China.

Between 2017 and 2022, Euromonitor is forecasting a 14.6% compound annual growth rate (CAGR)

for the total value of cider/perry(fermented pear juice) sales in China.

MARKET SWOT ANALYSIS

|

STRENGTHS |

WEAKNESSES |

||

|

- - - - - |

Largest market by population in the world. Strong economic growth, and with it increasing disposable income. Well-developed and further improving infrastructure around the main population centres in eastern / south eastern China. Consumers have increasingly varied tastes. NZ products often have good reputations and / or are well recognised for some product types. |

- - - - |

State intervention can hamper the business environment The performance of some higher end product sectors is reliant on economic conditions. Transport and refrigeration remain logistical issues, particularly in lower tier cities. Regulatory framework can be complex. |

|

OPPORTUNITIES |

ISSUES/THREATS/RISKS |

||

|

- - - - - - |

Consumers are developing more western dietary tastes. Quality & reputation are key for alcoholic beverages Increased consumer interest in health provides opportunities for products perceived as healthy. Emerging opportunities in tier 3 and 4 cities. As the consumption of some product types is quite a recent phenomenon, there is limited brand loyalty providing opportunities for new entrants. Strong gift giving culture opportunities, particularly around festivals. |

- - - |

Limited consumer knowledge means that imitation products are not often identified by consumers. Some competitors have favourable access under FTAs (e.g. Australia, Chile). Anti-extravagance measures have impacted spending on luxury products. |

MARKET GROWTH DRIVERS

A key growth driver in the Chinese economy has been the rapid rise in average household incomes. Over the past ten years, China has experienced an average GDP growth of approximately 10%, which has created a new middle-income group with much higher disposable incomes. In addition, Chinese urban populations have increased by an estimated 153 million over the past ten years (2005-2015); by 2025, it is expected that urban areas will grow from 607 million to 822 million people.4 China's major cities – Beijing and Shanghai – will continue to be leading consumer hubs.

Beyond Beijing and Shanghai, McKinsey predicts that by 2015, nine large Chinese markets will account for 30% of luxury consumption in China: Chongqing, Dongguan, Foshan, Guangzhou, Hangzhou, Nanjing, Shenzhen, Tianjin and Wenzhou.

At the same time, rapid developments in transportation (including major rail improvements and road arteries) are expanding the economic potential of second- and third-tier cities. In terms of F&B, infrastructure improvements are speeding up distribution times, efficiency and costs, thereby stimulating local economies by raising consumer demand for higher value products.

Due to China's rapid urbanization, the number of urban residents is expected to reach one billion by 2030.Urban residents' steady consumption growth of basic ingredients over the last 20 years reflects the rising proportion of income spent on food and eating out.

TARGET AUDIENCE OVERVIEW

Consumers living in larger cities or who have more experience with Western products are more likely to be aware of cider. Specifically, Expats & Retrunees : Primarily those from Western countries where Cider is already established. Consumers in Tier 1 and 2 cities with experience living or working abroad in Western countries where cider culture is already established Young, Urban and Women: High-income Chinese consumers living in Tier 1 cities, who are interested in food trends, luxury products, and/or Western brands.

Find Out How UKEssays.com Can Help You!

Our academic experts are ready and waiting to assist with any writing project you may have. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs.

View our academic writing services

CONSUMER PROFILES

The key consumers of cider in mainland China are mainly women and students, especially female students. The lower alcohol content and fruity flavours make cider an appealing alternative to this demographic, as does the perception of cider as a healthier drink compared to something like beer or sweeter RTD alcoholic beverages (Ready to Drink; packaged and pre-prepared mixed drinks). Female customers in China respond well to the use of natural ingredients and lack of artificial colours and flavourings.32

Young consumers: born in the 1980s or 1990s and having grown up in an increasingly outward looking China and cosmopolitan cities and with widespread access to the internet the new generation of consumers have had large exposure to Western culture and products. This demographic is the most likely to have adopted certain Westernised eating or drinking habits and are increasingly open to try new products. They account for an estimated 200 million people in China36.

Female consumers: whilst female consumers are included in the categories below, female consumers differ from their male counterparts in several key areas. Notable differences in an increased value placed on safety and quality of products as well as different tastes for certain products such as a preference for wine over spirits and cider over beer.

As education opportunities and earning power continue to rise for women in China understanding these preferences will be increasingly important. Although by no means universal, nor as prevalent today as in the past, women in China have often managed household finances; market research should therefore not underestimate the importance of female consumer preferences.

Leveraging the brand's unique and pure NZ positioning in the premium cider market, target consumers located in Tier 1 cities in China who are much more likely to have been exposed to cider in the past or overseas. Focus on-trade sales through venues such as bars, restaurants, and hotels 。This exposure reduces the barrier to adoption for new cider products, compared to the inhabitants of smaller cities.

In addition to women and young customers, the outreach also need to cover the following customers.

High net worth individuals: these consumers are usually the first or second generation of China's social elite with high disposable incomes and predominantly concentrated in China's tier 1 and 2 cities. The number of millionaires is increasing rapidly. In 2016 there were approximately 1.6m millionaires (with a personal wealth of CNY 10 million), up almost 10-fold over the preceding 10 years32. These millionaires are concentrated mostly in Beijing, Shanghai and Guangdong province, and as consumers see foreign high quality goods as a marker of taste and will purchase high quality products as part of their conspicuous consumption.

Knowledge of products may be limited and these consumers will often be drawn to well-known brands that come with high price tags and consumption can be occasional or frequent depending upon individual lifestyle. As exclusivity appeals to affluent consumers, retail channels such as hypermarkets or supermarkets are less likely to be utilised compared to boutique or specialist stores or purchases made in hotels, restaurants and cafés. Marketing campaigns for products targeting these consumers often emphasise the exclusivity of the product or themes of success and luxury and this segment can often act as trend setters for other social segments.

Affluent consumers: with less disposable income than their high net worth counterparts but with higher earnings than middle class consumers, the affluent consumer represents the upper end of the middle class and are an important demographic in both higher and lower tiered cities. Earnings will have risen to an inflection point where the affluent consumers will be focussed on trading up and do not mind paying a premium for this, foreign products and brands can be a means of attaining higher quality and can therefore be highly desirable. The "mass affluent" consumers in China – that is to say affluent consumers who have built their own wealth – are estimated at around 34 million33.

More and more affluent consumers are travelling studying or working abroad and with exposure to western food and drinks culture they are more likely to have adopted new eating and drinking practices as well as a preference for high quality imported products.

Affluent consumers may purchase imported food and beverages on a frequent basis where these products play an increased role in nutritious intake and the range of products purchased will encompass both luxury products as well as daily staples. Purchases are made in both larger retail channels such as hypermarkets and supermarkets as well as in more specialist stores.

Middle class consumers: are an important demographic in tier 1 and 2 cities as well as having significant purchasing power in tier 3 and 4 cities where lower salaries are offset by lower living costs. Although definitions can vary, they are generally considered to be consumers with an income over CNY 60 000, with those earning over CNY 109 000 considered upper middle class. While it is challenging to estimate the number of these middle-class consumers, one estimate places them as accounting for 68% of the urban households in 2012, rising to 74% in 2022; implying a middle class of over 550m people by 20223435. Furthermore, not only is the number of middle class consumers expected to increase, but their income level as well with over half of urban households expected to earn over the CNY 109 000 by 2022 compared to just 14% at present. Factors such as increasing disposable income, more exposure to western food and drinks often from eating out at restaurants with Western or fusion cuisine as well as increased concerns over food safety, and a desire to trade up in purchases have all meant middle class consumers see western produce as increasingly attractive.

These consumers may purchase more expensive products on an occasional basis if they are savvier in their spending or have specific preferences picked up from previous dining or travel experiences, they will also purchase mid-price range products more frequently for daily or frequent consumption. The range of products may be more diverse than other consumer groups with imported products playing a larger role in changing diets. Where these consumers have increased awareness of the food and drink culture purchases will be more targeted and made in retail channels such as specialist or 'lifestyle' supermarkets whilst mid-price range products may be purchased in large hypermarkets or other traditional retail channels. Marketing should tap into the dual desire for trading up and also for healthier lifestyles with quality and safety assurances.

MARKET ACCESS AND MARKET ENTRY

Leverages home country capabilities, innovations and products for the Chinese markets, export ing directly from NZ to China will be a good strategy initially. Due to there are a variety of requirements and restrictions for importing to China, identify local distributor for market access will be very important for success.

China imports beer & cider mostly from the EU. The trends in import origins reflect the recent strong increases in demand for dark beer and cider.

DISTRIBUTION

Overall, the roughly equal amounts of beer & cider are sold through the off and on trade channels. However, for the categories with a greater proportion of imports (i.e. stout, dark beer imported lager) the on-trade channel accounts for a higher volume (65-70%) than the off-trade channel. The offtrade share of imported b beer & cider have been increasing since 2012 and are predicted to continue this trend.

Retail Channels

Convenience stores

They typically cater the mass-consumed and leisure segment. This channel is getting more popular and complements the changing working environment. Beer & cider are often more expensive than in other retail channels and there is a larger proportion of canned drinks.

Traditional convenience stores

Offering only mass-consumed beer, most commonly in 600 ml returnable bottles. Very low price, circa 1 EUR/litre. This channel is quickly disappearing in T1 cities.

Supermarkets and Hypermarkets

They all have several options in the mass-consumed segment. Variety of their imported beer & cider portfolio depends on their size, prices are standardised.

E-commerce

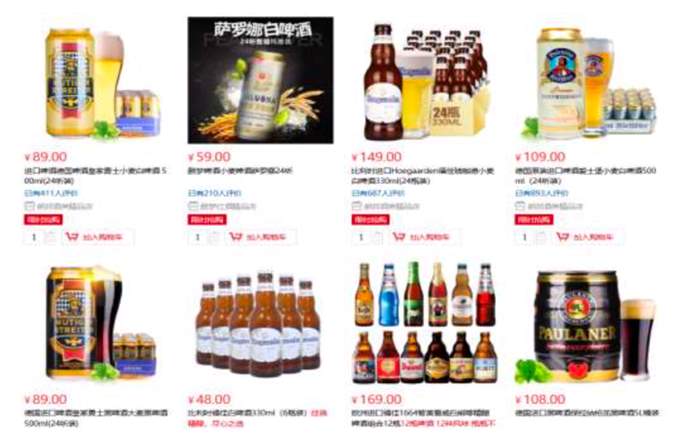

There are several generalist platforms (JD.com, YHD or Tmall) and some vertical platforms (jiuxian, ichinabeer.com, among others) offering a huge selection of beer, both domestic (competing in price) and imported (competing in price and variety).

Hotels

Chinese hotels tend to have mass-consumed beer since they are served with meals in a Chinesestyle restaurant, normally they have no bars. Foreign chains are usually five-star hotels with several restaurants and bars, with a selection of imported beer & cider as good as any from a bar downtown.

Restaurants

Traditional Chinese restaurants will only serve mass- consumed Chinese beer in bottles of 600 ml. Western- style restaurants and bars have a wider selection, since they are not as food-centered as Chinese restaurants.

Others (Bars, clubs, KTVs)

They usually have domestic produced beer and some foreign brands, almost always in bottles. Those located in T1 city will display a wider offer of foreign brands, while those in smaller cities will limit their selection mostly to domestically brewed foreign brands (Budweiser, Carlsberg, Heineken...).

Bars with wide selection of beer on tap and Microbreweries

Growing exponentially in the last few years, especially in T1 but also in T2. Western-style food is a central part of the offer. There is little perceived difference between bars with a lot of beers on tap and microbreweries from the consumer's point of view.

7. Expected market positioning vis-à-vis market leader

Craft products imported into China often measured the worth of a product by the perception of authenticity in regards to its origin as well as the product's overall shelf appeal. Research has shown that amongst cider drinkers, price and preferred brand have less of an influence over alcoholic drink choice than amongst non cider drinkers. Conversely, health, convenience, sustainability and packaging design all have a greater influence on product choice amongst cider drinkers. Consumers are increasingly interested in the story behind what they drink.

The craft positioning of cider is one of the major factors contributing to cider growth within China. The craft positioning has been demonstrated through the use of small glass bottle packaging (as opposed to large plastic bottles) as well as the focus on provenance and quality. Moreover, flavour innovation has also been a major development, new cider flavours, such as boysenberry, feijoa, cranberry and passionfruit are good examples of going beyond the traditional apple and pear.

Leverage the made in NZ advantage, selectively tapping into these consumer needs has been a key factor behind the successful launch and the subsequent take-up of the Z brand v.s. market leader.

The focus for this New Zealand Z cider manufacturer is likely to be on craft positioning and flavour innovation over the short term, with this brand continuing to produce ciders that are made traditionally, are award winning, and have beautiful presentation.

Cite This Work

To export a reference to this article please select a referencing style below: